Our guest on the 18th of November, 2019, on the sellerboard show was Nathan Evans from fulfin.io The main subject of our episode was financing and liquidity. We discussed different options of financing for your business (investors bank loan, fintech).

Nathan talked about fulfin’s financing process, advantages and disadvantages compared to other sources of money.

Watch the full video here: https://www.youtube.com/watch?v=dfBVpG0bKs0&t=900s

Speaker 2: Hi guys welcome to The sellerboard Show. My name is Vladi Gordon and today I am joined by Nathan Evans from fulfin.io and we’re going to talk about the money.

Speaker 2: You guys probably know selling on Amazon is pretty capital intensive business sells some constructional hash which they need to find the next purchase especially if you’re growing need to buy more and more inventor you need more money right and it’s kind of hard to find instead of your cash flow and we discussed different options where you can get the money for example if you get an investor or go to the bank will go just intact like fullfin and Nathan told his process what’s important for them and what your risks are and how long it takes to get a loan from them what are the advantages and disadvantages compared to other sources of light if you’re interested in this topic they are active in Germany only as of now in November twenty nineteen they will expand to nationally eventually but for now it’s Germany so are interesting in Germany which.

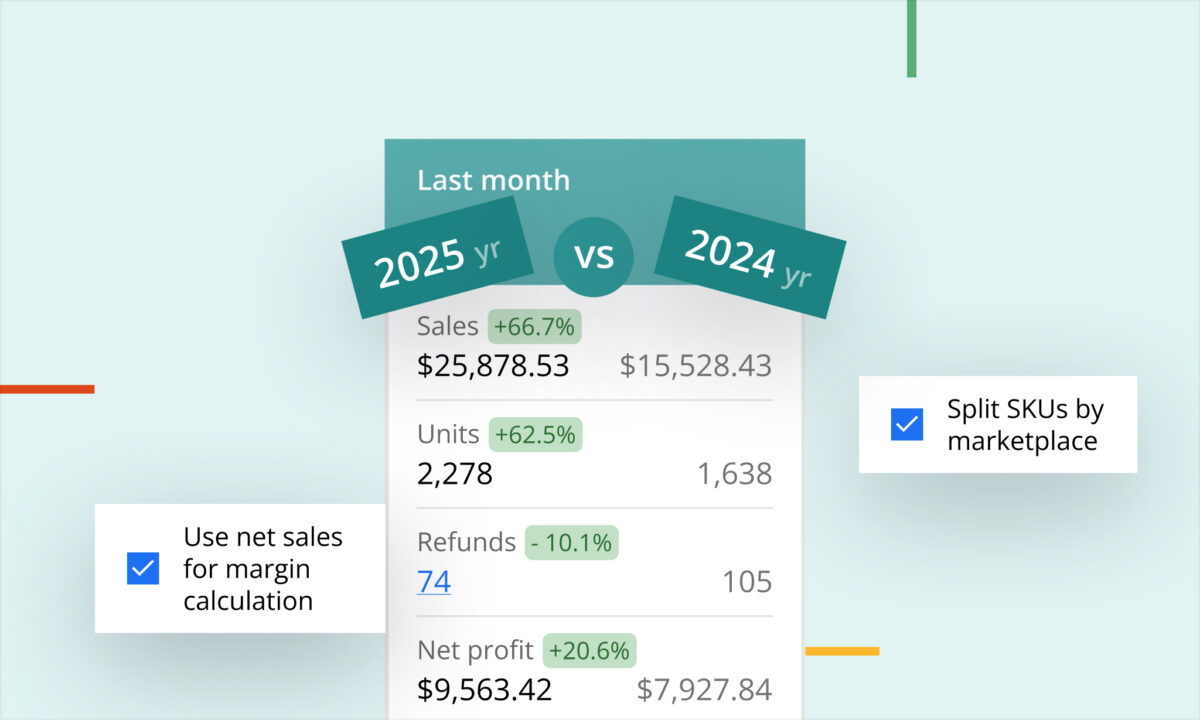

Speaker 2: We have some special deals in the description and before we start our show, if you don’t have a sellerboard account yet then go ahead and check our free trial, sellerboard is a profitability software for Amazon sellers with a free trial with a very competitive pricing also make sure to check it out we have a lot of bonuses in every package even in the smallest package are you get some other tools just as a bonus . Don’t forget to subscribe to our channel a press like button in the let’s start the show.

