Understanding seller fees on Amazon is critical for a seller’s profitability. If these costs surpass your earnings, financial instability ensues. A transparent understanding of your settlement statements helps you identify and minimize unnecessary expenses.

This guide provides a comprehensive breakdown of Amazon’s diverse seller fees. By utilizing this information, sellers can anticipate fees, scrutinize their statements, and address any discrepancies with the platform.

Equally important is the availability of an accurate profit dashboard. It gives you a real-time view of your financial health, including all transactions and fees, thereby enabling informed decision-making for improved profitability.

Amazon Adjustment Fees

These fees include price adjustments on recent purchases, restocking fees on returned items, the principal amount in promotional offerings, and balance adjustments related to inventory discrepancies.

- Adjustment Item Price Good Will: This fee is a reimbursement made by Amazon to your customer when there’s a reduction in the price of an item. This happens when an item purchased on Amazon decreases in price within a week of the transaction.

- Adjustment Item Price Restocking Fee: This is a charge that Amazon sellers can apply when a customer returns an item. The fee fluctuates based on the condition of the returned product, the circumstances surrounding the return, and the specific type of item.

- Adjustment Promotion Principle: This is primarily the price that customers pay for your product, not including shipping and taxes. If the item price encompasses sales tax, the Principle is the price with the tax deducted.

- Other Transaction Balance Adjustment: This type of adjustment can act as a compensation for a missing unit. Such a situation might occur when a customer fails to return a unit, but Amazon eventually locates it, or the customer belatedly returns it.

Amazon Delivery & Transport Fees

Amazon’s shipping and transportation costs include fees associated with sending your products to Amazon’s warehouses, often referred to as ‘inbound’ shipping charges. This could be shipments directly from your premises or from a third-party manufacturer. The fees also include the Fulfillment by Amazon (FBA) Transportation Fee, which applies when using Amazon’s shipping label service.

- Non-Amazon Order Shipment Fees, FBA Transportation Fee: This is the sum you pay to ship your own items to Amazon, via their shipping label service.

- Other Transaction Inbound Transportation Charge: ‘Inbound’ refers to the shipment that you send to Amazon. This could be coming from you, as an Amazon Seller directly, or from your manufacturer.

Amazon Sales Commissions & Fees

These costs involve adjustments to your inventory, handling of refunds, sales on Amazon’s platform, provision of additional services like gift wrapping, and even in situations where Amazon mediates disputes with customers.

- Adjustment Item Fees Commission: These fees are classified by type and specific reason code. The code reflects whether the adjustment to your inventory increases or decreases and if it’s associated with product modifications, misplacements, ownership corrections, or discovered inventory.

- Adjustment Item Fees Refund Commission: This is a fee that Amazon retains on refunds. Amazon holds this sum back as a refund handling fee.

- Refund Item Fees Commission: This is a charge levied by Amazon on refunded items.

- Order Item Fees Commission: This fee is charged by Amazon for items that are ordered and sold on their platform.

- Order Item Fees Gift Wrap Commission: If you are an FBA seller and have activated gift wrapping on your account as a service for your customers, Amazon will accumulate this fee and present it as your revenue. Since Amazon offers the gift wrapping service, they will receive a fee recovery from you.

- A to Z Guarantee Refund Item Fees Commission: The A to Z guarantee is provided to customers by Amazon when transactions involve third-party sellers. This guarantee ensures a certain level of customer service and expectations, considering aspects such as delivery times, item conditions, and returns. If the third-party seller and the customer cannot resolve an issue, Amazon intervenes but charges a commission for this service.

