We’ve released a powerful set of improvements focused on one core outcome: clearer numbers → better decisions. From faster performance analysis to cleaner cost allocation and more flexible dashboards, these updates help you interpret your data with greater confidence.

Here’s what’s new.

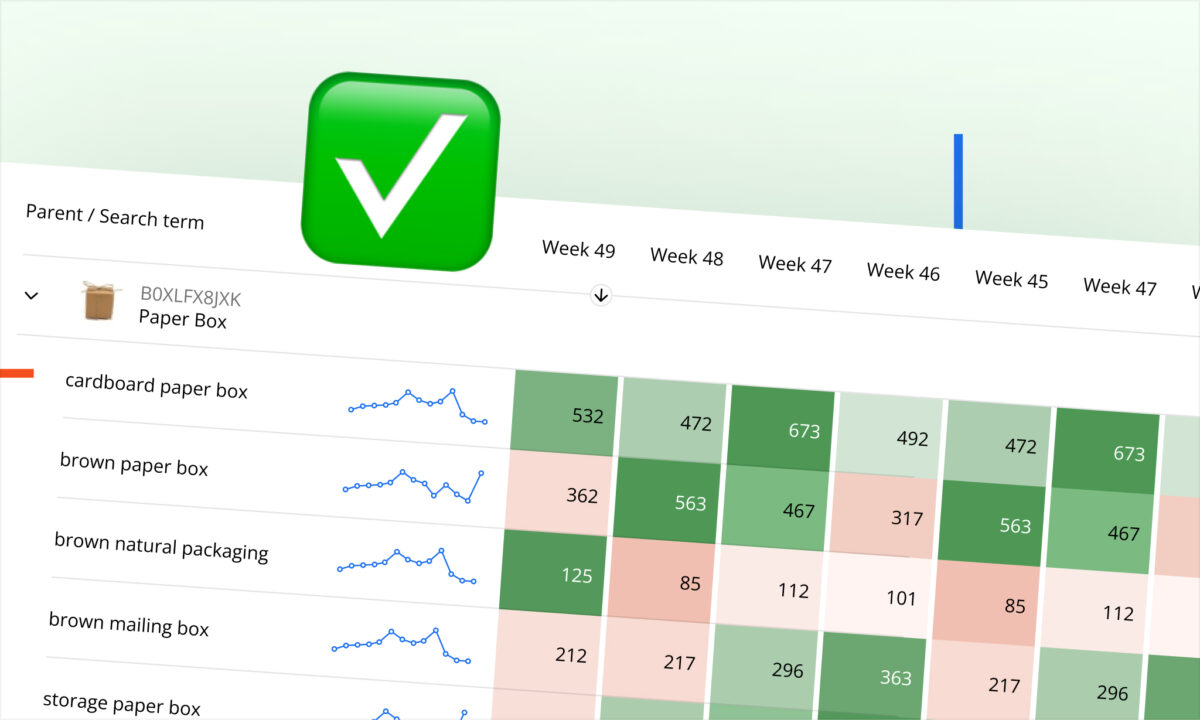

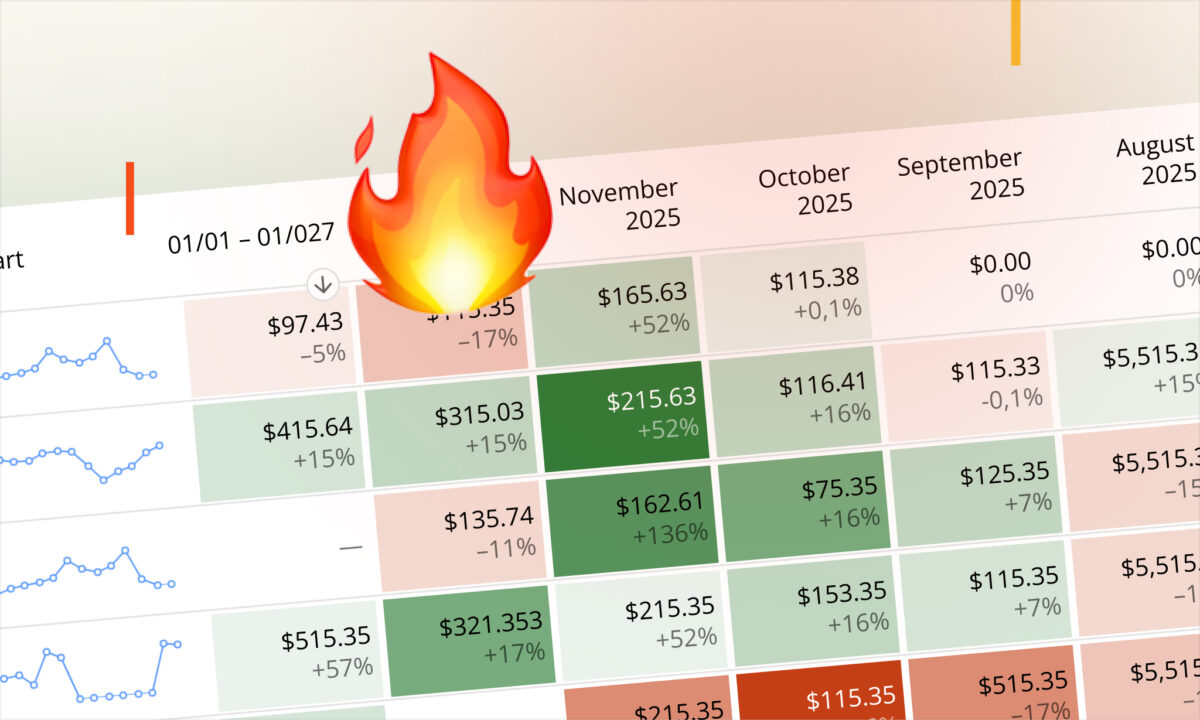

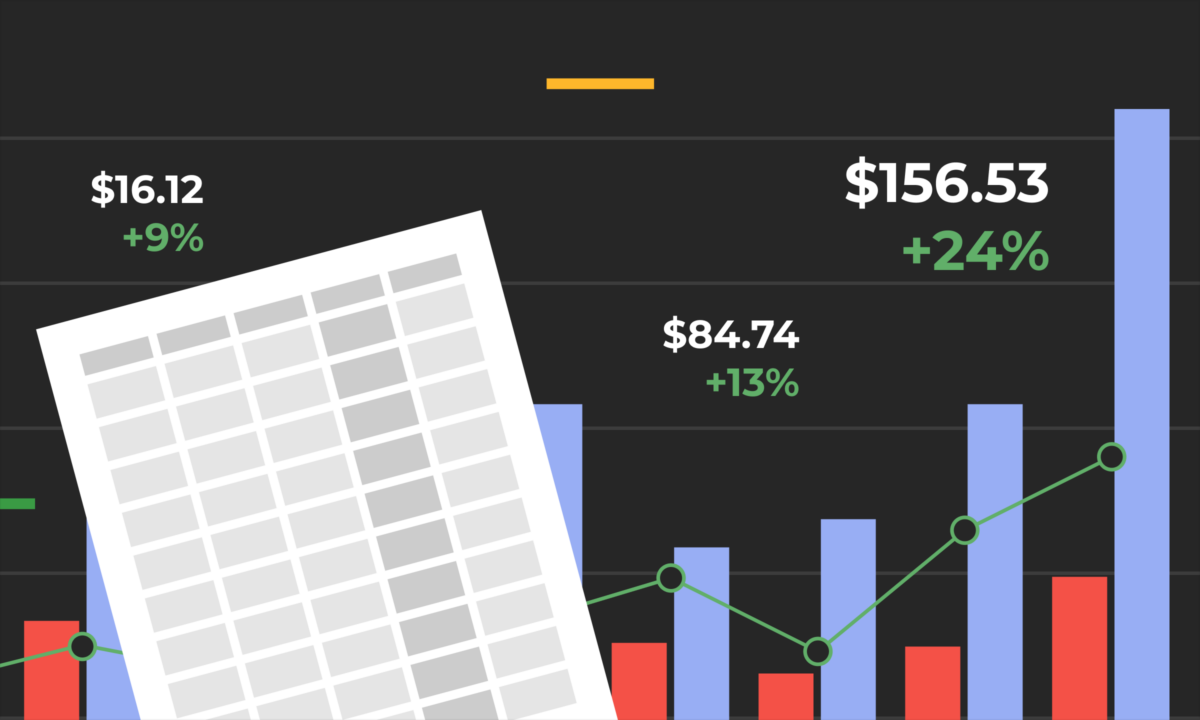

🔥 P&L View: Heatmap Visualization

We’ve added a Heatmap toggle to the P&L view, giving you a visual layer on top of your profitability data.

