Our guest on the sellerboard show was Jen Kruk – vice president and head of Mergers & Acquisitions at Forum Brands, company which provides exit options to entrepreneurs, uses technology to scale small businesses, and builds brands into household names that consumers love.

Contents:

- top of mind for the sellers at the Prosper Show 2023

- how to improve operational efficiencies and process to get the most out of your brand

- steps to diversify beyond Amazon

…and much more!

Watch the full interview by this link.

Speaker1: [00:00:06] Hello, everybody. This is Fernando, your host for the sellerboard show. I have an amazing guest today. Her name is Jen Kruk from the Forum Brands. She’s going to tell you everything you need to big that big exit, sell your brand, and just enjoy life. And the good thing is that everything that she says that she’s looking for in a company, you can track with cell reports. Click on the demo, play with the software. I’m sure you’re going to like it. And now let’s watch the interview. I’ll see you guys at the end. Bye bye. Hi, everybody. Welcome. I have a very special guest, here on the sellerboard podcast for you. I have Jen Kruk. She’s the head of M&A. If you don’t know what M&A is, I didn’t. It’s mergers and acquisitions for the foreign brands. So if you are a seller and you’re thinking about making that big asset one day I have here head of M&A for Forum Brands talking to you right now. Jen, thank you so much for being here.

Speaker2: [00:01:21] Thank you for having me. I’m super excited to chat to you and speak to the audience as well. It’s great.

Speaker1: [00:01:27] I know you’re very, very busy, so I’m going to try to keep things short for you. So first question, tell us your story.

Speaker2: [00:01:36] Yeah. No, no, happy to. So I think I’ve spent my entire career really working with high growth consumer retail companies and the entrepreneurs that founded them at various stages of the life cycle. So for me, it’s everything from, you know, personal seed stage investments through to being the first capital that a business has taken on, you know, right through to the time they IPO and even after that. So I’m really passionate about the sector, about consumer brands, and probably couldn’t really see myself doing much else. So I spent the best part of a decade working at larger financial institutions, originally as an equity research analyst, mostly in small cap consumer. And then since I moved to the US in 2018, I’ve been spent 100% of my time either investing in or buying brands. Yeah, exactly. So from Australia, if you haven’t picked up the accent, but I’ve been here since 2018 and just solely focused on investing in consumer businesses since then. So in terms of how I got to Forum, I actually met the founders really early on, so I was the second full time employee at the company. Yeah, which is pretty wild. And I think for me, what really got me excited and interested about it was that, you know, from the outset there was a very clear focus on building a company with the right values, principles and culture that was going to take, you know, the business not just for the next couple of years, but build something really long term. So for me, it was like really exciting to be part of something from the beginning really, or almost the beginning, call it. And you know, I love building things. So for me it was really exciting to find great people to build something with as well.

Speaker3: [00:03:24] Oh.

Speaker1: [00:03:25] Sorry. I’m muted. No.

Speaker3: [00:03:27] All good.

Speaker1: [00:03:28] What is what is the. So you explain your background, your path to follow. Okay, so, uh, prosper show. What’s the type the top of mind for, uh, for the sellers you spoke with at the at the purpose Show? Las Vegas 2023.

Speaker2: [00:03:47] Yeah. No, I think it’s a it’s a good question. So we were at Prosper. It was definitely a little different, I think, to 2022. But I think interesting couple of interesting takeaways from the show. I think firstly, there was a definite focus on the sellers that we spoke to on improving operational efficiencies and processes in their businesses. So looking for better margins, expanding cash flow. Look, I think, you know, with international freight headwinds, while they have eased a little, you know, we still have inflation, we still have Amazon fees going up, cpc’s going up. And that all remains, you know, that can be problematic if you’re not an eat away at your margins, if you’re not focused on proactively trying to offset some of that. So that was that was the first part. I think the second thing, which was really interesting about like who was actually showing at the show was, um, the. Concept of diversifying beyond Amazon. I think, you know, customers shop not just Amazon’s a great platform, but it’s not the only place that people go and shop. And I think if you looked around at Prosper, there was a huge presence from Walmart, Target Plus was there. You know, there were some DTC providers as well. So very clear that I think the Amazon people that are selling now just on Amazon really are starting to look for other channels and other ways and places to sell their products.