Speaker 2: Hello everybody and welcome to the seller board show my name is Vladi and today I am joined by Nathan Evans.

Speaker 0: Nice to speak to you again.

Speaker 2: Thanks.

Speaker 0: Thank you.

Speaker 2: So Nathan tell us where you’re from.

Speaker 0: I know many people who say it’s a cold like symptoms such media and northern English accent from here.

Speaker 2: Okay.

Speaker 0: One that I assist my younger daughter use growing up in Germany has inhabitants you know I tried to save her from it.

Speaker 2: When I.

Speaker 0: Yeah it’s a it can be difficult to understand so I tried to speak slowly and clearly everybody’s benefit.

Speaker 2: Well I find it very nice because I mostly speak with like German so speak in English or people from all over the world or Americans that it’s nice to have to have you on the broadcast.

Speaker 0: We’ll have to do something just for you, would you like a call to see.

Speaker 2: There was a couple of key.

Speaker 2: I almost understood.

Speaker 2: Okay so nowadays and tell us about yourself what are doing and you know what’s your role in this community.

Speaker 0: Yeah well when an eight the big question to start with so I’m the founder and the co founder of fulfin.io and I founded this company in two thousand and eighteen with Delta Alfa group to give his full name but at least I did we both have a background in financial services and stretching or in my own case it instant check on this almost.

Speaker 0: And we came together it almost intact wait when we go looking at one of the possibilities that they run out of banking and financing and founder sandy financing we were looking for the right area and when this could make sense for us and I’m very quickly we sold what economists say is uncertainty.

Speaker 0: I’m a cemex and it’s it’s a massively underserved areas consequential products especially on products of consent and we decided this there was a need and we want we wanted to meet the needs of another standing dark concert in two thousand and eighteen.

Speaker 0: It dived into it then it must also.

Speaker 0: Needs marketing leads us and and to basically build up products to best serve.

Speaker 2: So tell me what’s what was like the first time being countered this and wasn’t selling on Amazon topic.

Speaker 0: I’m putting I mean everybody knows it has but I wasn’t even out for four years I think two thousand and seventeen right in the sense of the southern German business model lesson Freddie and I we’re working in a previous intact together I’m not old but some of my customers and were on my case and some of them hypothesis is would be to be on on online and similar.

Speaker 0: We noticed that.

Speaker 0: The teacher before misc analysis I’m to understand the business posted on my customers was far greater than it was offline cases because we have up to the minute I’m gonna fusible business data from these cases that was very attractive to us and we also so.

Speaker 2: Because it’s such a new discipline and it is just so fast moving that other traders in the market be they banks or even the day of the I’m in Texas they were just looking behind me when using the resources and the tools that went on to be able to make it a great office to set up for me kind of student on this.

Speaker 2: Okay I understand so tell us like what is the the problem that you’re solving Fineman Amazon seller I mean why would I wanna call fulfin.

Speaker 0: A soaking it’s not been snowing founder friendly I’m capital out and the same you certainly can get some financing from a bank and we always advise our guys the best of our ability to get a state level working capital financing from what but if subsidized program that you speak with a local license non banking checking Jones.

Speaker 2: But then eally the best sellers I’ve never even seen the good sense.

Speaker 0: The growing so fast these business models are attractive to me they they needed grace not looking to escape the license or any it’s.

Speaker 0: Its important discussing them on the market place and waiting lists Hey you and that’s a look across commercial cycle and when the growth is so strong.

Speaker 2: It strips on the teaching grow our own retained earnings from the profit you make so you need external capsule. We don’t think that just for the purposes of finding your product it’s just opening your business operations do you really shouldn’t have to go to the investor so an equity investor I since your company and lose ownership of your company we think it should be a loan product.

Speaker 0: And that’s what we do we offer.

Speaker 0: A product where we are not to invest in your company the refinancing comical your company and we do a project with you generally that is a.

Speaker 0: You can still use our learn for general operating system marketing for launching a.

Speaker 0: The products going into different markets on the end of this project we received our capital bank and we received our respectful and you’re happy because you’ve grown your business that I’m in and we’re happy because we’ve made inappropriate financial center and the New York especially happy again because your company still belongs to you.

