Amazon sellers often struggle to track true profitability amid a tangle of fees, ad costs, and refunds. sellerboard’s profit dashboard is designed to cut through that complexity by presenting your financial data in multiple views – each tailored to a different analytical angle. In this comprehensive guide, we’ll walk through how to use each view (Tiles, Chart, P&L, Map, and Trends) effectively. You’ll learn real-world use cases for each, from high-level account health checks to granular product cost analysis, and how to translate those insights into actionable steps (like trimming unprofitable SKUs or optimizing ad spend). Let’s dive into each view and explore how it can supercharge your Amazon business decisions.

Tiles View: Your At-a-Glance Profitability Snapshot

Tiles View in sellerboard’s dashboard, showing key metrics for Today, Yesterday, and other periods side by side. Each “tile” (column) displays sales, orders, refunds, advertising cost, estimated payout, gross profit, net profit, and more for the specified time frame.

The Tiles view is the default dashboard view and provides a quick snapshot of your business across multiple time periods. By default, you might see tiles for “Today,” “Yesterday,” “Month to Date,” “This Month (Forecast),” and “Last Month,” each listing vital KPIs like sales, units sold, Amazon fees, ad spend, gross profit, net profit, and margin. This layout lets you compare performance over different periods at a glance – for example, seeing how today’s sales and profits stack up against yesterday’s or how the current month is trending versus last month. The Tiles view is essentially your real-time profit report card. It’s interactive too: if something looks off, you can drill down for more detail (by clicking a tile’s “More” link or specific metric) to investigate further.

Use cases and best practices for Tiles view:

- Account-Level Profitability: The Tiles view is perfect for daily or weekly account health checks. Many sellers open this dashboard each morning to review overall sales and net profit for today and yesterday. For instance, if today’s net profit is drastically lower than yesterday’s, the tiles will highlight that immediately – perhaps you see sales are down or ad costs spiked today. This high-level view helps you spot anomalies or trends in your entire Amazon business. Tip: Configure the date ranges of tiles to suit your needs (you can click the date on a tile to set custom periods). Some sellers like to keep a rolling 7-day tile or a quarter-to-date tile for broader context. By routinely monitoring the account-level tiles, you’ll quickly notice if profits are eroding or improving, and you can respond before small issues snowball.

- Product-Level Profitability: While the Tiles view shows aggregate figures, you can easily narrow it to specific products or groups. Use the search bar (next to the period selector) to filter by product name, SKU, ASIN, or tag. The tiles will then update to show metrics only for the filtered items. This is incredibly useful when you want a quick profitability snapshot for a particular brand or product line. For example, if you filter to a single ASIN, the Tiles view becomes that product’s dashboard – you might discover that a product’s “Yesterday” gross profit was high but net profit was low, indicating heavy ad spend or fees for that item. Additionally, clicking on a tile (say, “This Month”) opens a detailed breakdown of products sold in that period, with each product’s sales, profits, and related metrics. Many sellers use this to identify their top and bottom performers for the month at a glance. If one product has a negative net profit tile, it’s a red flag to dig deeper (perhaps its Amazon fees or return costs are too high). In practice, agencies managing multiple SKUs might filter by brand or marketplace to examine subsets of products one at a time in Tiles view.

- Profitability Structure Breakdown: The Tiles view presents both Gross Profit and Net Profit side by side for each period, along with the calculated profit margin (%). This helps you understand the structure of your profits. For instance, a tile might show $10,000 in gross profit for the month but only $2,000 net – prompting you to realize that operating costs (ads, returns, etc.) ate $8,000. By scanning the tiles, you can immediately gauge margins and ROI. sellerboard even displays ROI in some product breakdowns (Return on Investment, often defined as net profit divided by COGS). If your net margin% this month is, say, 5% (very low for Amazon) whereas last month it was 15%, the tile will highlight that drop. In real-world use, sellers seeing such a margin squeeze might conclude that advertising or fees increased disproportionately. The Tiles view’s value here is speed: it gives a structural profit overview without running a full report. You might not use it for detailed cost accounting (that’s what P&L view is for), but it’s great for a quick gut-check of profitability. If margins are trending down in the tile comparisons, it’s a cue to take action (e.g. renegotiate supplier prices or adjust ad strategy).

- Analysis of Specific Cost Factors: Each tile breaks out key cost components – notably Advertising Cost, Refunds, and Amazon fees (as part of the net calculation). This means you can use Tiles view to watch specific cost factors in relative terms. For example, you might notice in the “Last Month” tile that Advertising Cost was $5,000 on $20,000 sales (25%), which is higher than your target ACOS. Or perhaps the Refunds count in “Today” or “MTD” tile is higher than usual – hinting at a problem product. Sellers often click on the Refunds number on a tile to see the reasons behind returns for that period (sellerboard allows this drill-down), which is a practical way to pinpoint if a spike is due to, say, a product defect or a listing issue. The Tiles view also shows your total Amazon fees and shipping costs in each period, so you can quickly tell if fees are constituting an unusual portion of sales. Actionable tip: If you see a tile where net profit is significantly lower relative to gross profit, scan the listed costs – is it advertising, fees, or refunds driving it? A common practice is to react accordingly: for example, a high ad cost in the tile might prompt a seller to lower PPC bids or pause campaigns for a bit; a high refunds tile leads them to inspect product quality or customer feedback immediately.

In summary, the Tiles view is your everyday command center. It’s commonly checked daily by individual sellers and at least weekly by agencies to ensure nothing is wildly off track. Use it to stay informed on key metrics, then leverage its interactive features (filtering and drill-downs) to move from a broad overview to specific insights in one or two clicks.