Understanding how profit evolves over time is essential for protecting margins. The Heatmap makes performance intensity immediately visible, helping you interpret results faster.

With one click, you can quickly identify:

- High-margin periods and loss-making days

- Volatile performance windows

- Seasonal trends

- The impact of pricing or ad changes over time

Instead of manually comparing periods, you instantly see where performance strengthens or weakens — allowing you to react before small shifts turn into material losses.

How it works:

Turn on the Heatmap in the P&L filters to switch to the color-coded view.

All updates are live now.

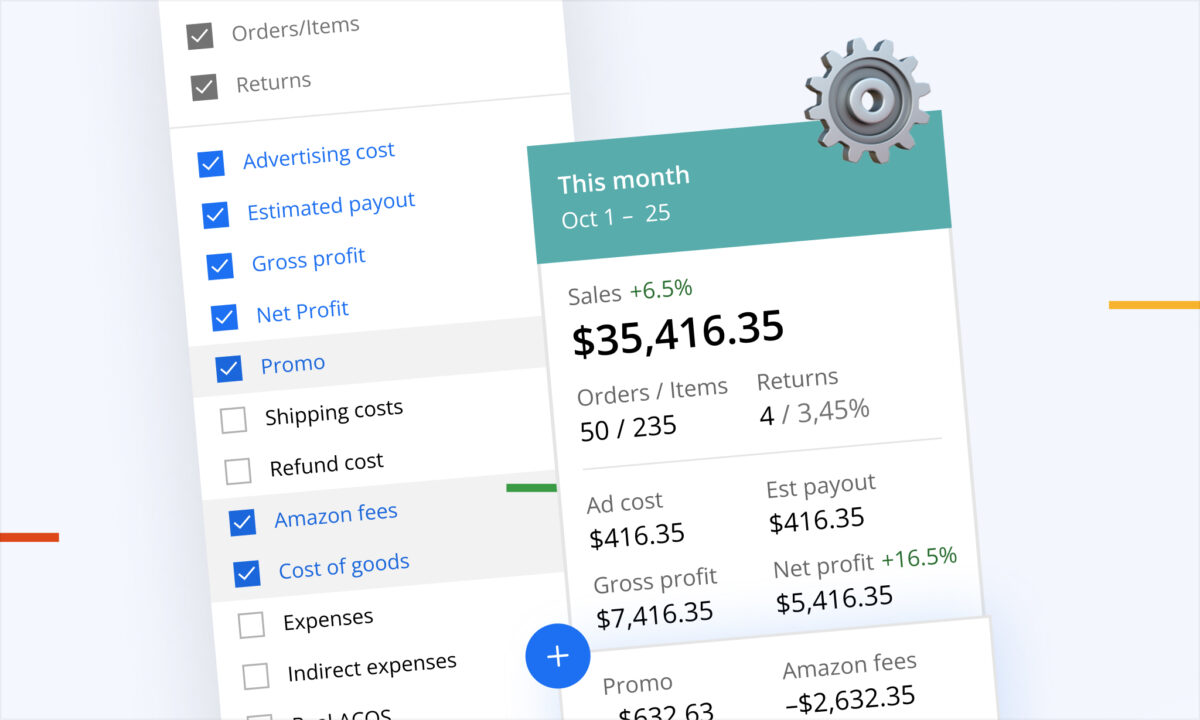

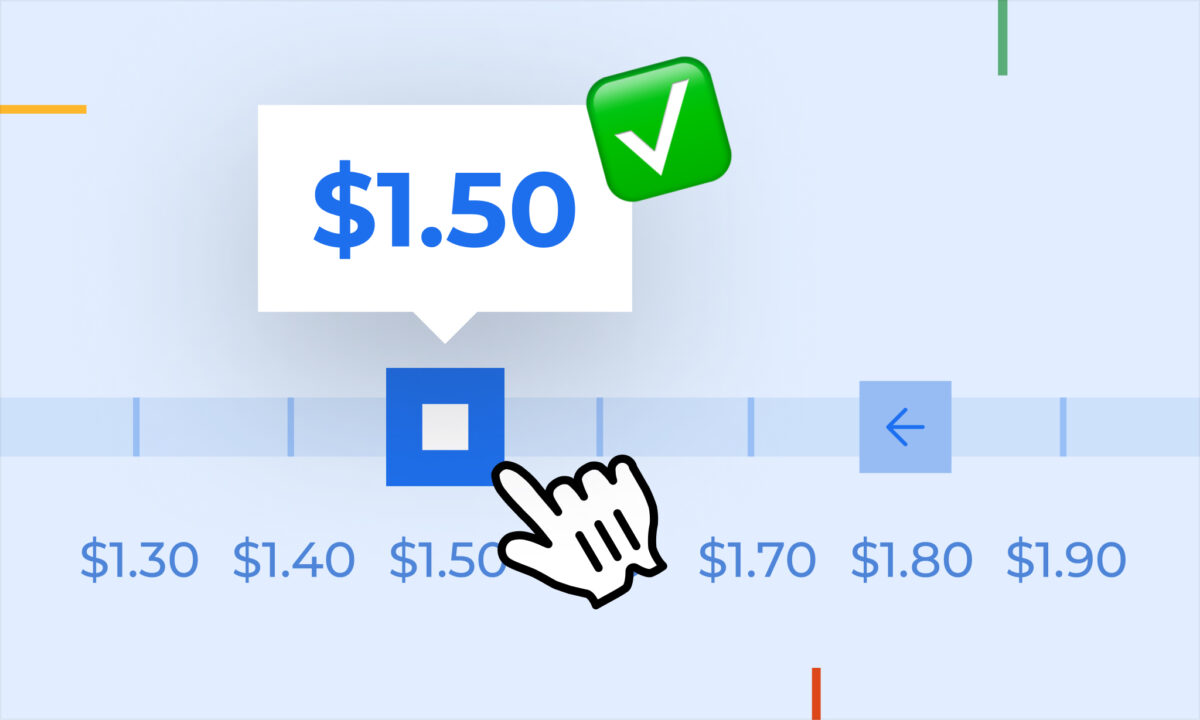

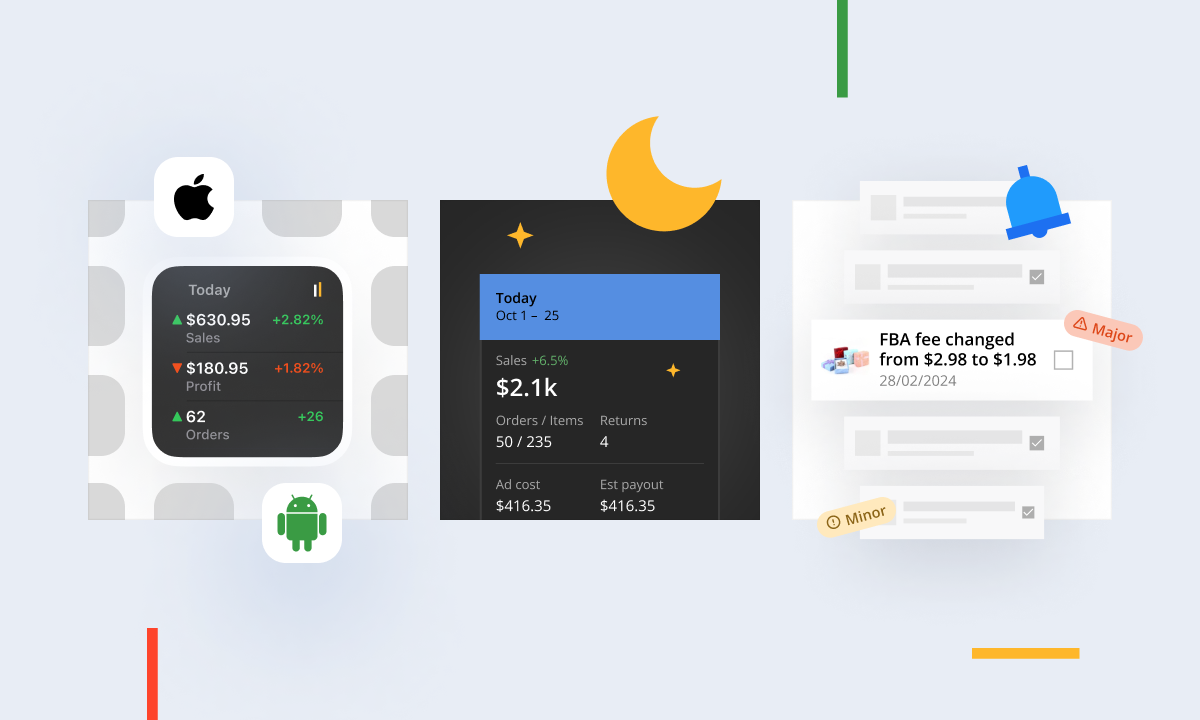

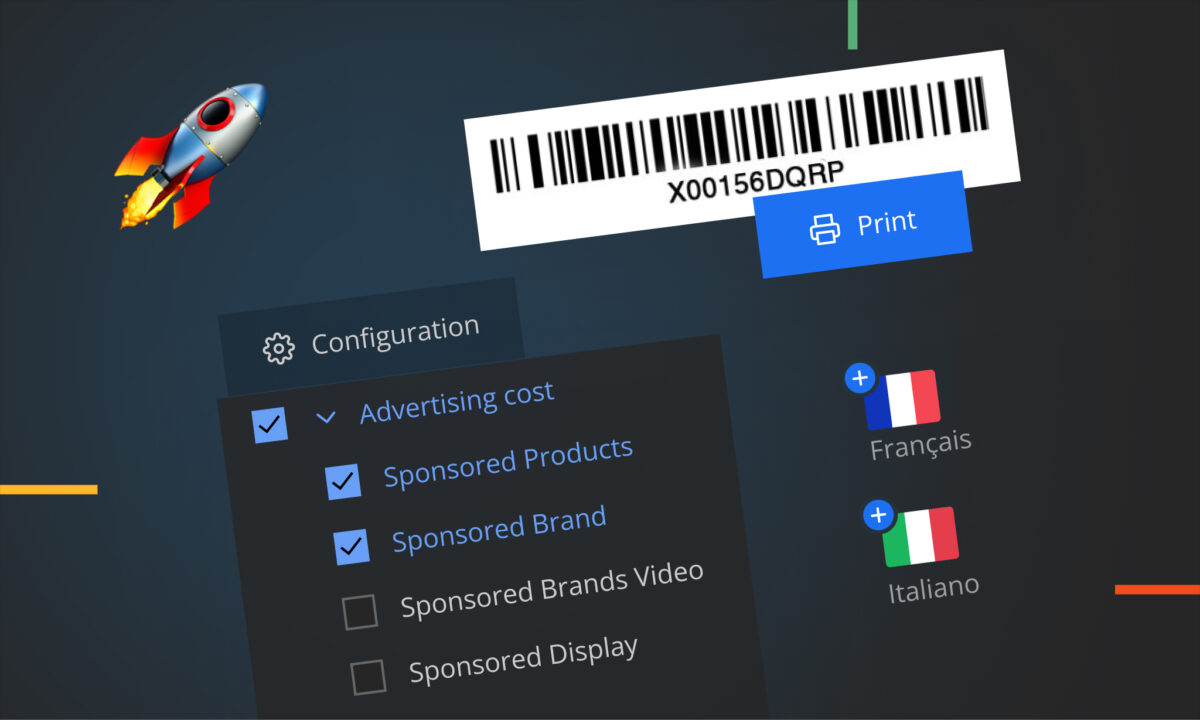

📊 Dashboard: Custom Indicators in Tiles

Your dashboard should reflect your business priorities — not the other way around.

You can now configure Dashboard Tiles and add up to 8 metrics per tile, allowing you to align your layout with the KPIs that drive your decisions, such as:

- Margin

- Real ACOS

- Amazon fees

- % Refunds

- Contribution metrics

This transforms your Dashboard into a true control center, tailored to your strategy — whether you’re optimizing for growth, efficiency, or cash flow stability.

How it works:

Click Configure Tiles under the Period filter and select the metrics you want to monitor.

Available now.