Speaker 2: Yep.

Speaker 0: Given up any equity.

Speaker 2: Okay I understand so look let’s I I have a lot of questions about every every aspect of this but maybe let’s start with some different financing options so suppose a minimum seller I’m I understand of course you need some capital to start normally you know also asked him to start lean and very very not too much money right because it’s a risk what is certain point if you see okay politics up okay you need you need capital so.

Speaker 2: After you maybe borrowed some money from your from your parents and friends and you can get the anymore but you do need more what what are the options in general so you mentioned going to the bank.

Speaker 0: Yes.

Speaker 2: What else what else can do.

Speaker 0: Been pick up on your points about people starting with the area and I I think that’s wonderful to us that’s why we do what we do as well I’m I’m basically inspired to one so that I can call to you so we started something like a hundred seventy dollars one hundred seventy dollars an injunction hearing in the nineteen nineties just.

Speaker 0: Say something up making it a bit of money and order you know he’s.

Speaker 0: Products you bring into the any and he and he’s building now I’m in this guys started with nothing he did he doesn’t even have family and friends named him the money he has no track record on your credit history in Jan he’s he’s not.

Speaker 0: In that sense but he works like a dog and he’s intelligent and he’s getting that it might take a little bit longer.

Speaker 2: And it’s wonderful that is possible today in his speech and each each every property you can start with almost nothing we want to kind of democratize the next stage as well. We want to make it possible that as quickly as possible, when you need capital to scale that we can be there and an offer you this. The alternatives that you have, it’s effectively like any any startup in many ways yet for families, friends, as they say, great options, especially if this money comes as a loan. Personally, I find it less attractive. If you have to take an investors to your capital structure at the company, you have to be very careful with that. But if your parents can give you a loan and they’re prepared to, that’s that’s the best place to start. You’re probably more diligent with that money than anybody else’s money as well. Then free money in every way, shape and possible form if your business qualifies for some of the many subsidies that there are. And in Germany, especially, I speak from this position at the moment. Then you need to go and get it because it’s these subsidies on non-dilutive. And sometimes it would be a sushi’s additional contribution to your own expenditure. It could be a a particular program. For example, it is something called exist, which helps young students start as well. That’s perfectly valid if you have that right. If you have that background, we actually have a contact from our network who specializes in advising entrepreneurs, generally young online entrepreneurs on this.

So if anybody’s interested in that particular form of financing, then they can they can just pick you up and put them in touch. And beyond that, it’s really banks and investors. And the problem with e-commerce, her say is it it disqualifies itself in many ways for classical B.C. companies and it also disqualifies itself in some ways for business angel investors as moli the early stage. So we know e-commerce companies find it particularly difficult in this. That model is a particularly a brand. If there’s a brand there or some particular innovation, then then you might get a, B, C or a a specialized business angel to come in. And if not, e-commerce entrepreneurs have to fund in a different way. Well, OK. The last thing that completes the picture is that the office, it come from different fintechs out there and there are lots of banks have it and many, many banks. And in every 10 days or so, many, many different fintechs as well. We have healthy competition, which we which we love as well. And some of these have more relevant products and some of them have less relevant products for e-commerce entrepreneurs.

Ok. Understood. Let’s talk about investors for a second. You said you wouldn’t recommend it.

So what? Why not? I mean, investors sound like, OK. I mean, free money if you get a resolution just like that. That’s that’s wonderful. Of course. So, you know, guys, go check out what’s possible in your state or in Germany. There are a lot of possibilities. And that’s wonderful, of course, in Finland, France. It’s kind of intuitive. But like investors say, you wouldn’t recommend it. I mean, it sounds like a good deal, right? So there’s some guy who gives you money basically just for your ideal, maybe a little bit more than idea. And they kind of share the risk with you. Right. So I don’t need to pay back. So why is it a bad idea?

So, I mean, I must be careful not to sound like a hypocrite here, because we recently closed down own seed investment with a large and respected chairman v.c, and we took in a seven figure amount of capital because that’s necessary for us to grow our business.