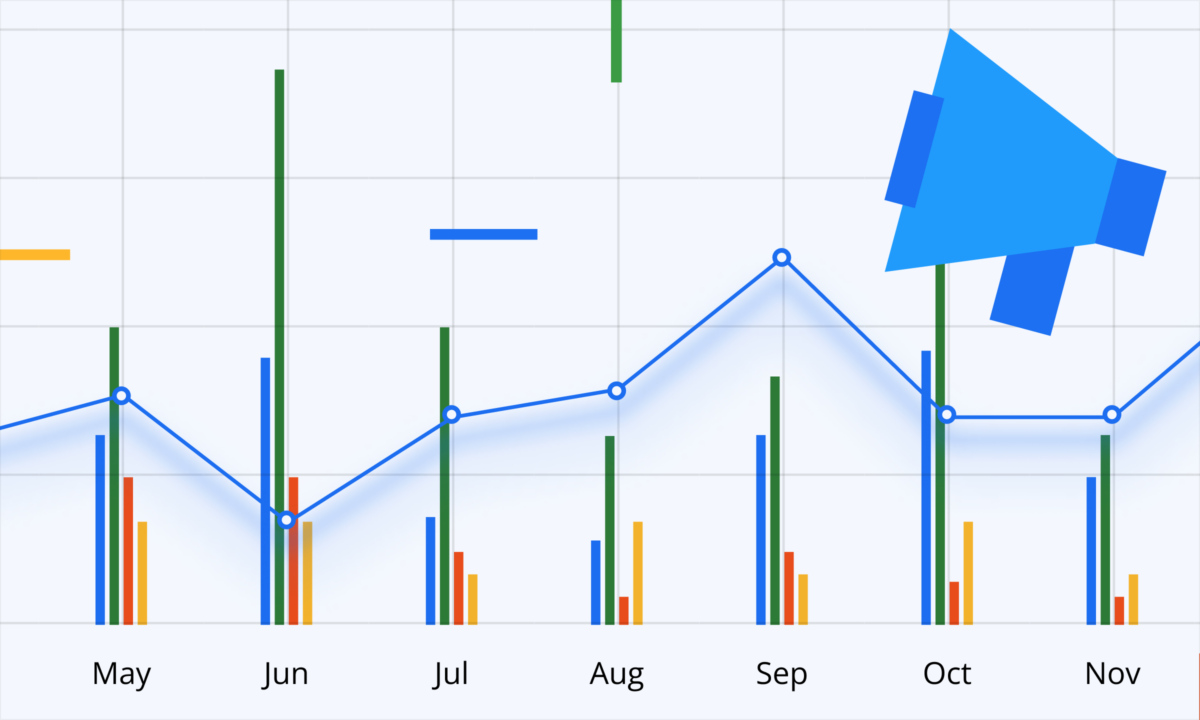

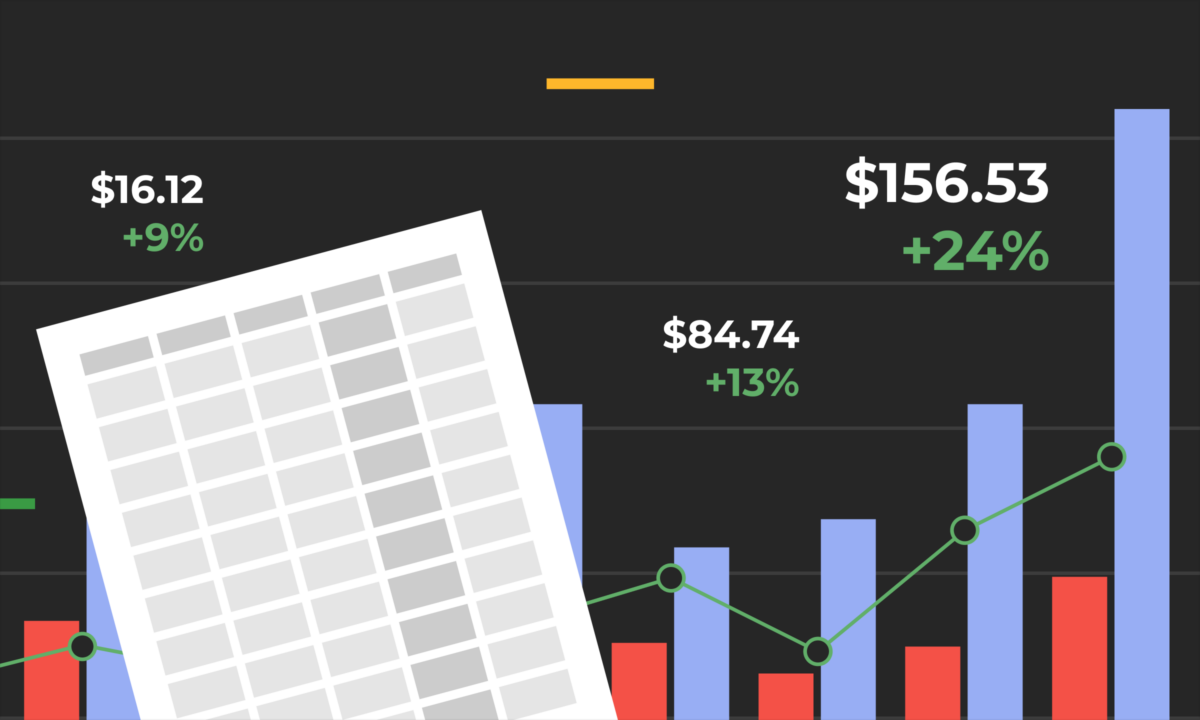

Chart View: Visualizing Trends Over Time

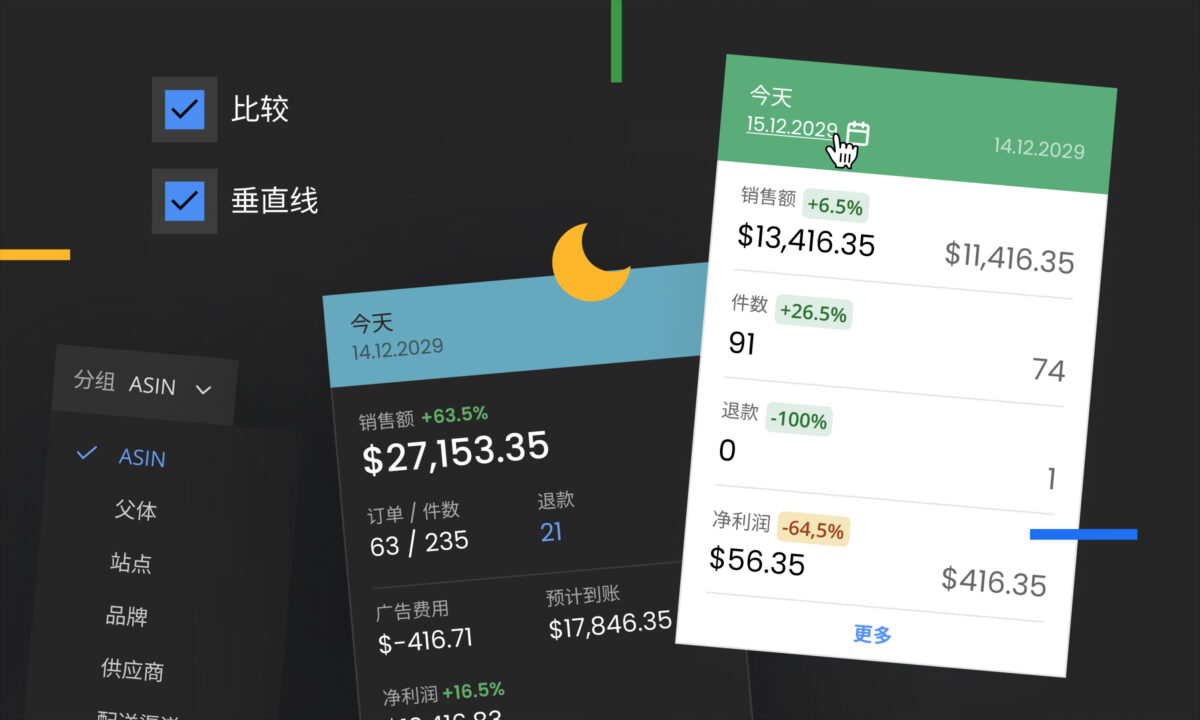

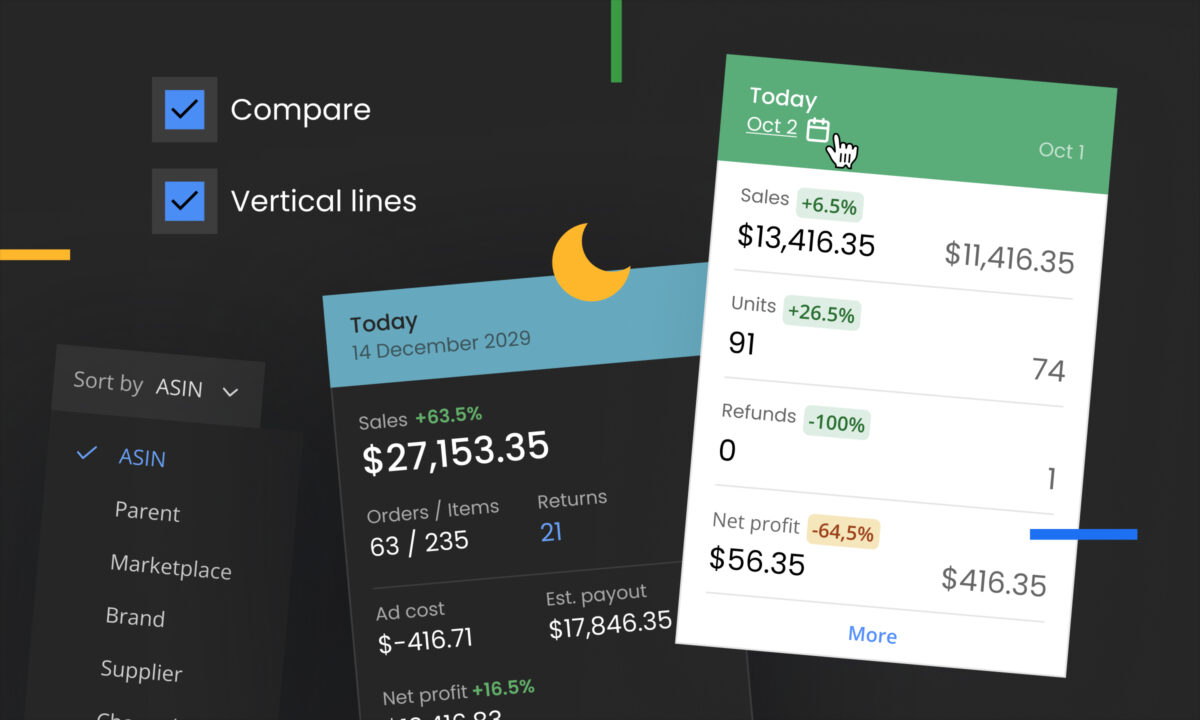

Chart View in sellerboard, showing multiple metrics over time. Here, sales, advertising cost, refunds, and net profit are plotted monthly. A configuration panel allows selecting different metrics or time frames, and the summary on the right shows the exact values for the chosen period.

The Chart view turns your data into graphs, making it easier to spot trends and seasonality. Rather than static numbers, you’ll see lines or bars showing how metrics change over time (daily, monthly, or any range you select). This dynamic view is ideal for analyzing trends, correlations, and the trajectory of your business metrics. You can chart multiple metrics together – for example, plot sales and ad spend to see their relationship, or net profit and refunds to watch how returns impact your profits over time. The Chart view is highly configurable: you choose the date range, interval (e.g. by day or by month), and which metrics to display. sellerboard even provides preset metric groups like “Account Overview,” “Sales vs. Refunds,” or you can pick custom metrics. The result is a visual story of your business performance.

Use cases and best practices for Chart view:

- Account-Level Profitability Trends: At the account level, Chart view helps you answer big-picture questions like “Is my business growing profitably over time?”. By plotting Net Profit month-by-month for the past year, you can easily see your profitability trend, seasonal peaks (e.g. Q4 holiday spike), or slumps. Sellers typically use a monthly sales and profit chart to gauge year-over-year growth and to see how changes in strategy affected outcomes. For instance, if you ramped up advertising in summer, a chart can show if it led to higher sales (and whether profit followed or not). Agencies often generate such charts for client reports, illustrating how the account performed across quarters. A practical example: suppose your chart shows revenue climbing but net profit flat or declining – this visualization can quickly signal that costs are rising in step with revenue, which might prompt a cost review. In short, use Chart view to keep an eye on the direction your entire business is headed, not just the current status.

- Product-Level Performance Over Time: Chart view really shines when tracking a specific product (or group of products) over time. You can filter the chart to a single ASIN or a tag (e.g. a product line) and then visualize metrics like units sold, sales revenue, and profit for that subset. A common real-world use case is new product launches: Sellers will chart a new product’s daily or weekly sales and ad spend from launch onwards. This way, they can see the trajectory – is the product gaining traction (sales line going up)? How does advertising spend correlate (perhaps initially high, then tapering if organic sales take over)? With this insight, you might decide to adjust your launch strategy – e.g. if the chart shows ad spend climbing but sales