Speaker1: [00:05:08] Do you think Amazon is still the best place for a startup to start selling their products?

Speaker2: [00:05:14] Yeah, I really do think that and that’s one of the the things that got me interested, call it in the Amazon space originally because my background is much more direct to consumer like this other than, you know, working at Forum was my real introduction, other than 1 or 2 small parts of other deals that I’d worked on. But my real introduction to working with very Amazon heavy businesses and I think for me that’s what one of the things I love about Amazon is. I mean, you still do need some initial capital to get up and running in terms of, you know, buying your initial inventory and things like that. But it really does, you know, level the playing field a little, I think, for entrepreneurs and is still a great place, I think, to start a business. And to be honest, a lot of the times when I speak to people that do run omnichannel, certainly when you compare it to direct to consumer like the margins on Amazon often can be better just because of what you have to spend on advertising and how that works off Amazon. So yeah, I think I think it’s a great place to start a brand.

Speaker1: [00:06:13] Nice. Um, what are your tips for the sellers to improve their operational operational efficiencies and processes here?

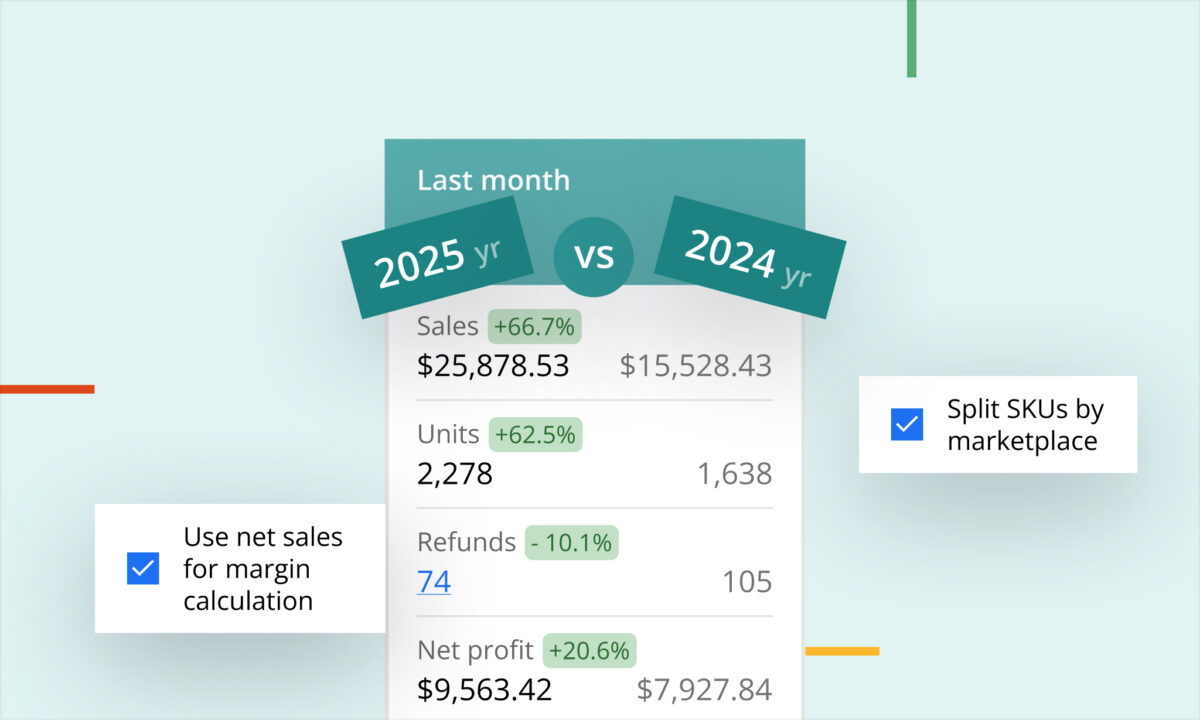

Speaker2: [00:06:22] Yeah, I think it’s a great question and I think it’s something that, like I said, it’s top of mind for a lot of people. And I think, you know, particularly going into this year with a bit of an uncertain macro outlook, you really want to be focused on tightening up as much of your business as you can. So I think there’s probably two buckets that I would think about this. There’s the financial side and the operational side. So as you think about the financial side, if you really want to improve efficiencies, you’ve got to have a really good understanding of your financials. And I think there’s like two parts to that. So you have obviously your PNL and also your cash flow and your balance sheet. So as you think about your profit and loss statement or your PNL, yeah, the three financial statements, very simple, but also very important to remember all of them. And so I think with your PNL, it’s like, you know, you really want to understand the cost side of things. And particularly, you know, your landed costs or your cost of goods is an area where I see Amazon sellers sometimes get a little stuck and don’t quite get the calculation right. So I think the way I think about your PNL is you just want to make sure all the costs are in there. And a simple way that I like to think about it is, you know, think about every single touchpoint your product has, Like, so you place an order and then it ends up in your customer’s hands and it’s like you want to make sure at every point along the way all of that’s sitting in your PNL so you actually know what the margins are for your business and have a true a good estimate of how profitable it is.

Speaker2: [00:07:50] And I think you also want to understand as know as a retail business, you know, which SKUs are actually driving your growth and profitability because that’s that’s really important as well. So that’s on the PNL side. I think the cash flow and balance sheet side, we probably talk about it. As much. A lot of people tend to focus on the PNL, but being on top of your working capital is can make a huge difference to the cash flow that comes in the door for your business. So things like as your business is growing, you know, revisit the payment terms with your suppliers, you know, maybe you, you’ve been working with them for a little while. Maybe you can push out payment from 30 to 60 days. Maybe they can drop the requirement for a deposit. You know, all those things really add up and just result in quicker cash in the door to you. Maybe you can negotiate better terms with the three PL And then I think probably the last important point there is just, you know, your inventory and like your demand planning. So how much am I going to order and when am I going to order it? Because that’s a that is that’s cash out the door. And I think, you know, you want to create a really good plan, a demand plan.