We have large projects that we need to do with banking partners. We have a lot of detail as well that that’s that’s what fintech is about. And there’s no way we could we could do that with investors and investors for these purposes. There’s no way around it. And they can they can age you and support you and make things possible. Investors for the purposes of buying product to set said if you got it that way, you are taking the most expensive type of capital and funding that is available. You’re giving them ownership in your company. And I’m not saying that it’s always a bad idea, but if you can find an alternative source of capital to do that, generally it will be it will be cheaper in both the short and a number.

So it’s kind of more capital effective to get more. All right. Or if you know, it is.

And I think if you’re growing and your country is becoming worth more and more every single every single time, if you can fund your operations in a way without giving up equity in a company. Why? Why? Why would you that? And that’s it. That’s certainly the way to look at it. If an investor thinks something else to some sort of competency, some sort of connection to a particular supplier. And so if you might consider it on that basis alone, that needs to be acutely aware of the different types of capital. And then if you look into getting bet with an investor, I think it’s important not to have too many investors as well, to have some awareness of not losing the capital structure of your company loan. Loans are very easy, sluggish. You are not conservative, but let’s say a reasonable businessman in terms of the loans that you take. And obviously you have to make sure that you can pay your loans back out of the cash flow that you generate. Then it’s it’s wonderful in many ways because you do keep ownership of your company. And then when ceremoniously paid, you have a credit history and an undiscovered. Well, no, it’s effectively you you have no liabilities to anybody anymore. And you’ve grown your company moved it.

Ok. I think so. All right. Let’s let’s suppose we want to take a loan.

I can go to a bank or I can go to fintech. Like like fulfilled. I guess, you know, banks are there. They have been there forever. They’re very stable.

Like, why would why would anybody want to go into fintech rather than going and speed, expedients, understanding of the business model and product innovation?

Basically, what it comes down to. So the process at the bank is drawn out as well. It’s certainly not the quickest. And you need to consider this in the cost structure as well. You may be tied up with these people for four days, but you got funds in the worst cases. It will definitely be kind of that classical. Go into it. off-line. Meet the adviser and get him through your business model, which he clearly will not understand and then receive an offer from them that will be for a large amount which it would need to be disposed to make you look at the uncut structure for a longer period as well. But if you’re in a position where 50 100k is going to help you, then definitely go to the bank because it’s it’s one of the cheapest sources of capital that you will get. Make sure you get the best deal and probably be a little bit more conservative. Been taken a little bit more than you need. If you can, with where banks are very inefficient, we’ve noticed, is in being able to react quickly to season needs or capital for a very low capital. So that’s how we conceptual. You see, our product that we live, I said, is to have a day, a basis with a bank. We know that they have the seasonality and that they come to us for treatment, financing, climate financing, six months of financing.

They come with less. But a loan that they take today and they start paying back in in three months as opposed to straight straightaway. How many payback for six months. And then we said, I mean, the loan is gone west. Wouldn’t you go to January? You’re talking about a 3, 5, 10 year engagement. OK. Well, if you’re talking about a credit line with the bank, then you really have to be careful how the fee structure looks as well. With that bank, often we’ve heard of cases where the bank would get credit lines of up to 50000 without any fees. And then the second that the customer goes above 50 thousand. They have 2500 of what’s called a jump. I think it’s perhaps too long since. And so I could get the English, especially for now, but. The fees associated just with having the possibility to use the money you use it on. Yeah. And that can be inefficient. So if you think you need fifty thousand for most of the year. But for two months of the year you need another twenty thousand. Then you don’t want to go to a bank that charges you and have seventy thousand for the whole year.

Yeah. OK. I understand. OK. So you’re kind of trimmed or optimized for for e-commerce for this short cycles because you understand, okay. People need to buy products in three months or two months.

The goods arrive from this study starting to sell them off. And then maybe two months later or maybe four months later, the whole batch of salt and maybe they’ll need another another portion of capital. Understand. And you also mentioned efficiency. I can I can kind of. I actually don’t have a lot of experience in talking with banks, but I can see that probably it’s gonna be hard to explain them all the FBA fees and, you know, the process of.

Shipping goods and preordering and quality inspection thoughts and what what? Banks still understand, they tend to price higher.

They have they have to. I mean, it’s that that they did. They’re doing job. That risk is uncertainty. Uncertainty.