flat, it signals low ad efficiency, so you might refine keywords or listing content. Another example: charting a mature product’s performance over the past year could reveal slow declines in sales. Seeing a downward slope over months in visual form often prompts action, like refreshing the listing or analyzing competitor moves. Tip: Use the Chart view’s filtering and metric selection to compare multiple products. You could overlay the sales of Product A vs Product B to see which one is gaining share – useful for portfolio management.

- Profitability Structure Breakdown Over Time: While the Chart view is more about trends than detailed breakdowns, you can certainly visualize components of profit over time. For instance, plot Gross Profit vs. Net Profit as two lines on the chart. The gap between those lines represents your overhead costs. If that gap is widening over time (gross profit steady, net profit declining), the chart makes it obvious that expenses are eating more of your margin. Or consider charting Profit Margin % each month – a line trending downward might alert you that rising costs (Amazon fees, COGS, or ads) are squeezing margins. Another structural insight: use Chart view to track ROI over time. Let’s say you plot ROI (return on investment) for each month this year – if ROI was 50% in January and only 20% by June, that trend might lead you to revisit pricing or cost of goods. Many experienced sellers check such charts quarterly to ensure the business fundamentals aren’t eroding gradually. The visual format helps turn abstract ratios into a concrete trend.

- Analysis of Specific Cost Factors: If you want to zero in on a particular cost or expense, Chart view is the place. You can select a metric like Advertising Cost, Amazon Fees, or Refund Cost and see how it changes over time. For example, plotting Advertising Cost and Sales together can reveal the efficiency of your ad spend – ideally sales rise in tandem with ad spend; if ad cost is increasing faster than sales, the lines on the chart will diverge, signaling declining ad ROI. Another scenario: chart your Refunds or return rate over the last 12 months. You might spot a spike in returns in a certain month – correlating perhaps with when you switched to a new supplier or when a specific batch went out. With that knowledge, you can investigate product quality or customer feedback for that period. Practical insight: Sellers often use Chart view after a major change, such as a fee increase or a shipping policy change, to see its effect. For instance, if Amazon raised FBA fees in Q2, you could chart “Amazon fees as % of sales” by month – a rising line confirms you’re paying more of your revenue to fees now. Knowing this can inform actions like adjusting prices or packaging (to reduce dimensional weight fees). The Chart view essentially turns raw data into a visual “heartbeat” of each cost factor, making it easier to monitor and react. Many users check these charts monthly; agencies might include some in quarterly business reviews to highlight cost trends and recommended actions (e.g., “Our charts show return costs climbing – let’s address product QA”).