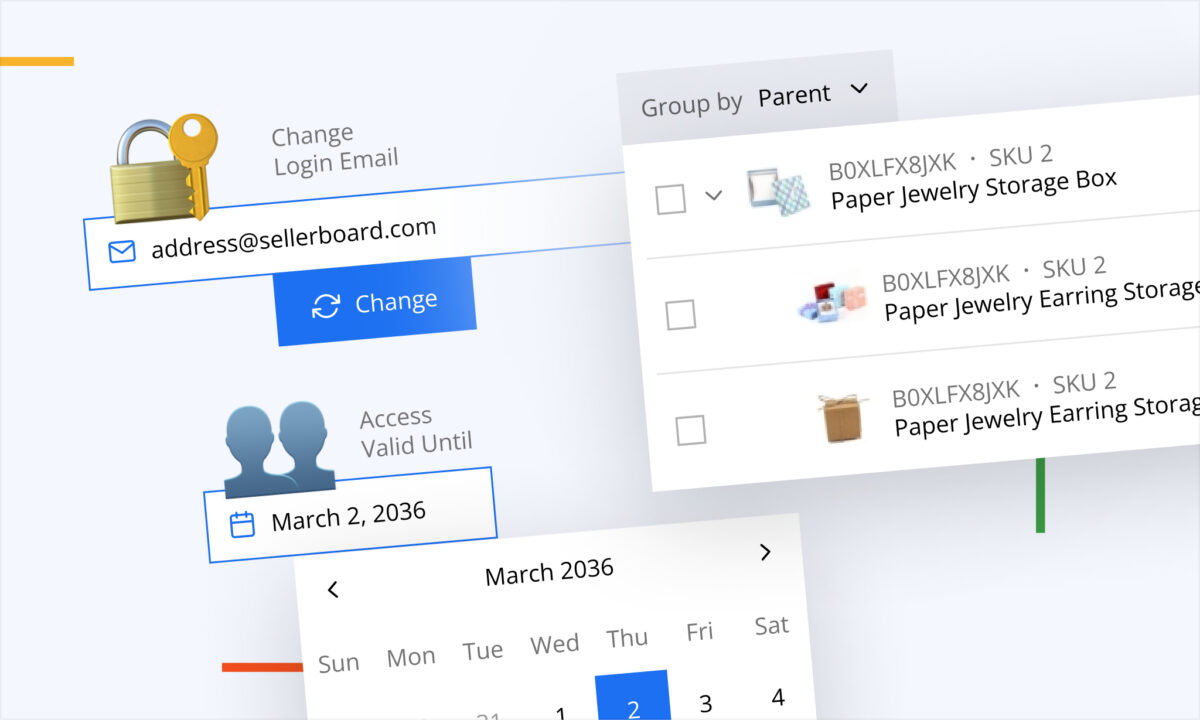

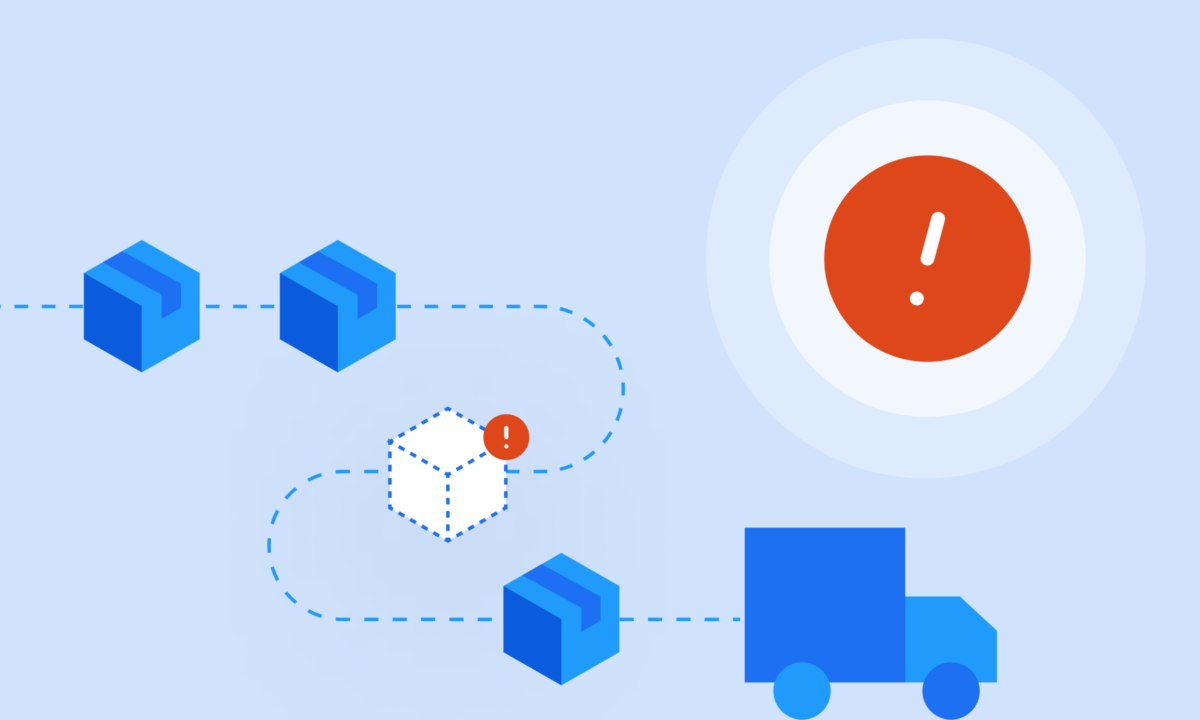

🚨 Alerts: New COGS Accuracy Warnings

Margin decisions are only as reliable as your cost data. Missing COGS or incorrect FIFO allocation can inflate profits and distort performance analysis.

To protect your reporting integrity, we’ve introduced two new alerts:

Product being sold without COGS set

Triggered when a product generates sales but no cost is defined under Product settings. Without COGS, profit appears artificially high.

FIFO batch oversold

Triggered when recorded sales exceed the defined quantity of a FIFO batch. This disrupts accurate cost allocation and affects margin calculations.

These safeguards proactively flag cost inconsistencies so you can correct them before they impact pricing, advertising, or restocking decisions.

How to activate:

Enable them under Alerts → Settings.

Live now.

🛒 Walmart: Import & Export Indirect Expenses

As your Walmart business grows, managing indirect expenses manually becomes inefficient and error-prone.

The Walmart Indirect Expenses page now supports both import and export — giving you full flexibility over cost management.

You can:

- Export expenses to review or share with your accountant

- Import bulk expenses using a template

- Reconcile monthly numbers faster

- Allocate overhead costs in bulk

- Apply large-scale corrections without editing line by line

This streamlines accounting workflows and keeps your marketplace reporting consistent and scalable.

Available now.

📦 eBay: Order-Level COGS & Shipping Import

Profit often varies at the order level — especially when shipping costs differ per transaction.

You can now upload COGS and shipping costs per eBay order via file import. The system automatically assigns the data to matching orders and recalculates profitability.

This ensures:

- Accurate transaction-level margins

- Reliable profit comparisons

- Cleaner cross-marketplace analysis

When every order reflects its true cost structure, your performance decisions become significantly more precise.