It’s lack of knowledge. And you have to price risk. So if they are not sure what your revenues are going to be, but more generally, they’re not sure what your revenues are. Because if a bank does not look at your e-commerce data like we look at it, because that’s an automatic, we take the Amazon reports. And the second we talk. I know what your sales were yesterday. And this transparency helps us to give you a very competitively priced product in a perfectly structured products.

So, yeah, I understand. Probably the bank takes you like a text statement from from the previous month or so. Like anything. OK. That’s.

As we as we do this, whether we ask, we are split because there is some information in that and we have the policy effectively everything that a customer shows us helps build about understanding of the business, helps us offer a more competitive product. But it’s very naive of the banks to ignore the most useful advice and insight. Up to date source data. And that’s the e-commerce for folks that come out. I think you’re exhausted. Perfidy. I I really. I’m gonna have to ask, can I steal that, please? I optimized that e-commerce. I just I just want to. I want to do it. I want to be bothered with that, because that’s exactly what we are optimized e-commerce.

Ok, so tell me. Suppose somebody wants to become your customer. Somebody needs need some cash. How how’s your process and how quickly can I get the money?

It’s a weird, weird just in the Middle East phase of our platform so commonly we would come to our Web site, they would register on our phone and we would get back to them within 24 absolute latest 48 hours with initial information and a process and an onboarding in the next few days, we would actually launch to especially the products probably by the time this goes apps. That process would be that if he’s interested in the financing, they can always still come and have a conversation with us before before they’ve actually stopped. If they want it to be as quick as possible, they can register dynamically on our platform. They could connect that Amazon account. They can submit the details that they want for their financing. And we will analyze that and to turn it around in the vast majority of cases within 24 hours.

Well, OK. Suppose we have a pretty easy case. We have an understandable product. And I don’t know, maybe one with with some sales history and a decent amount of money will look like 12 million or something. So. When would you say it? Fella can get the money on their bank account. How many days after they finish, I’ll contact you.

Well, what’s interesting with products that we set it up specifically not to be something that’s called violent financial journey. So not to be a product financing will purchase financing.

You do not have to use money directly to buy the goods. So the way flagship product is set up is it’s a it’s a collateralized loan, which simply means that you need to give us your kids a security for a loan. Often we are working with cities who are already working with three peoples and third party logistics providers using them for storage before they go to send to Amazon. And if that happens to be one of the partners who already works with Eskil apartment, it very quickly confirms that they’re able to work with us. Some risk analysis system. And the contract is signed, including a pledge of the products to us. We can effectively pay out within two to three days. So basically our prerequisite for paying out is that our flagship product, that the loan is collateralized. If those if those goods are sitting in the warehouse already, as soon as that agreement is signed and we have confirmation from the warehouse provider, we’re happy to pay.

Oh, well, that’s life. That’s that very fast. Okay. Understand, Stencil, you mentioned you need the goods security.

So this basically means I’m getting like you’re paying for it. If we are talking about product, you’re paying for for the purchasing. Right, for the bike price. But you keep the goods until I sell them all that until I basically pay back. Is that right?

There’s one little correction I’d make, which I think is very important to differentiate us from some of the other fintech players.

We don’t give you just the purchase price. We’re actually less concerned about what these goods cost. I mean, we think it’s wonderful if you buy if you buy them for one and you sold it for 10. Then we will be happy for you. But that one purchase price isn’t really relevant for us because these good service executes. What’s one of them? Assist the salesperson. So we can generally give you a multiple of your purchase price certain as say, 20 to 30 percent. We think that is a very reasonable loan to make. And with that amount, then you can fund not just to purchase your products, but also import your products and potentially the first marketing of your products as well.

Well, okay. And what’s my risk like? I mean, of course, if I go to an investor, it’s it’s a long, long term story. But but probably there’s no risk like I don’t risk by my own home or my car or whatever. Right. So it is the inventory. The only risk I carry or I know do I need some other securities?

So generally we mean we have a loan contract as well.