Speaker2: [00:08:58] Think about the seasonality of your business. So when are you going to need to order more? When can you order a little less? Stay on top of like your factory and shipping lead times. Thank God shipping has gotten a little easier now. But you know, things can change and they can change quickly and they can also change with your factory as well. So you need to stay really close to those. And I think the main thing with inventory is just like, just don’t set and forget. You have to constantly be looking at it, reassessing it, because otherwise you’re going to end up very quickly with too much or too little stock. So I think that’s sort of on the financial side. And what I’d sort of say, because I know obviously this is a seller board podcast, I think that, you know, tools like seller board can help with this. I think that’s, you know, that’s an important thing to mention. But I will say what I will say to people as well is, like I always say, the quality you get out is the quality you put in. So seller board is going to give you a great foundation to work with. You also need to have a really good handle on the full picture of your business to make sure that you’re using that tool effectively. So I think that’s the financial side. But I’ll say, Fernando, if you have any questions or anything to add on that because this is like this is the seller board conversation. But I think all this stuff is really important.

Speaker1: [00:10:09] We’re mostly getting to the part that I’m going to start asking more things.

Speaker2: [00:10:12] So All right. But there is also an operational side to this, which is really important because that was all just the numbers. And, you know, you need to have a really good grasp on your numbers, but there’s also the implementation of your day to day operations, like how your process is more efficient. So I think the one thing I would definitely say on the operational side is, you know, as your business is growing, you need to build processes in that are scalable and then you also need to document them. So some people forget that they build stuff out and then they forget to write it down and they think, you know, this does take time, but ultimately it pays off a lot in the future. And so I think I get it right. As an entrepreneur, you need to be scrappy. Sometimes you need to like put in things in your business, like just to get something done, you know, maybe just to save yourself from running out of stock or something like that. But ultimately, at some point, if you keep growing your business, you’re going to need to hire people at some point and, you know, maybe much further down the road, you might want to sell your business. And so having all this stuff in place allows you to scale much more quickly. So just even as like a quick example, like, you know, try and avoid doing things like, you know, creating like bundles like at home in your garage or having it being a really intensive process, like see if your factory can do it or if your three can do it. Like little things like that actually make a really big difference to how efficiently your business can operate. And then you just build that cost like into your margin and your pricing. So ultimately you still end up net in the same spot. So.