Amazon Fulfillment & Storage Costs

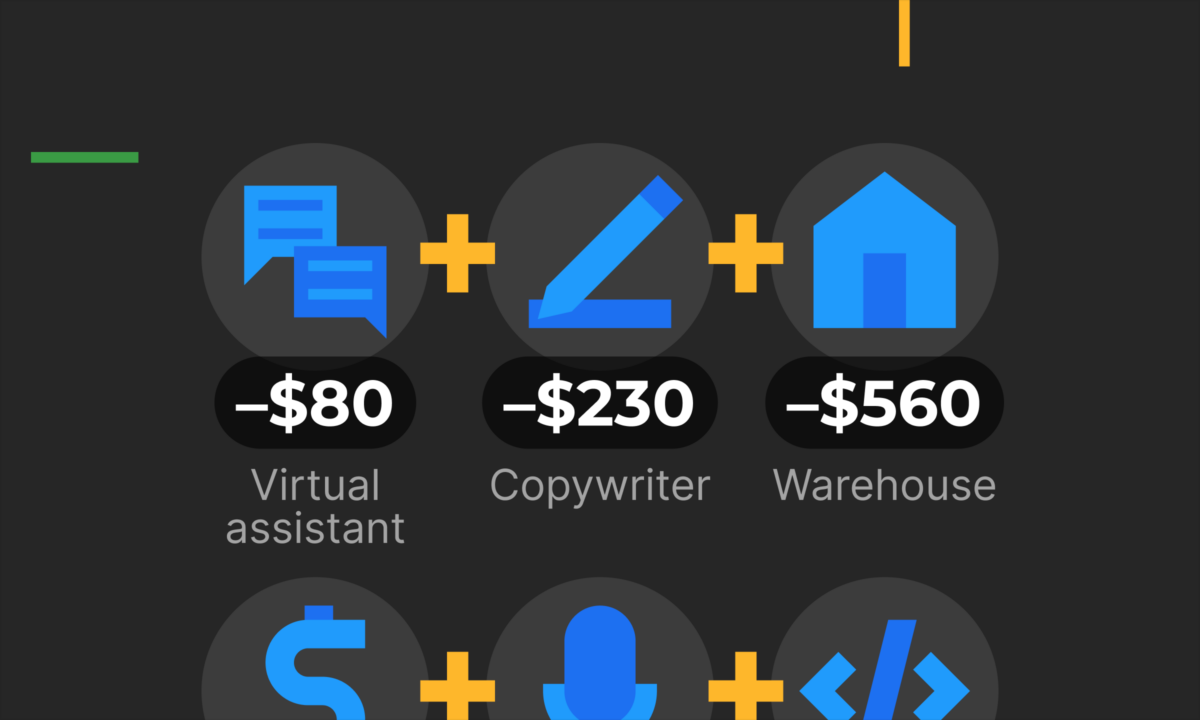

These costs represent a variety of fees that Amazon charges for the storage and handling of products within their warehouses, as well as the processing of orders through their Fulfillment by Amazon (FBA) program. These charges can vary depending on factors such as item size, weight, and whether the item is sold directly on Amazon or not.

- Order Item Fees FBA Per Order Fulfillment Fee: This Fulfillment by Amazon (FBA) fee is a charge per order, computed based on the total dimensions and weight of your entire order.

- Order Item Fees FBA Per Unit Fulfillment Fee: This Fulfillment by Amazon (FBA) fee is a charge per item, calculated based on the individual dimensions and weight of each product.

- Order Item Fees FBA Weight-Based Fee: This Fulfillment by Amazon (FBA) fee is determined by the weight of each item in the order.

- Non-Amazon Order Item Fees FBA Per Order Fulfillment Fee: This Fulfillment by Amazon (FBA) fee is a per-order charge, computed based on the total dimensions and weight of your order for non-Amazon items.

- Non-Amazon Order Item Fees FBA Per Unit Fulfillment Fee: This Fulfillment by Amazon (FBA) fee is a per-item charge, applicable to non-Amazon items.

- Non-Amazon Order Shipment Fees FBA Transportation Fee: This Fulfillment by Amazon (FBA) fee covers the transportation and shipment cost of your total order for non-Amazon items.

- Other Transaction Storage Fee: This fee is incurred for storing your products in Amazon’s warehouses.

Other Amazon Selling Transactions

Other Amazon Selling Transactions cover a diverse set of fees and transactions that don’t neatly fit into the primary categories of sales, shipping, and refunds. These include everything from gift wrapping charges and goodwill compensation, to inventory placement and brand-neutral packaging fees, and even charges related to administrative matters such as failed fund transfers or reserve amounts. Essentially, this category encapsulates the wide array of additional services and operational complexities that can influence the overall profitability of selling on Amazon.

- Order Item Fees Gift Wrap Charge-Back: An optional service for FBA sellers where Amazon handles gift wrapping of your product. The cost for this service will be borne by you.

- Order Item Price Gift Wrap: The price associated with the gift wrapping of a purchased item.

- Refund Item Fees Gift Wrap Chargeback: A chargeback fee applied when gift-wrapped items are refunded.

- Refund Item Price Gift Wrap: This represents the cost of gift wrapping that is refunded on returned items.

- Refund Item Price Goodwill: A compensation to the customer, signifying a goodwill gesture from Amazon. This may be deducted from the seller or Amazon’s account, subject to the specific circumstances.

- Refund Item Price Restocking Fee: A fee deducted from the refund amount when a customer returns a product. It’s a portion of the item’s price, contingent on the product type, its returned condition, and the return timing.

- Other Transaction Current Reserve Amount: An amount withheld by Amazon that’s released upon seller’s action. This reserve is typically created when settlement payments are retained due to issues with the seller’s bank account, expired credit card, or being a new seller without history.

- Other Transaction Inventory Placement Service Fee: A fee associated with sending inventory to a single Amazon warehouse instead of distributing to multiple fulfilment centres. Amazon, then, splits and distributes the inventory at its end.