To get the most out of Chart view, remember to use the customization features. Switching metrics is easy – sellerboard provides checkboxes or a config menu to add/remove metrics from the graph. You can also change the date granularity: for short-term analysis (like a flash sale impact), view daily data; for long-term, use monthly. One advanced tip: utilize preset views (like a “Refund Analysis” preset might automatically chart refunds, refund cost, and units sold) to quickly load relevant charts. Ultimately, Chart view is about seeing the forest for the trees – it helps you visualize patterns that you might miss when staring at spreadsheets. Incorporate it into your workflow perhaps weekly or whenever you need to investigate a trend, and use those visual cues to drive timely adjustments in your business strategy.

P&L View: Comprehensive Profit & Loss Breakdown

Profit & Loss (P&L) View in sellerboard, configured to show a monthly breakdown. Each column is a month, and each row is a revenue or expense category (expandable for details). This table-style view provides an in-depth look at where your money comes and goes over time.

The Profit & Loss view is like your Amazon business’s income statement on steroids. It lays out all the components of your profits across a chosen time frame in a tabular format. Typically, the P&L view can show each month (or each day) as a column, with rows for every metric: starting from Gross Sales and Units, then subtracting Amazon fees, Advertising costs, Cost of Goods Sold, Shipping costs, Refund losses, and so on, down to Net Profit. What makes it powerful is the level of detail – categories can be expanded to see sub-components. For example, “Amazon fees” can be expanded to reveal referral fees, FBA fulfillment fees, storage fees, etc., for each month. This view is invaluable for understanding exactly where your money is going and how each cost element impacts your bottom line. It’s the view you’d use for serious financial analysis, monthly reporting, or whenever you need precise numbers for every expense and income category.

Use cases and best practices for P&L view:

- Account-Level Profitability Analysis: Most sellers and agencies use the P&L view as a monthly report card for the entire account. It’s common to pull up a P&L table for, say, the last 6 months, to see trends in each line item. At a glance, you can tell if sales are growing or shrinking month to month, and more importantly, how net profit tracks alongside. Because all the costs are broken out, this view answers questions like: “Why was net profit in July lower despite higher sales?”. Perhaps the P&L shows July had a big jump in Amazon fees or advertising spend. By examining the columns, you might find that Ad Costs were $10k in July vs $5k in June – explaining the profit dip. Account-level, the P&L view is fantastic for end-of-month or end-of-quarter reviews, budgeting, and forecasting. For instance, if you notice your Gross Profit (sales minus COGS) is healthy but Net Profit is lagging, you can zero in on which expense line increased (maybe warehousing fees doubled?). Agencies love this view for preparing client summaries because it provides transparency into every dollar: “Last month, we made $50k sales, paid $7k in FBA fees, $5k in PPC, $20k in COGS, leaving $18k gross profit and $10k net after other expenses.” Use the P&L view to get that clarity – many sellers check it monthly as part of their financial routine, and deeply analyze it quarterly to adjust high-level strategy (like cutting costs or increasing prices where needed).

- Product-Level Profitability Analysis: While the P&L view is naturally aggregated, you can apply sellerboard’s filters to dissect P&L for specific products or groups. For example, you could filter the dashboard to a single ASIN or a product tag, then switch to P&L view: now the table would show the P&L of just that product (or group) over time. This is incredibly useful if you want to see a product’s true profitability each month after all fees and costs. Imagine you’re evaluating whether to discontinue a product – pulling its P&L might reveal that in the last 3 months it actually lost money two months out of three (perhaps due to high return costs in those months). You can also compare products by doing one at a time or using tags (like one tag for Product Category A vs Category B). Another way to get product-level insight from P&L view is by using the interactive drill-down: in sellerboard’s P&L table, each column (month) is clickable. Clicking on a month can bring up the list of products sold that month (with their individual contributions). This way, from the account-level P&L you can dive into which products made up the numbers. For instance, if December had lower net profit, you click December and see that one particular SKU had a large loss (maybe due to holiday returns). That bridges into product analysis without leaving the P&L screen. In practice, many sellers use the P&L view in combination with filters to evaluate product lines – e.g., an agency might filter by brand for a client that sells multiple brands, showing each brand’s P&L to see which is more profitable. If you spot a consistently unprofitable product here, it’s a candidate for either improvement or removal from your catalog.

- Profitability Structure Breakdown (Gross vs Net, Margins, ROI): The P&L view is unparalleled for examining the structure of your profits. It explicitly shows Gross Profit (sales minus direct costs like COGS and Amazon fees) and Net Profit (after all expenses). You can calculate gross margin and net margin for each period by looking at the totals. For example, you might see that in April your gross profit was $30k on $50k sales (60% gross margin), but net profit was $5k (10% net margin). Seeing these figures month by month lets you track margin fluctuations. If net margin fell from 15% to 10%, scan down the rows to see which costs rose as a percentage of sales. Maybe advertising went from 10% of sales to 15% – instantly visible in the P&L breakdown. The view also often includes ROI% for each period if you have input product cost data; if not explicitly shown, you can derive it (net profit vs COGS). Because categories are expandable, you can inspect the structure in detail: e.g., expand “Amazon Fees” to see referral fees vs FBA fees – you might realize FBA fulfillment fees are the bulk of it. This level of detail might lead you to optimize something specific, like packaging weight (to reduce FBA fees), if you see those fees climbing. Real-world example: An Amazon seller noticed their net profit didn’t grow in proportion to sales in a high-volume month. The P&L showed that shipping costs and Amazon fees had scaled up dramatically. This prompted them to negotiate lower shipping rates with their 3PL and to reconsider their product dimensions (to reduce fees). Without the P&L view’s clear breakdown, pinpointing that would have been difficult. We recommend using the P&L view for a thorough profit “health check” at least monthly – and definitely before big decisions like budgeting for next quarter or pricing changes. It ensures you understand every component of your profit structure.

- Analysis of Specific Cost Factors: When you need to analyze a particular expense in depth, the P&L table is your friend. Because it lists expense categories separately (and often with sub-categories), you can follow each cost’s trend and weight. For instance, you might analyze Amazon PPC costs: the P&L shows “Advertising Cost” per month – you can see if it’s rising, and also calculate ACOS if you compare it to sales. Or look at Refund costs: the P&L might have a line for “Refunds & Return Costs” which accounts for refunded revenue, lost FBA fees on refunds, and cost of damaged returns. If you notice one month has an unusually high refund cost, you can investigate why (maybe a defect batch that month). Another example: Amazon fees – by expanding it, you might discover a line like “Long-term storage fees” appearing in a certain month. That tells you you paid extra storage fees (perhaps in Q4), which could lead you to clear inventory faster next year. The level of granularity is extremely useful for cost-cutting strategies. Sellers and financial controllers often export the P&L data to Excel as well, to compute ratios like “% of sales” for each expense. However, sellerboard already gives a pretty clear picture. If a specific cost (say, FBA inbound shipping fee) looks too high relative to the past, you can catch it here. Actionable insight: Sellers commonly act on P&L findings by, for example, reducing ad budgets if advertising as a percent of sales is above target for several months, or by finding a new supplier if COGS has crept up and eroded margins. Some advanced users set benchmarks (like, “Amazon fees should not exceed 1/3 of revenue”) and use the P&L view to ensure they stay in range. If not, it triggers an operational change.

