Our guest on the 17th of August, 2020, on the sellerboard show was Yael Cabilly from fortunet.net

We talked about the valuation of an amazon FBA business and the process of selling a business.

Watch the full video here: https://www.youtube.com/watch?v=2qWGYuUhO8A

[00:00:07] Hello, everybody, and welcome to the show. My name is Vladi Gordon and my today’s guest, Yael Cabilly, she’s an owner of a law firm called the Cabilly and and an FBA broker or an e-commerce broker fortunate. And today we’re going to talk about selling your Amazon business.

[00:00:27] So if you’re interested in knowing how much your business is worth and how the sales process looks like, then this episode is for you. Before we start. Make sure you check out our software sellerboard.com

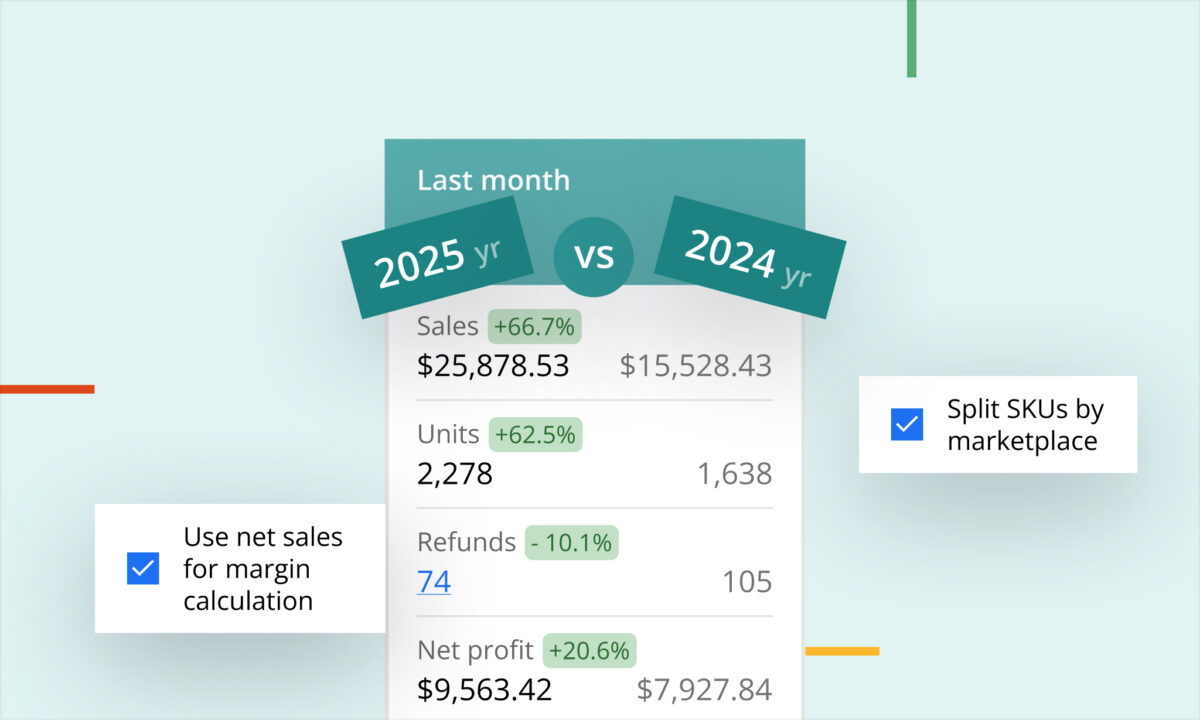

[00:00:43] sellerboard is a profit analytics tool for Amazon sellers with a ton of other stuff included, like the autoresponder for follow up email campaigns, the PPC optimization model and model which helps you get money back for lost and damaged inventory, which was lost or damaged to the FBA warehouse by Amazon and a ton of other stuff. And it’s all starting at nineteen dollars a month. There’s a one month free trial. Follow the link in the description. Subscribe to our channel. Press the like button if you like this video and let us know what you think. We’d like to know your opinion about the topics we discussed about the show and if you have any questions to us or to the guests feel free to comment on this video.

[00:01:28] Now let’s start the show.

[00:01:35] So let’s talk about your second company, a couple of minutes ago, you said it’s about selling the businesses or more. All right.

[00:01:45] So the second company named Fortunate, we’re three partners, one of them because she comes more from the M&A world. She’s been working in a large international firm, dealing with them and these and the third partner is actually an ex Amazon sellers who sold this is seven figures, the business. He’s also an accountant. So he’s responsible for all the financials. But what we do basically is if you’re a maid or a large is what we do is we help you. First of all, gathering all the information, getting ready for the sale, deciding if yes or no, that’s the right time to sell. Sometimes we actually telling you you should wait and that we help you gathering the financial information and creating a full P&L. So when you have software, for example, like sellerboard, it’s really easier and it goes faster. If you don’t have one, then we’ll try and dive deep into your business then. And what we’ll do is we’ll prepare a full report so that the buyer receives everything. And there are no surprises later during the due diligence. We also prepare a full presentation about your business and show the advantages and where it’s better than other.

[00:03:20] We show information about the lie, about the market and everything, and then we present it to relevant buyers that we know can buy. We don’t just present it on the Internet and wait for random people to come. We actually approach relevant buyers led by businesses every day. And that would buy your specific buyer in your specific niche. So the process doesn’t take so long, it can take about three months or four months, depending on the size of the business with eight-figure businesses, it can take a little more, but that’s the time frame. And at the end, so at the end, you just sell your business to someone and then you have to give three, three months usually to assist the buyer with the process. So we try and help through all the stages, including the transfer of the assets. Transferring the Amazon account is always something that Amazon sellers are worried about. We’ve been doing even at the firm. We’ve been doing that for years. So it’s not an issue for European. McComb’s Yeah, for Europe it’s more difficult. It takes more time, but it’s definitely doable.