- Non-Amazon Order Shipment Fees Brand Neutral Packaging Service Fee: A fee for using Amazon’s brand-neutral packaging service for non-Amazon orders.

- Non-Amazon Order Shipment Fees Multi Channel Fulfilment Brand Neutral Box Fee: A charge when Amazon’s logistics system is used for fulfilling non-Amazon orders from different channels with brand-neutral boxing.

- Other Miscellaneous Event: These charges encompass various fees such as for sending unlabeled inventory to Amazon, processing fee for returned items qualifying for free returns, and fee for the removal of unsold inventory stored at an Amazon warehouse for over six months.

- Other Transactions Amazon Capital Services: Represents an outstanding amount owed to Amazon. It’s either charged to your credit card or carried over to the next settlement depending on the size of the amount.

- Other Transaction Disposal Complete: This is the fee charged by Amazon for disposing of your inventory, typically when it’s more cost-effective to discard unsold items, or for expired food products.

- Other Transaction Removal Complete: A per-item fee charged upon the completion of item removal from the warehouse. It appears in the ‘Payments’ report after around 14 business days.

- Other Transaction Previous Reserve Amount Balance: The previously withheld reserve amount that gets released and reflects in your statement as ‘Previous Reserve Amount Balance’. It can be coded to a suspense account in Xero and is offset by a corresponding debit.

- Other Transaction Successful Charge: A charge made to your credit card by Amazon, marked as a ‘Successful Charge’ transaction in a settlement.

- Other Transaction Transfer of Funds Unsuccessful: A transaction denoting a failed fund transfer due to incorrect bank information or similar issues.

- Other Transaction Warehouse Prep: A fee for Amazon’s FBA prep service which ensures your items meet packaging and prep requirements for Amazon fulfilment centres, aimed at minimizing shipment delays and safeguarding your product.

Promotion for Amazon Selling

- Principal Order Promotion and Principal Refund Promotion: These refer to promotions or discounts provided to customers on the “Principal”, that is, the actual product sold, or on its shipping costs.

Amazon Return, Refund and Reimbursement Fees

Amazon’s Return, Refund, and Reimbursement Fees involve a system of compensation and deductions tied to product return scenarios, damage in Amazon’s warehouse, and lost items during inbound transit or within the warehouse. These fees reflect Amazon’s approach to addressing financial aspects linked to handling inventory under the Fulfilment by Amazon (FBA) service. They ensure sellers receive proper reimbursements or bear appropriate fees, thus balancing the risks involved in storing and shipping products through Amazon.

- Amazon FBA Inventory Customer Return Reimbursement: This relates to Amazon compensating you for a damaged item they have taken responsibility for, potentially reselling it at a discounted price.

- FBA Inventory Damaged Warehouse Reimbursement: Amazon will compensate you for any items damaged within their warehouse. Reimbursement can be requested.

- FBA Inventory Fee Correction Reimbursement: Amazon can restock or resell returned items stored in their warehouse. Should a buyer return an incorrect product and receive a refund, Amazon provides this differential reimbursement fee.

- FBA Inventory Lost Inbound Reimbursement: This is a fee covered by Amazon if an item dispatched to them via their Fulfilment by Amazon service is lost or damaged by an Amazon-contracted carrier.

- FBA Inventory Lost Warehouse Reimbursement: Amazon covers this fee if an item dispatched to their warehouse gets misplaced.

- FBA Inventory Reimbursement – Reversal Reimbursement: Amazon may revert a previous cash reimbursement, returning your inventory instead. This will appear as “REVERSAL_REIMBURSEMENT”.

- FBA Inventory Warehouse Damage Reimbursement: Amazon will compensate you if an item dispatched to their warehouse gets damaged. This will appear as “WAREHOUSE_DAMAGE”.

Amazon Sales Transactions

Amazon Sales Transactions involve the financial details related to the actual selling of items on the platform. These include adjustments to the selling price, the original selling price, refunds given, and even specific guarantees related to refunds. This set of fees or transactions essentially track the ebb and flow of money in relation to the principal price of items being sold, ordered, and refunded on Amazon, ensuring transparency and correctness in every transaction.

- Adjustment Item Principal Price: In Amazon’s terminology, ‘principal’ refers to an item’s sale price. This is the modified sale price for the product.

- Order Item Principal Price: This refers to the sale price of the ordered product.

- Refund Item Principal Price: This denotes the refunded sale price of your item.

- A to Z Guarantee Refund Item Principal Price: This represents the sale price amount refunded to the buyer when Amazon Pay manages the refund.

Shipping Products Sold on Amazon Transactions

Shipping Products Sold on Amazon Transactions encompasses all the shipping-related costs that sellers may incur during the course of conducting business on Amazon. These fees not only cover the physical transportation of products from sellers to buyers, but also include charges related to adjustments, refunds, and promotions. They can vary based on several factors, such as the type of item, whether you’re using FBA (Fulfillment by Amazon), and even the specific promotional activities you’re participating in.