Speaker3: [00:11:47] That’s what we want to build that out.

Speaker2: [00:11:49] But I also think you need to constantly reassess those processes as your business is growing. Like you can’t just set and forget, you have to constantly. Is this the best way to be doing this at this point in time for the business? So just as an example, on the marketing side of things, you know, sometimes sellers will set a hard budget for their marketing, but if your business is constantly growing, you need to constantly reassess that business because you’re you’re going to miss out on opportunities if you’re not growing your marketing budget while your business is growing. So I think that’s that’s really important. And then the last thing I’d probably say is just, you know, lean into where you’re seeing success. And so I think, you know, one thing I think I’ve seen the both sides of this is just taking a really disciplined approach to your catalog management. So like, you want to know like which SKUs are driving your growth, but also which are driving your profitability, because that’s more important than driving revenue and that tells you where you should be leaning in, where you want to direct your you know, we all have a limited amount of capital resources. You know, money doesn’t grow. You know, it doesn’t grow on trees. So we have to make sure that we know exactly where we should be putting that to work. So if you do have low margin, low velocity products, discontinue them and just don’t let your catalog blow out because like I said, I’ve seen I’ve seen really efficient catalogs that work so well and then I’ve seen others where there’s like a couple 100 SKUs with a really long tail that aren’t really adding much, but they’re taking up so much time to still manage. And so you really need to think about that, I think, as well. So they’re probably the on the operational side what I think about. But that was a lot of information. So I think I’m definitely going to pause for breath and and a drink. And then you can you can tell me if you’ve got any questions.

Speaker1: [00:13:37] Uh, no, no, I’m. I’m almost there. I’m. We’re getting there.

Speaker3: [00:13:42] Okay.

Speaker1: [00:13:43] Okay, So tell me something, Jen. Uh, people that are on Amazon selling well on Amazon, and they want to start expansion to other marketplaces, other selling on their websites. What is the best way you think they can do that?

Speaker2: [00:13:59] Um, I think it’s a great question and it definitely is something that I would definitely want to put a lot of thought and time and resources into. It can be it can end up being expensive if you make the wrong decision about which channels to go in, because particularly some of them do require a bit of a cost investment up front. So you want to make sure ahead of doing that, that, you know, you’re very confident in where you’re going. So I think the most the overarching theme is just like make sure your approach is measured and make sure you use data to drive you, not just like, you know, gut gut instincts are great. And if you have one, that’s great, but you should always get some data to back it up just to make sure that that you’re right. So I think the first and most important point for me is you need to really understand your customers basically, and you want to put a lot of time, I think, and resources into this. You want to know who they are, how and where do they shop? Why do they love your brand? Because like the general, my general philosophy and ours at Forum for, you know, for omnichannel expansion is you want to sell the products wherever your customers want to buy them. But it’s an important distinction. Not every brand should be in every channel, not all brands should sell everywhere. They should sell wherever the customers, wherever their specific customers are and where they shop and where they want to buy the product.

Speaker2: [00:15:19] So you need to sort of really map out your customers first. And then you also really need to map out the market. You want to get use some qualitative but also data driven insights to really understand how your positioned versus competitors. So you want to basically understand how your key competitors are SWOT analysis. Yeah, kind of. Or almost like a market map, like you kind of like you can map out the different, you know, because brands will have different value propositions, different price points. So you want to look at how are they messaging, how are they sort of, you know, how are they marketing, what platforms are they on? How are they sort of how are they putting that, how are they design their products? And then also how are they pricing? So, you know, there’s different brands have different value propositions for customers. So you need to understand where your competitors sit. And then the most important reason you do that is not because you want to copy them, because you want to understand what’s your unique value proposition to the customer. So how are you different to all of them? Because like to me, it’s like I’ve, I’ve had the privilege of working with some incredibly talented retailers and they don’t watch their competitors day to day to like follow behind them. They just want to make some of them, to be honest, don’t watch their competitors at all.

