Due to the Corona crisis, the German Government made a decision to temporarily reduce the VAT rate starting from the 1st of July, 2020 until the 31st of December, 2020.

- The standard VAT rate will be reduced from 19% to 16%.

- The discounted VAT rate will be reduced from 7% to 5%.

What does it mean for you? In case you are based in Germany, or you are selling in Europe and are VAT registered in Germany, this means that you have to apply the new VAT rate to all orders sent to German customers, starting from the 1st of July. Of course, this also has implications on your profit calculation.

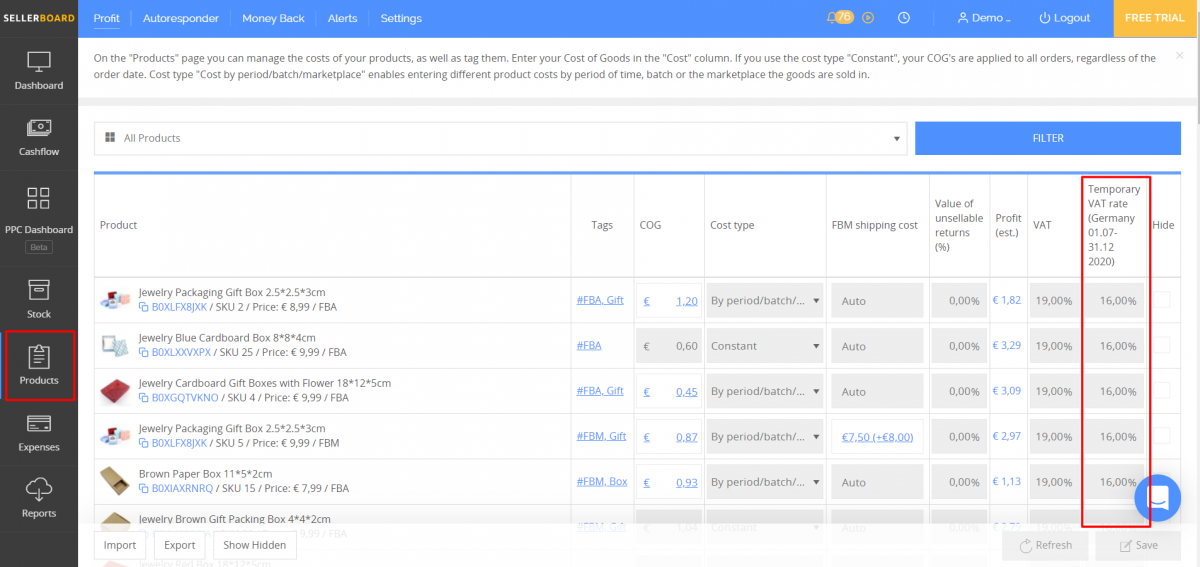

We already added necessary enhancements In sellerboard. A new field, “Temporary VAT rate” is available under the “Products” menu. If the German VAT reduction is not relevant for you, you don’t need to do anything. Otherwise check this field and make sure the reduced VAT rates are in place. sellerboard will take the new rate into account and will provide you with accurate profit information, as always.

Even if you’re not VAT registered selling in Germany, check out sellerboard. sellerboard is an accurate profit analytics service for amazon sellers with additional tools: follow-up mail campaigns, inventory management, reimbursements for lost & damaged stock and other FBA errors, PPC optimizer, listing change alerts. All this starting at $15 a month with a free trial.

Get 1 month of free access to sellerboard using this link: https://www.sellerboard.com/blog