- Shipping Chargeback Adjustment Item Fees: This is akin to the Gift Wrap Charge-Back fee. Amazon facilitates the shipping for your adjusted item, and equates the fee from your account with a charge-back to balance the transaction.

- Shipping Price Adjustment Item: This represents an amendment charge for shipping purchased via Amazon’s shipping service. Such adjustment fees occur when a carrier bills additional shipping charges for your package.

- Shipping Tax Adjustment Item Price: This is a modification fee for shipping and handling tax. These adjustment fees are incurred when a carrier imposes additional shipping charges on your package.

- Shipping Promotion Adjustment: This denotes an adjustment for shipping associated with a product promotion.

- Shipping Chargeback Order Item Fees: Amazon manages the shipping for your ordered items, and equates the fee from your account with a charge-back to balance the transaction.

- Shipping HB Order Item Fees: Also known as the Shipping Holdback Fee, this won’t need to be covered by you if you use FBA (Fulfillment by Amazon) and Amazon handles your items’ shipping. It’s a nominal fee added, contingent on the item type and the use of Amazon as a platform and service.

- Shipping Order Item Price: This fee represents the shipping charge purchased through Amazon’s shipping service.

- Shipping Tax Order Item Price: This is a fee for shipping and handling tax.

- Shipping Chargeback Refund Item Fees: Amazon arranges the shipping for your refunded items and adjusts the fee from your account with a charge-back to equate the transaction.

- Shipping HB Refund Item Fees: This is the Shipping Holdback Fee related to refunded items. You won’t need to cover this holdback if you use FBA (Fulfillment by Amazon). It’s a nominal fee added, based on the refunded item, and for using Amazon’s platform and services.

- Return Shipping Refund Item Price: This is a compensation fee for the customer’s shipping when a buyer returns a refunded item.

- Shipping Refund Item Price: This represents a compensation fee to the customer for shipping on a refunded item.

- Shipping Tax Refund Item Price: This fee pertains to shipping and handling tax on a refunded item.

- Shipping Refund Promotion: This denotes a refund on the shipping price of a promotional item when it’s returned by the buyer.

Amazon Subscription & Service Fees

Amazon Subscription & Service Fees cover the costs associated with accessing and using the Amazon selling platform. These fees can vary based on your seller status and the volume of units you sell each month. Non-subscription sellers may face a per unit fee, while professional sellers pay a monthly flat rate. Sometimes, Amazon may also need to make adjustments to these charges, due to overpayment or undercharging errors, for example.

- Non-Subscription Fee Adjustment Other Transaction: This fee indicates a possible discrepancy where Amazon may not have billed you correctly as a non-subscription model seller. It could also imply an overpayment scenario on their part, which they are rectifying.

- Subscription Fee Other Transaction: Different subscription models exist depending on your seller status. Individual sellers, who transact less than 40 units per month or don’t incur a monthly subscription fee, are levied a $1 per unit fee on each sale. Conversely, professional sellers pay a $40 monthly fee to gain complete access to Amazon’s seller platform, and in this case, the $1 per unit charge is waived. Therefore, transitioning to a professional seller is sensible if your sales exceed 40 units per month.

- Subscription Fee Correction Other Transaction: This fee is indicative of Amazon either having undercharged you as a subscription model seller or having overpaid you, and they are currently adjusting this error.

Amazon Taxes

Amazon Taxes account for the various tax costs associated with your transactions on Amazon’s platform. Whether it’s for an adjusted, ordered, or refunded item, taxes play a significant role in the total cost. Additionally, other services like gift wrapping also attract tax charges.

Tax on Adjustment Item Price: These are the tax costs associated with an adjusted item.

Sales Tax Service Fee on Ordered Item Fees: This pertains to the sales tax levied on items ordered.

Gift Wrap Tax on Ordered Item Price: These are tax costs imposed on the gift wrapping service for ordered items.

Tax on Ordered Item Price or Retro Charge Tax on Ordered Item Price: This involves the tax charges on items ordered.

Tax on Refunded Item Price or Retro Charge Tax on Refunded Item Price: This represents the tax costs for refunded items.

Key takeaway

Understanding the multifaceted landscape of Amazon fees and transactions is critical to any seller’s success. The complex nature of these transactions can significantly impact your overall profitability on Amazon. It’s not just about revenue; true profit is determined after all costs, including these diverse fees, are taken into account.

A tool like sellerboard is invaluable in this scenario. sellerboard meticulously considers every existing Amazon fee and transaction type, integrating them into profit calculations. This offers sellers a complete and accurate financial picture, enabling informed strategic decisions. Harnessing such comprehensive insights can empower you to navigate the Amazon marketplace more effectively, ultimately enhancing your bottom line.