Speaker2: [00:16:34] But what you want to do is like, just understand where you fit and sort of how you’re different. Because if you can’t offer a value proposition to customers, like no one’s going to buy your products. And so it’s not it’s not a and value doesn’t mean price. That’s an important distinction, just its perceived value to the customer. So you’re they’re paying you X amount of dollars for something and they’re getting something out of that. And there are some customers that all they care about is price, and that’s one bucket of customers. But there are others that get a perceived value from your product. And so then you need to really understand like what you’re offering them. So I think that is that’s sort of really important. So when you put those two things together, so like really understanding your customers and where you fit in sort of the broader market and then you basically can end up with a short list of channels because in doing that work you’ll figure out that’s where you get the okay, I think I need to go in these places and then you need to bring in some more data and go, okay, cool. I’ve got my short list of channels, but then I actually need to go and do the math and be like, okay, what are the actual economics of this channel? Can I price my, you know, can I what am I going to sell my product at to get the right margin? Because the last thing you want to do is get all excited about a channel, go all in, start selling, and then realize that actually I’m making a fraction of what I’m making on Amazon and I’ve put all my resources in here.

Speaker2: [00:17:53] So you really want to understand. And each platform has its own economics, different costs associated with it. So you want to figure out what’s my market opportunity like, how big is the opportunity for me here? And then how much is it going to cost for me to get there? And to be honest, like you also want to do it. It’s pretty granular, but it actually helps to do this. Like at this level, it’s like, what is my profitability going to look like in these different channels? And it’s certainly something we’re very focused on and sort of and then sort of think through that. So I think once you have all that in place, you’ve kind of got that sort of the mechanics of like of there. And so then once you’re on there, I think there are a couple of important things like as you’re doing all this work, that’s all the, what I call like the front end stuff, but you can’t forget about the back end. So your supply chain is also really important while you’re assessing and working on all these opportunities. Yeah, that was. Yeah, that was whiskey.

Speaker3: [00:18:50] Yeah, that was my dog Whiskey.

Speaker2: [00:18:51] His our pet brand ambassador at Forum and occasionally pops into meetings. So yeah, he’s just, just sitting behind me. Yeah. So I think that supply chain is, you want to be really careful like you’re going into all these channels, but you need to keep things really simple on the back end. I think it’s like, you know, you basically want to ideally have like all your cross channel inventory in one source, so you don’t want to have it all over the places and different different supply chains fulfilling different channels. Ultimately, you want to try and keep it all together and just, you know, for Amazon sellers like just starting out, you know, an interesting option is to look at Amazon’s mkf Like that’s that can actually be a really interesting way to fulfill that’s it’s called Amazon’s multi-channel fulfillment. So it lets you. Sorry, sorry for the acronym. No it’s my I should have explained it. Yeah. So basically it allows you to fulfill off Amazon channels using like Amazon’s fulfillment network. So that can be an interesting way if you’re just getting started to try and like kind of keep things. It’s not always appropriate for all channels, but I think it’s worth investigating. Um, and so I think that’s supply chain. And then I think the very last thing just in general and this applies to anyone selling across any channels is you just need to keep a really consistent brand story. Like customers are going to want to know your brand that they’re buying on Amazon. They want to hear the same story when they’re selling a Walmart because, um, and so I think as long as you keep the brand story. Authentic, you’ll be able to sell successfully across channels.

Speaker1: [00:20:27] I thought you were just going to say tick tock, but you gave us permission. It’s like I’m hearing myself but twice as smarter. So I love that. Okay. The most important question. What is Forum’s criteria for acquisitions?

Speaker2: [00:20:46] Okay. This is the. This is my this is my bread and butter. No, this is this is really important. I think, because criteria ultimately aligns to like our broader strategy and what we’re trying to do and how we’re definitely different from a lot of others in the space. So I think the overarching theme we have at Forum is, you know, we have and we’re looking for brands that take care of families. So young families, you know, like I said, we spend a lot of time thinking about our customers, and young families are sort of our core customer archetype. That’s who buys our products. So we’re focused on brands in three, you know, finding new brands in three verticals. So baby, call it baby family. X because as we mentioned with whiskey, pets are an important part of families and our health, beauty and personal care. So they’re the three categories that we’re really focused on finding new brands in and where our beverage portfolio.