Using the P&L view effectively may involve a bit of setup: ensure your COGS (cost of goods) are entered correctly in sellerboard so that gross profit calculations are accurate. Also, input any indirect expenses (like software subscriptions, salaries, etc.) through sellerboard’s expense module, which can then reflect in the P&L (often under an “Indirect Expenses” line). Once everything is configured, regularly reviewing the P&L will give you confidence in understanding your finances. Think of Tiles and Charts as the quick pulse checks, whereas P&L is the full check-up and diagnosis. Most importantly, let the numbers guide you – if the P&L shows an expense growing faster than sales, it’s sounding an alarm to optimize that area. If net profits are thin, it urges you to either cut costs or boost revenue per unit (maybe via price hikes or bundling). The P&L view grounds your decisions in solid data, ensuring your profitability improvement efforts target the right levers.

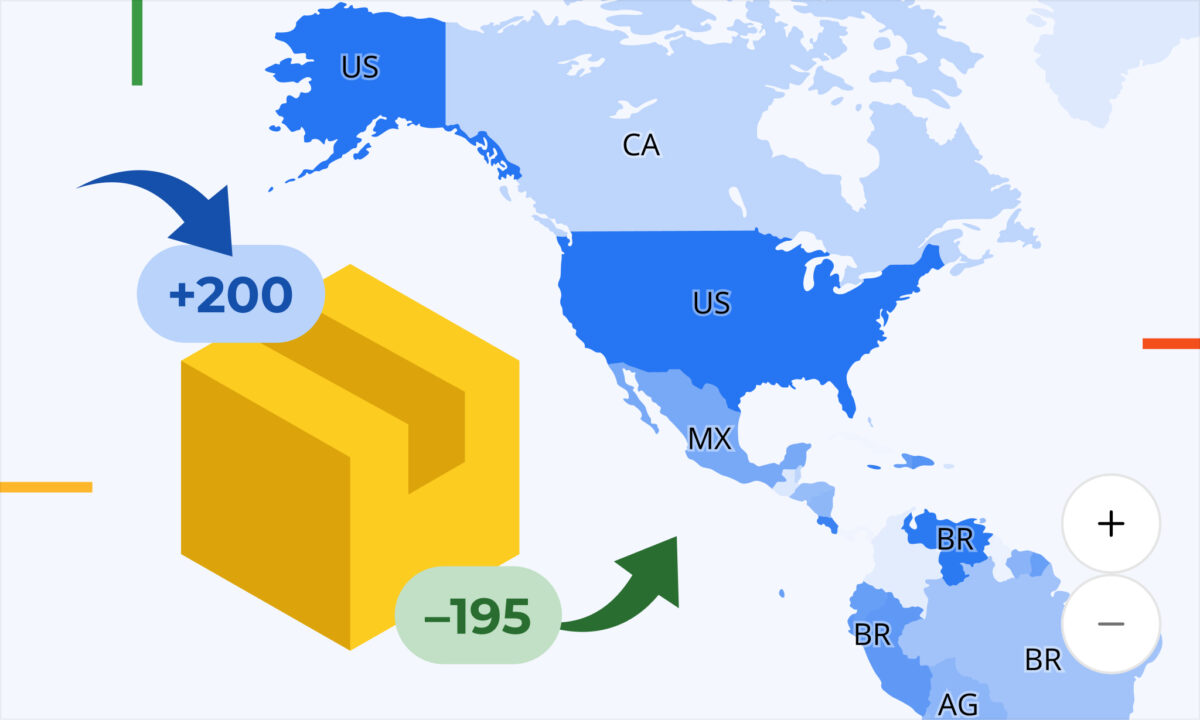

Map View: Geographic Sales & Stock Insights

(sellerboard’s Map View is a newer addition, combining a visual map with regional data – imagine seeing your sales and inventory spread across a map of the US or EU. While we don’t have a screenshot here, picture an interactive map where darker areas mean more sales or stock, and below it a table lists each region with metrics like units sold, current stock, refunds, revenue, and profit.)

If you sell across multiple marketplaces or regions, the Map view offers a completely different perspective: it puts your sales and stock data on a geographical map. This view is divided into two parts – an interactive map highlighting sales or inventory volume by region (for example, by country in Europe or by state in the US), and a detailed table underneath listing metrics for each region. The Map view helps answer questions like “Where are my products selling best?” and “How is inventory distributed relative to demand?” at a glance. It’s essentially profitability analysis through a geographic lens, which is especially valuable for global sellers or anyone dealing with region-specific strategies. You can toggle between viewing Sales and Stock on the map. In Sales mode, regions with higher sales volume appear darker or more intense on the map; in Stock mode, the shading represents inventory levels. This dual capability means you can quickly spot mismatches – e.g., a dark-shaded sales region with a light-shaded stock level could signal a looming stockout in a high-demand area.

Use cases and best practices for Map view:

- Account-Level Regional Analysis: At the account level, the Map view is fantastic for high-level strategy around markets and fulfillment. Sellers often use it to identify top-performing regions vs. underperforming ones. For example, the map might show that Germany and the UK have the darkest sales shade in Europe, indicating those two countries are your biggest markets, while Spain and Italy are lighter (lower sales). In the table below, you’d see the exact numbers: say, Germany – 500 units sold, gross profit $10k; Italy – 50 units, gross profit $1k. This insight might lead you to double down on the strong markets (introduce more products or marketing in Germany/UK) and troubleshoot the weaker ones (perhaps translate listings better for Italy or run promotions there). From a profitability standpoint, you can also compare gross profit by region in that table – maybe you find that despite high sales in one country, the net or gross profit is lower due to higher costs or taxes there. Account-level, the Map view essentially helps you optimize your regional focus and resource allocation. Sellers who expand internationally use this view to track how each new marketplace is contributing. Agencies managing accounts across EU, North America, etc., will use Map view in periodic reviews to advise clients on where to invest. For instance, “We see 40% of your revenue coming from California alone – perhaps consider a regional Amazon warehouse there to improve Prime delivery and further boost sales.” It’s a big-picture tool, so you might not check it daily, but it’s incredibly useful monthly or quarterly.

- Product-Level Regional Performance: You can combine the Map view with product filters to get granular, too. If you filter to a specific product (or brand) and then open Map view, you’ll see where that particular product sells and is stored. This is useful for products that have regional appeal. For instance, suppose you sell a seasonal item like a winter jacket – the Map view might reveal it sells heavily in northern states or colder countries and barely at all in tropical regions. That can guide your marketing: you might target ads or deals to the regions that actually want the product. Conversely, if a product isn’t moving in certain regions, maybe you need to adjust something (price, listing language) or accept that demand is low there. The stock side of the map will show you if inventory is sitting in a region where sales are slow. A real-world use case: A seller filters to a specific ASIN and sees they have 200 units in an Amazon UK warehouse, but the UK sales (via the map) are minimal whereas Germany has stock shortages. This insight would prompt them to reallocate inventory (perhaps create a removal order or Amazon inventory transfer) to get stock where it sells. On a product level, map analysis can even influence launching decisions: if you’re launching a new variation, you might start with the region that’s darkest for the parent product. Keep in mind, if you have separate Amazon accounts per region, you’d look at one at a time – but sellerboard’s map can integrate data if it’s linked. Sellers typically use product-level map insights when troubleshooting geographic performance, or when planning inventory distribution for multinational FBA (especially with Amazon’s European distribution network or North America where you can send stock to specific fulfillment centers).