So that is a a legal obligation for the for the company or the individual to pay us back. Many, many of our customers come into our code. So trade is a fancy name in Germany. And then purely by the legal definition, I’m an angel and to name it is personally liable for the euro for Gamby has such a limited company. We do generally, like many fintechs banks, ask for a personal guarantee. So we obviously that that is personal liability, but we are very clear in our communication that we’re not here to provide capital to you that could get you into trouble. So proud of our product and how we differentiate it to some of the other competitors is that we work very closely with assets on a sizing. And we’re looking at your disbursements on Amazon. We’re looking at other sources of income and cost. And we’re making sure that this loan is we have our products. The products are certainly our first line of collection. So in the event that for some reason we were not paid back by a seller. I would say who could can’t pay us back, then we have a right to take these products and to sell them to receive our generate cash to pay them back. When this to give you an example of a case. Right, where this is actually actually happened with one of our customers.

The reason he couldn’t pay us back was because his Amazon account was blocked and he would respond if he found it very difficult. And obviously, we know the story as well to get this unblocked. So in this case, we did indeed take the products into our custody. And we. But what we did was we sold them and we took our loans competent enough fees and we paid out the balance directly to our customer. So in that case, it was actually a service. And because we we don’t let the overleverage we give. We don’t get 100 percent of the sales price as a loan, for example, because maybe we’d never be able to get the money back. It’s it’s pretty much inconceivable for us with the due diligence that we might that we do that if there was a default event where we were not paying back, that we wouldn’t be able to cover the full funds from the product. And we’ll be able you know, we always work with the sellers as well. We don’t we don’t work against the sentence. We we understand that these things unfortunately sometimes happen, that we do a lot of work, ex-ante in advance of the loan to make sure the product is correct. The treatment product, as you said, optimize for the communist. We ought to be optimizing some life life.

Ok. Some guys I think you shouldn’t in general. Probably a good idea.

Shouldn’t get a loan if you’re not sure if you can pay it back because otherwise it’s too risky. But if you are short then then I guess that also there’s also not too much risk. Right? So your product is your security. And of course, you know, eventually you have to pay the money back if everything goes wrong.

But that’s the life of an entrepreneur. Well, like your. I like your idea of bringing together with the sellers and providing such services. That’s so very, very nice.

So, buddy, if I may say, I think a lot of the data comes in when people don’t know what they have to pay back and they’re unaware of what comes. And that’s why we believe and we give a total transparency offer is tailored exactly to our customer. That would mean the number of installments that he requires. When those installments stop and in advance, it is perfectly clear when those repayment days would be and how much as we payments will be. And it is also perfectly clear to us as financial professionals that this loan can be paid back from the Business Week. We are not looking to be paid back from the products. If that happens and we see it as a failure on an asset, the mechanism is more that to protect the seller’s interest in the case that something happens like the Amazon account being the.

Cool. Look, tell us they have a special deal for us. For you? Yes, for me.

We don’t feel ourselves, but we have a lot of customers who are selling. So maybe, maybe we can get them a good deal if in case they are interested in becoming your customers.

So it won’t be really like.

And how with with position without a thing is that we want to be there for good sellers who want to build solid businesses. So we live. We live a product like set abode. I mean, we we use it ourselves in another system. We’ve taken a lot of inspiration from it. For me, this is work because we need a risk management and we know that guys that are customers of yours, that they are doing some sort of financial controlling themselves. They know they know how to say it right. Then they’re not being cowboys, but that this is set. So we have the best tools possible to make sure that they can have a solid business and that makes them very attractive customers first. So we certainly very, very happy to recognize that with a special offer and we extend an offer of two months free financing to any set of board some of the month.

So how can they get this offer? We’ll post a link in the in the footnote. But maybe for somebody who was just listening to us.

What’s your role? I don’t to get the offer.

So if they just if they just come to fulfin.io and they register on the account and then in the onboarding process they simply give us the code that we would include down here below us.

And if that doesn’t. And if for some reason they forget to do that simply at any time before we prepare the contracts, that they let us know that they reference this this interview, then that’s fine. Then it automatically qualify for your life.

All right. So the code will be in the description. So, guys, make sure to check it out. Get a month of free financing. Right. So don’t get don’t pay me anything for it.

For the for the load to tell you to pay anything for two months of the 12 months of the loan. So we will calculate how loan and they will take two months that I.

Spees and we’re and we’re working on for the first for the first rate for new customers and we’ll make the code nice and simple. We won’t make it supercalifragilistic ex-politicians. We’ll make it a little bit shorter.