Speaker1: [00:21:44] Pardon. What about beverage and supplements?

Speaker2: [00:21:47] Unfortunately, no, we don’t. We do for dogs, but not not for humans. So we will actually, you know, we’d love to find a pet supplement brand if if anyone’s out there that has a good one. Would love to would love to meet with you. But I think, yeah, we don’t do consumables for humans, but we will do we do do personal care. So we do do lotions, creams, like all that sort of stuff. Um, but no, great question. Um, and so we really do execute what we call like a portfolio strategy. So we’ll buy brands, but most importantly, we build them out once we in these verticals, similar to the way if you think about how a Procter and Gamble might work, like I said, they think about product and customer segmentation and build out build out product verticals. So intentionally we’re a lot more selective than our peers. But when we find a brand we love, like we really do chase after it because we have a very strict criteria. Yeah.

Speaker1: [00:22:45] You only consumables or do you do apparel, for example?

Speaker2: [00:22:50] Uh, no, we don’t, don’t do apparel. So in baby, we won’t do apparel. We’ll do like products, accessories, all those like call it consumer durables is probably the best way to think about what we do in the overall as it relates to like hard good products, consumer like hard and soft goods. But durables is the best way to to think about it. Nothing. We don’t do anything like fashion or fad based. So apparel obviously has a lot of that component to it. So we generally want things that are not as seasonal gifting related, um, and just kind of much more everyday everyday products. So I think, um, we’re, and also an important distinction I’d say is we’re looking for and this is people on Amazon will understand this it’s a we’re looking for brands, not products. So it doesn’t mean you have to have like the sexiest branding, but there has to be a cohesiveness to how you put together your, you know, how you’ve selected products that you can build a brand around it. And importantly, that’s going to resonate the customers off Amazon as well as on Amazon, because for us it’s very important long term that we have a large part of our business not on Amazon, so we really need to find these. So we’re looking for high quality, you know, the real bones. It already is a strong brand or there’s bones for a brand there.

Speaker1: [00:24:12] Okay. Does the buyer need a patent on their on their main products?

Speaker2: [00:24:18] Not notrillionequired generally. We’ll you know, there’s different ways you can sort of have control over your intellectual property. So patents is like an extreme example. You know, patents are great. We have some friends that have patents, but it’s not required and it’s also they’re hard to get. But there are other ways you can have, you know, you can build, you know, IP or intellectual property into your business. So, you know, it can be things like and this is, you know, this is also helpful advice, I think, for people as you’re building out brands and businesses is like, you know, getting a patent that’s like the highest of high, you know, But there’s whiskey behind me. You know, getting a patent is like the highest of high. I’ll see if I can get him to come up later. That’s like the top of the peak it of like intellectual property. But there are other things you can do to like shore up and create a little bit of a moat around your business, you know, So things like, you know, not buying directly from the manufacturer’s catalog, making modifications to things, adding your own elements and then having some level of like exclusivity over those adjustments.

Speaker2: [00:25:21] So it’s not it’s not a patent, but you’ve still, you know, your product has some level of IP built into it. If you’re in the health and personal care space, you know, owning your formulations is a really important part of it. So it’s not that’s not a patent, but it’s like certainly if you have that ownership over your formulations, then you know, that’s that’s another type of intellectual property. So I think it’s an important way you should be thinking about it. And ultimately it’s just to protect, right? It’s to create a moat so that no one can, like, exactly copy what you’re doing, which, you know, we do see a lot of on Amazon as I’m as I’m sure you’re aware. So I think that’s that’s kind of it’s not mandatory. It always helps but I think it’s you know you should always as you’re building out your business, think about how you can build a moat around it. And intellectual property is a really interesting and important way to to think about that.

Speaker1: [00:26:14] What’s the minimal revenue for you to consider?

Speaker3: [00:26:17] Great question. So, yes. Yeah, good question.

Speaker2: [00:26:21] So we would look at minimum revenue. So in terms of the financial profile we’re looking for, I would say minimum revenue, maybe three, 4 million. If it’s growing really fast, we can go.