- Profitability Structure and Margins by Region: The Map view’s table includes metrics like gross profit, units sold, and refunds per region, which allows you to derive profit margins by region. This can be eye-opening: you might find that a country with high sales is actually not very profitable once costs are considered. For example, maybe in Canada you sell a lot, but the gross profit column is relatively low due to higher shipping fees or import costs, resulting in a thinner margin. Recognizing that, you might adjust pricing in that market upward to compensate. Or, if one region’s net profit is significantly higher in percentage, perhaps their tax or fee structures are more favorable – encouraging you to push more volume there. While the Map view doesn’t directly show percentages, you can manually compute margin if needed (gross profit / sales for each region). Additionally, by looking at refund rates by region (the table might have a “Refunds” column or you can enable a “Return %” column), you could discover, say, that your return rate in one country is double that of others. That might indicate an issue like a cultural preference or a product-market fit problem (e.g., maybe your apparel item gets more returns in one country due to sizing issues). With that knowledge, you could take action – perhaps adjust the sizing chart or description for that country, or improve the product if feedback indicates a specific issue. In sum, Map view gives a spatial dimension to profitability structure: not only how much profit, but where the profit comes from, and where it’s diminished.

- Analysis of Specific Cost Factors by Region: Certain costs and challenges are region-specific, and Map view helps isolate those. Shipping and FBA fees, for instance, can vary regionally. The map’s table will indirectly reflect that – if one region has much lower gross profit on similar sales, perhaps FBA fees to that region’s fulfillment centers are higher (maybe due to distance or storage fees). Also, as mentioned, refunds or returns can cluster regionally. Sellers use the Map view to spot if, for example, “California has an unusually high number of returns.” If so, one might ask why – are West Coast customers returning an item more often? Could it be a late delivery issue in that region causing returns? Or maybe a competitor in that region leading to more returns in favor of their product? While those are investigative questions beyond the dashboard, the Map view surfaces the pattern. Another factor: Stockouts and overstock – the Map view’s Stock mode is essentially highlighting a cost risk (overstock leads to storage fees, stockouts lead to lost sales). By comparing sales and stock on the map, you handle a critical cost factor: inventory holding cost vs. revenue opportunity. For example, if the map shows Florida has a lot of stock but very light sales, you have overstock there – which might lead you to run a regional promotion or remove some inventory to cut storage fees. On the flip side, New York area shows high sales but low stock, you risk stockout – so allocate more units there to avoid the lost sales (lost sales are an “opportunity cost” often overlooked in profitability, but very real). In practice, advanced sellers will use the map data in conjunction with Amazon inventory tools to balance inventory, thereby reducing unnecessary FBA fees and ensuring products are available where customers are, improving overall profit. Insight in action: One seller noticed via Map view that their product had a high return rate in Germany due to a translated instruction issue (German customers misunderstood the product setup). They fixed the translation and returns dropped the next month, improving profit in that region. This kind of targeted fix comes only after identifying the regional nature of the problem, which the Map view made possible.

To use Map view effectively, be sure to utilize the table’s features: you can sort the table by any column by clicking the header (e.g., sort by Gross Profit to see your most profitable region on top, or by Refunds to find the worst offending region for returns). You can also often select which metric the map visualizes – toggling between Sales and Stock as mentioned, but sometimes even filtering by time or choosing which marketplaces to include. For example, you might look at last month versus this month on the map by adjusting the date filter, giving you a visual of growth or decline regions. Many sellers incorporate Map view in their monthly ops meeting – for instance, checking it when planning inventory transfers or regional marketing efforts. It brings a dose of reality to discussions like “We feel market X is doing well” – you can literally see it on the map if that’s true or not. Overall, Map view adds an invaluable dimension to profitability analysis, ensuring you don’t make the mistake of treating your entire market as one homogeneous blob. Different regions behave differently – and now you have the data to act on that knowledge.

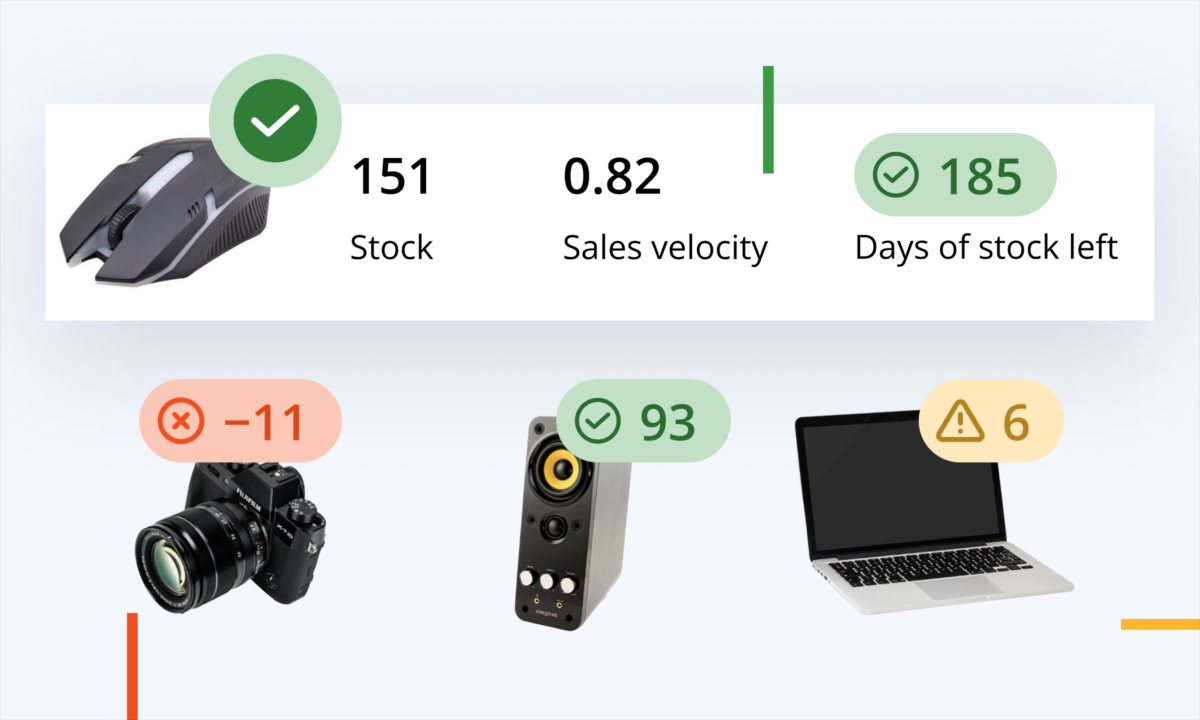

Trends View: Tracking Product Metrics and Spotting Trends

Trends View in sellerboard, focused on a specific metric (in this example, Sales $ by product, month-to-date vs previous months). Each row is a product; small sparkline charts visualize the trend, and columns show recent periods with values and percentage change. Green or red percentages help identify growth or decline for each product.

The Trends view is all about product-by-product performance over time. Think of it as a smart spreadsheet that tracks a chosen KPI (Key Performance Indicator) for all your products across periods (days, months, etc.), highlighting trends and percentage changes. In sellerboard’s Trends view, you first select which metric you want to analyze – for example, Units Sold, Net Profit, Refund Rate, Advertising Cost, BSR (Best Seller Rank), or even derived metrics like Margin% or ROI. Once selected, the dashboard displays a table where each row is a product (or parent ASIN, depending on how you group it) and each column is a time period (often the current month, previous month, etc., or day-by-day if in daily mode). For each product and period, you’ll see the metric value and typically a % change compared to the prior period. This makes it incredibly easy to spot which products are trending up, which are steady, and which are declining on that metric. Trends view also offers filtering (by product name, SKU, tags) and sorting, so you can zero in on specific subsets or sort to find extremes (e.g. sort by % change to see biggest gainers or losers). In short, if something about a product’s performance is changing, Trends view will catch it.