Ok. So, look, thanks so much. I think it was very, very interesting.

Before we wrap up. Tell me about the sellerboard.

I it is a little to somewhere in the background of me as well. This this is something that’s very close to heart.

This is something this means that both and I until I think we’re organizing this, would be sleeping even less than me. We do normally because it’s it’s an event series that we’ve taken it upon ourselves to organize. But I think it’s fine with both about business models as a house, as a fighter of capital and timbo with conflict as a provider of a platform by which to sell e-commerce businesses. We noticed also within the event space that there was something missing. We saw the popularity of the forums and the blogs and we see how quickly Amazon is new. It’s moving and we know the knowledge isn’t really centered on a few influencers. It’s it’s dispersed amongst the community. And we figured out what we really wanted to do was create an event, especially with this facial format, to the unique concept where we have no speakers, no predefined speakers. We bring together sellers. You have to be a senator to qualify for this event as well. And in this event, everybody has designed to present and everybody is asked to present a topic is also right at the start of the event. We have a little bit of a round to welcome to F-D Introduced and then we have a mini pitch where people come up and say thank you, talk with a level of expertise about this problem within Amazon and it could be anything from creating the perfect product photos to listing hacks to PPC to logistics topics as well, or finance or financing and working capital topics. But it’s very interactive, said the sessions, the event, the community type between 100 and 200 sites, nobody attending opaque housing committee workshops. And you can go find exactly that topic this week.

I think I can add to that that I like the concept very much.

I think it’s very fair and priced very fairly because most conferences are very expensive. And also this direction, other sellers and this user generated content. Kind of cool because I find it sometimes hard to sit in a conference for like nine hours or eight hours and listen to tell me, tell me. And so I hated it, though. After the third one, I start to go out for a break every 15 minutes and just chat to somebody. And I like it. It’s very dynamic. Also, I know I can pick a session you’re interested in. It could also stand up and go to another one if it becomes boring or something. That doesn’t mean you don’t like the speaker. It’s just, you know, use your time differently. And I’ve been there two times and I can recommend it to everybody. It’s a lot of networking going on. This is for me at least as important as the content itself.

Yeah, we hope to see it. We hope to see you again. I mean, I think people are always very keen to hear you say it yourself and speak with the expertise on your topics.

You made a very good point. And I should have said this is what the the event is bootstrapped. So don’t come to us if you’re expecting a seven course conference banquet, the banquet at the end. But in a week, we keep the costs low. We sponsor the event ourselves with Jack and Flick and organize it. And we have support from different organizations, yourself included, to help us in many ways and also make it even possible at a fraction of the cost of these other conferences where it’s a fraction of the customers say a multiple of the venue. So what’s not to like?

With this look, we’re now in November twenty nineteen. I know you’re going to have two or three more next year or this year.

Actually, we have one in November. If this goes up before twenty twenty seconds to find the ink in column and then we fund it for the next one is it’s a home game in Munich in February.

Nice. So we’ll put the link below so you guys can check it out. Click on the link and see it. So they don’t tell barcamp.

What we’ll do today is to put a special effect down below as well. For anybody who wants to send one of the set of outcomes, that’s nice.

Ok, guys. So if you want to go, then make sure to check out. Nice. Thanks so much. Hey, Vladi, it’s a pleasure. Thanks.

So then if you guys have any questions to myself or to Nathan, then make sure you come in this video and we’re going to let you know, Nathan, when there is a question or we can try to answer it ourselves, or would you both end up guys, don’t forget to give us, like if you like this video and subscribe to our channel and. And Nathan, thanks for coming in.

Thank you. Thank you very much. It’s an absolute pleasure. We were big fans of the product and what you do and also even your pricing of the product that you want to get an advantage out there to as many senators as possible was very, very close to our own philosophy, a very genuine person. Lovely to speak to the folks in Mexico.

Thanks so much. See you, guys. Bye bye. Bye bye.

Thanks for watching. If you like this podcast like comment below, subscribe to our channel. And if you don’t have a sellerboard account yet, then go ahead and check out free trial. sellerboard is profit analytics for Amazon sellers with a lot of extras in every package and we’re priced very fairly and very competitively. I bet you won’t find that tool with a more competitive pricing than sellerboard, guys. See you soon. And good luck. All right.