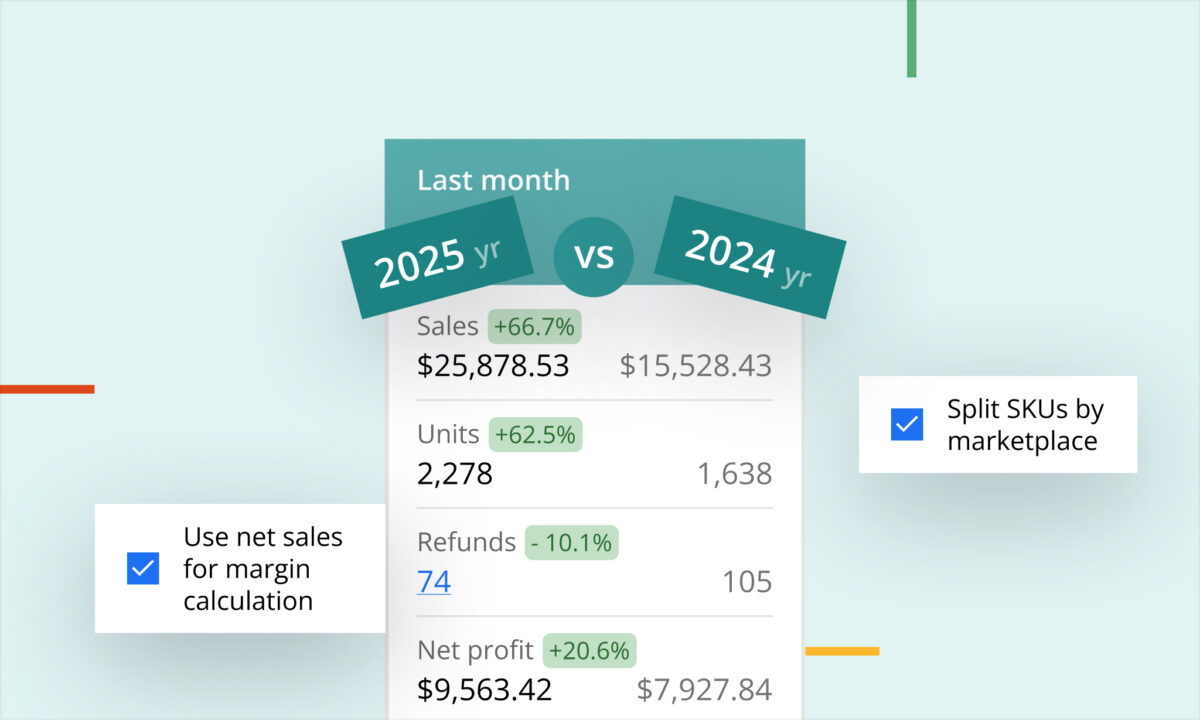

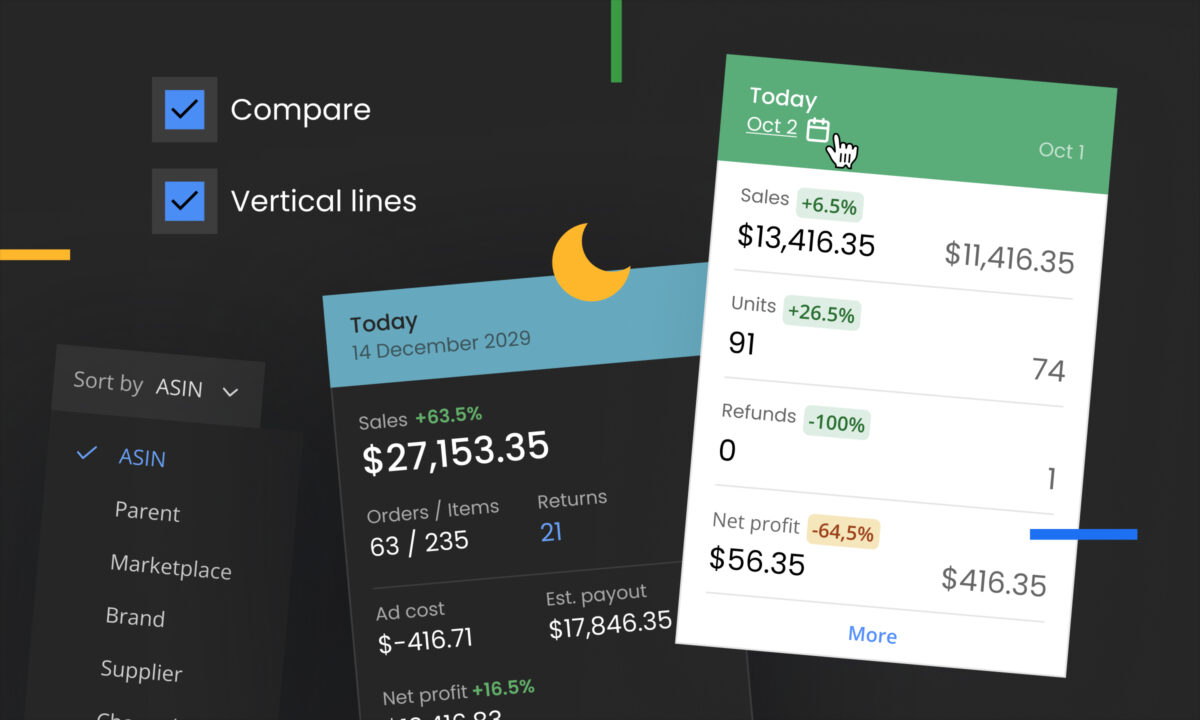

💶 Dashboard: Separated VAT & Marketplace Facilitator VAT

Not all VAT affects your cash flow the same way. Some VAT you collect and remit yourself; other VAT is collected and remitted by Amazon as a Marketplace Facilitator.

We’ve separated these flows so you can clearly distinguish:

- VAT you owe

- Marketplace Facilitator VAT handled by Amazon

This improves clarity around cash flow exposure and helps you interpret profitability more accurately at both account and product levels.

You’ll find the breakdown under Dashboard → More, as well as in P&L and Charts.

All updates are live now ✅

As always, we’d love your feedback.