Use cases and best practices for Trends view:

- Account-Level Monitoring of Product Trends: Even though Trends view is product-centric, it’s a great overview of your entire catalog’s health. Many sellers use it as a dashboard to answer “Which products need my attention right now?” For instance, if you select Net Profit as the metric and view by month, a quick scan might show that most products have a small green +5-10% change (meaning they improved profit slightly from last month), but one product has a red –30% for this month. That immediately flags a concern – that product’s profit dropped 30%. You didn’t have to dig through each ASIN’s report; the Trends table surfaced it. At an account level, you might do this for sales units too, to see if any product’s sales are sharply down (potentially indicating a stockout, a lost Buy Box, or a new competitor). Conversely, big jumps upward (big green percentages) might indicate a successful promotion or a product going viral – which you’d want to capitalize on (ensure stock is sufficient, maybe raise price if demand jumped). Agencies and advanced sellers often keep a Trends view saved (sellerboard allows bookmarking filter/views) for key metrics. For example, a common practice is to check the Refund Rate Trends across products each month. If any product’s return rate is trending up significantly, it’s a sign of trouble (maybe a quality issue) that needs addressing. Account-level, think of Trends view as the “early warning system” and “opportunity highlighter” for your product portfolio. It’s typically reviewed weekly or monthly, depending on business size – larger catalogs might need it more frequently to catch issues among hundreds of SKUs, whereas a small seller with 5 products might glance at it monthly.

- Deep-Dive Product Performance Analysis: For product-level insight, you can use Trends view to really dissect how a given product is doing over time on various metrics. Suppose you want to analyze why a product’s profit is down – you can switch metrics in Trends view for that product. First, look at Sales trend: is it selling fewer units than before? Next, check Advertising Cost trend: did ad spend go up? Then perhaps Amazon Fees or COGS per unit if those are trackable: did fees increase or costs rise? Because Trends view lets you flip metrics quickly while keeping the time breakdown, you’re essentially seeing the product from multiple angles in one place. For example, you select one ASIN via the filter and then view a sequence: sales trend (flat), ad cost trend (up 50% this month – aha), net profit trend (down accordingly). That quick comparison could confirm that rising ad spend without a sales lift is hurting profits – a clear action item to optimize the PPC campaign. Another example: track a product’s BSR or sessions/conversion rate in Trends view. If sales are down, Trends might show that sessions (traffic) also fell or conversion rate dipped – helping diagnose whether it’s a traffic problem or a conversion problem. Without Trends view, you’d have to pull separate reports to piece that story; here it’s one interface. A best practice for product managers is to schedule a monthly product trend review, cycling through key KPIs like sales, profit, refund%, ACOS for each product. It’s a bit like doing a mini “health report” for each ASIN. You’ll catch things like a product gradually losing momentum or, conversely, a product that’s accelerating (so you might boost its stock or marketing to ride the wave). Insight to action example: A seller noticed in Trends that one of their products had a steadily rising Advertising Cost per Sale over 3 months (their ACOS went from 20% to 30% to 40% as seen in the metric trends). This signaled increased competition on ads for that product. They responded by revamping the listing and shifting some budget to other products while optimizing the campaign (different keywords) to bring ACOS back in line. The key is that Trends view quantified the creeping change, which might otherwise go unnoticed until profit is badly hit.

- Profitability Structure & Metrics per Product: Trends view can track not just simple metrics like sales, but also profit-related metrics such as Margin (%) or ROI (%) by product over time. Monitoring these in Trends view is extremely useful for ensuring each product meets your profitability criteria. For example, you might set a rule that every product should maintain at least 20% net margin. By selecting Margin% in Trends, you’d quickly see if any product falls below that threshold in recent months. If one product’s margin was 25% three months ago but only 15% this month (Trends will show a red decline), you know that product’s cost structure has worsened – perhaps Amazon fees went up or you had to lower price due to competition. Either way, it’s an alert to take action: maybe renegotiate supplier costs or reconsider if that product is viable. Similarly, ROI (profit relative to cost) might reveal which products are giving the best bang for buck. Some sellers use this to decide where to invest their capital – e.g., a product with a rising ROI trend is becoming more efficient/profitable; one with a falling ROI might be tying up money for little return. Also, Trends view for refunds or defect rate can be considered part of profitability structure for a product: if a product’s return rate jumps, effectively its true profit will drop. Catching that in Trends means you can fix issues faster (which improves that product’s long-term profit structure). In essence, Trends view isn’t just about top-line metrics; it can illuminate shifts in the underlying profitability of each item. As a practical tip, you might alternate different metrics each week – one week, focus on sales and units; next week, margin and ROI; another week, on-time delivery or feedback if those are available. It’s a rotating check that keeps you informed holistically.

- Specific Cost Factor Trends by Product: If you suspect a certain cost is hurting some products more than others, Trends view can shed light by product. For instance, advertising spend might be acceptable for most SKUs but out of control for one. Select “Advertising Cost” or “ACOS” in Trends and you’ll see which products’ ad costs are trending up. Or take refund costs – maybe one product is generating the bulk of your return expenses. By selecting “Refunds” or “Refund Rate” in Trends, you might find that product A has a 10% return rate and climbing, whereas others are 2%. That tells you exactly where to focus your quality improvement or customer service efforts. Another often overlooked factor is storage fees or inventory days – while not a direct metric in the standard dashboard, you can infer it by looking at sales vs. stock. If a product’s sales trend is flat or declining but you know you have a lot of inventory (Map view can show stock levels), then effectively your storage cost for that product is rising relative to its revenue. In Trends, you might track “Units Sold” and notice it declining for a product that’s overstocked; this signals you to perhaps run a sale or lightning deal to avoid long-term storage fees. In summary, for any specific cost or KPI, Trends view lets you rank your products by how that metric is changing, which is great for pinpointing outliers. Sellers often leverage this when they have initiatives like “reduce advertising waste” – they’ll use Trends to find which SKUs have worsening ACOS and tackle those first, rather than blanket cutting ads on all products.

Using the Trends view effectively means taking advantage of its sorting and filtering. One recommended approach is to sort by the latest period’s value or % change to surface the extremes. For example, sort by “% Change vs last month” to see which products had the biggest drop and which had the biggest gain. Then you can manually examine those specific items to decide why they dropped or spiked. Also, use the filter to group products if needed – sellerboard allows grouping by parent ASIN or brand. If you group by parent, you can see trends at the parent level (useful if you have variations). If you group by brand or supplier (assuming you tag products by supplier), you could even see if an entire brand’s products are trending down (maybe the brand fell out of favor or got bad press). Many power-users create saved “smart URLs” for trends – for instance, a URL that always shows “last 3 months net profit trend, sorted by biggest decline”, which they check periodically. This way, no product that’s nose-diving escapes notice. The key to Trends view is regular attention: it’s like a dashboard on your car – if you glance at it often, you’ll catch the engine light or fuel warning before you stall. In Amazon terms, that means catching a faltering product before it becomes a money loser, or catching a rising star early and nurturing it. Turn those observations into actions: fix listings, cut costs, boost winners, and so on, as the trends indicate.

Putting It All Together: Frequency, Interpretation, and Action

We’ve explored each sellerboard view in isolation, but in practice they complement each other. Here’s how you might integrate them into your workflow, based on typical seller and agency practices:

- Daily: Start with the Tiles view to get your quick pulse check on the entire account. Check if today’s sales and profits are on track and scan yesterday vs. today for any abrupt changes. Many sellers also glance at a daily Chart (e.g., last 7 days trend) for context, but the tiles likely suffice unless something stands out. If a tile shows an anomaly (say, today’s profit is unusually low), you might drill down immediately – click that tile to see product breakdown or cost breakdown for the day. In a few clicks, you could find, for example, one big refund or a batch of high ad spend that caused the drop. Address those immediately (maybe pause a runaway ad campaign or investigate a sudden refund).

- Weekly: Dive deeper with Chart and Trends views. For example, every week pull up a Chart for key metrics (sales, spend, profit) over the past several weeks – this smooths out daily noise and shows directional movement. Next, review the Trends view for the week or the current month-to-week comparison: identify products that are significantly up or down in sales or profit versus last week. This is what many savvy sellers do to stay proactive – if a product’s trend is down, they won’t wait until month-end to react. They might, over the weekend, tweak that product’s PPC bids or adjust the listing if they suspect the downward trend is due to, say, lower conversion. Agencies managing client accounts often have a weekly checklist including: check tiles for each account (ensure all green or explainable), check trends for any red flags (client’s SKUs dropping), and check the PPC spend vs sales (maybe via Chart or PPC dashboard) to rein in overspending quickly.

- Monthly: Do a comprehensive P&L view analysis. This is akin to closing your books each month. Go through each line item and note changes from prior month. If net profit is down, use the P&L breakdown to pinpoint cause – maybe ad cost line went from $5k to $8k, or refunds doubled – whatever it is, mark it. Then formulate an action: e.g., “Refund costs up by $2k -> initiate product quality check on SKU X (which Trends shows had most returns)”, or “Advertising spend up 60% with only 10% sales increase -> refine campaigns, possibly cut keywords with high ACOS”. Monthly is also a good time for Map view if you operate internationally or in multiple regions, to adjust inventory and marketing per region as we discussed. Additionally, a monthly look at ROI and margin by product (via Trends or P&L filtered by product) helps ensure every product is still worth its keep. If one is consistently underperforming (low margin, low ROI, or even net negative after all costs), the hard decision might be to cut that SKU and reallocate resources to better ones.

- Quarterly / Periodically: Step back and identify broader trends and strategic pivots. Use Chart view for year-to-date vs. last year comparisons, identify seasonality patterns (maybe certain views in sellerboard let you compare year-over-year for a given month or you might export and chart externally). Also, use P&L view to check profit percentages (not just dollars) – what percent of revenue is each expense category? Perhaps set goals for next quarter like “reduce advertising cost to 15% of sales” if it’s currently 20%. The data from the last quarter will guide these targets. Agencies often prepare a quarterly business review for clients with charts and tables from all these views to show what’s working and what’s not, and propose actions (e.g., “Our analysis shows product group A has a 5% margin whereas others are 20% – next quarter we’ll either turn around A or phase it out”).

Throughout all these periods, interpreting metrics correctly is crucial. Always consider context: a spike in one metric might be fine if it comes with a spike in another (e.g., higher ad spend is fine if it’s driving proportionally higher sales). The beauty of sellerboard’s tools is that you can correlate those – high ad spend will show in Tiles (lower net profit) and Chart (line going up) but you can open Chart with sales and ad together to see if sales line rose too. If not, interpretation is that your ads became less efficient (so fix it).

Finally, turning insight into action is the whole point. Here are some common actions sellers take based on what they discover:

- If margins are shrinking (seen in Tiles or P&L), they might raise prices modestly or negotiate lower supplier costs. Some will look at the fee breakdown to see if an FBA fee change occurred and adjust the product dimensions/packaging to fall into a lower fee tier if possible.

- If a product’s trend is declining (Trends view shows consecutive monthly drops in sales), typical actions include optimizing the listing (improve images, title, keywords to regain competitiveness), running a promotion to boost visibility, or investigating if the product has quality issues or new competition. Often, sellers will also check their advertising for that product – maybe it slipped in search rank and needs more ad support.

- If a product is unprofitable (P&L or Tiles shows negative net profit for that SKU, or ROI far below target), the decision tree is: Can costs be cut or price increased without killing demand? If yes, implement that (cut ad spend that isn’t converting, find cheaper fulfillment or packaging). If no, sometimes the best action is to sunset the product – sell out and not reorder – because it’s tying up capital. This is a tough call, but data-driven sellers make it when needed, using the clear evidence from their profitability analysis.

- If advertising ACOS is too high (maybe seen in Tiles as low net profit while sales ok, and confirmed in Trends showing high ad cost% for that product), they typically lower bids, add negative keywords, or pause campaigns for that ASIN until it’s back to acceptable levels. Some use sellerboard’s PPC optimization suggestions or other tools, but the key is acting quickly once you spot the trend of overspending.

- If the refund rate is high (seen via Tiles or Trends or P&L), actions include reading customer feedback and reviews in detail to find the cause. Sellers might discover a sizing issue, a part that frequently breaks, or even a mis-expectation set by the listing. They then either improve the product quality, adjust the description to set proper expectations, or in some cases, disable a problematic variation. Reducing refunds directly improves profit, so this is a high-impact action.

- If a region is underperforming (Map view insight), one might invest in localized advertising, translate the listing, or even adjust pricing in that marketplace. If a region is doing great, conversely, maybe allocate more inventory there or run region-specific deals to further dominate that market.

- If inventory issues are noted (either from Map or from noticing stockouts affecting sales in Trends), actions include shifting stock, speeding up reorders, or using Amazon’s Inventory Performance Index guidance. Sellerboard won’t directly fix stockouts, but by correlating sales dips with stock levels you glean from Map or Amazon reports, you can avoid lost profit opportunities.

In summary, using sellerboard’s profit analysis tools is an iterative process: View → Interpret → Act → Repeat. The Tiles, Chart, P&L, Map, and Trends views each play a role in this cycle. By checking the right view at the right frequency, you catch both the low-hanging fruit and the subtle shifts in your business. The payoff is a tighter, more profitable operation – you’re not flying blind or relying on gut feel, but making decisions anchored in data. Whether you’re an individual seller keeping an eye on a handful of SKUs or an agency juggling multiple clients and marketplaces, mastering these tools means you can quickly diagnose issues and spot opportunities, then take decisive action to improve profitability.

Conclusion: sellerboard’s dashboard views give Amazon sellers an analytical edge. The Tiles view keeps you grounded in daily performance, Chart view uncovers trends and relationships, P&L view ensures every dollar is accounted for, Map view adds a strategic regional dimension, and Trends view monitors product trajectory. Use them in combination – much like instruments on an airplane – to navigate your business toward greater profitability. By regularly reviewing and acting on these insights, you’ll make data-driven optimizations: cutting waste, boosting winners, and ultimately increasing your bottom line. Happy selling, and may your profits always be in the green!