[00:04:39] Ok, look.

[00:04:42] I think my question is probably the one that everybody has no like how much am I worth? Right. But maybe before we start with that, tell us what type of businesses are even sellable. I mean, like we have listeners that are doing private label. We have four wholesalers or we have probably some other types of business as well, like online arbitrage or retail arbitrage. Right. So what kind of businesses is sellable and how much can you get for it?

[00:05:15] First of all, most of the growing businesses are sellable. And I’m saying growing on purpose because, you know, businesses that are declining and there are less sexy buyers won’t look at them. They’ll go and find there are so many businesses for sale. So their goal for the next one. But generally speaking, I got to say that most of the buyers who prefer a private label account versus a wholesale account, both are sellable. The buyers would be different. But I’m talking about our experience and who are the buyers that come to us every week and are looking for brands. I guess there they want their own IP. They want their own brands rather than selling other people’s brand. But most business, I mean, both are sellable.

[00:06:10] It’s just a matter of, I guess, how many buyers there are for each group of accounts.

[00:06:20] Ok, I suppose I have a small private label, business registered brand, no problems with IP or patents or whatever. So and I don’t know that, you know. OK, OK. Yeah, I suppose I had a consultation with you and you also acknowledged there are no pros. OK, obviously if there are some problems that I don’t know, but I can’t estimate how serious they are. Right. But let’s say like it’s a standard case and we’re growing so sexy. How much money such a business worth.

[00:07:00] Right. So what we’ll do is we’ll look at your business, we’ll look at the revenue, OK, and then we’ll look at your profit. Let’s say your revenue is one million dollars. It’s not a small business, as you said, but let’s say it’s one million dollars and then that your profits are two hundred, OK, which is 20 percent, which is nice usually in private labels. We see a profit of 20 to 30. How do you calculate the profit? What we do is we take the revenue and we retract all of Amazon’s fees. We retract the cost of goods and shipment and we retract all the advertising costs. PPC. If you have Facebook advertising rebates, everything we wear, we track that. We do not retract the salary of the owners.

[00:07:54] So that’s not included in all of that.

[00:07:58] And everything we do retract VA. So we retract all the expenses that are directly related to the business vs are actually something that the buyer will. I mean, these will probably want to continue working with the Vas. There are great and they are great assets to the business that they will probably continue working with them. So we do include VA is we include software like Sellar Board or whatever, and then and then we take that profit and you apply a certain multiple. The multiple in that industry can be two to four really depending on the kind of business you have for is really the maximum that you see for to four years. Yeah, it’s like four years. There’s a multiple on your last. So we take the profit for the last 12 months and then we apply a multiple of four to that last 12 months profit before is really for larger businesses. The average for growing good business is around three in the industry. So going back, we have an account selling one million. The profit is two hundred K, so you would probably say four to six hundred plus the inventory to that. I mean you would add the inventory to that amount. So it can be in a transaction of seven hundred or something like that.

[00:09:38] Emissions growth is set by growing, businesses are more sexy, like how, how big should this growth be? It’s like one percent, five percent, 20 percent. One hundred percent. How does that impact the price?

[00:09:54] So it really depends of your category and what can be expected in your category, some of our clients are growing. One hundred percent really depends, of course, but I don’t want them saying wrong is at least more than last year. OK, that’s more than the previous year. So even 20 percent or 30 percent, that’s enough. It’s not that. I’m just saying that if you’re selling less than last year, then sometimes it’s fine and there’s an explanation for that. So it doesn’t mean you won’t be able to sell. Sometimes it’s because you didn’t have the money for inventory or you had a problem for a few months or the coronavirus started or whatever happened that can be explained. And that’s fine. That’s absolutely fine. But if it’s something that if you’re declining because there are more and more competitors, that that can be a problem.

[00:11:07] So actually, you mentioned Corona was what I was going to ask is twenty twenty because twenty twenty is a year at least. Look, look, I hope it’s less fun, but is it a good time to sell?

[00:11:23] No. Or does it even matter and the whole Caronna stuff and everything.

[00:11:30] If it’s a good time to sell.

[00:12:33] Actually, it’s for us. I can only speak for you from our experience at Fortune. Many more sellers and less buyers. What happened is the exact opposite. So there are more and more buyers. During the last month, there has been so many new buyers. Many of them just saw what was happening, I guess, online and the fact that that’s where people should be. So we are seeing new large retailers starting to look at online businesses. So for us at least, they’re fortunate. I mean, we’ve been doing so many deals since the covid started that we were actually very surprised. Of course, some of the businesses were declining for a couple of months, but that didn’t stop the the deals at all. I mean, buyers understand that it’s something that can stop. And you can also you can always structure a deal that would deal with the KARANA. For example, you can say that the multiple will apply to the profit for the last 12 months when you’re looking at September, for example. So you can do a deal based on September. Many months after the Caronna or just retrack the phone and ignore that period. Some sellers have been selling 10 times more than the usual times, you know, the usual period. So for them, it’s been the opposite. They have been doing even better. And the Caronna was actually very positive for them. All the toys categories were booming during the car. For them, it’s like Christmas.

[00:13:26] So tell me, when do you get your money?

[00:13:30] Because it’s your money, I mean your money. So this is a straight away or is it like next 12 months you get.

[00:13:39] Yeah. So what happens is that so there is you start a transaction. Most of the transaction or work that way, you sign you usually sign an alibi, which is like a letter of intent to start the process. Then you sign the agreement. OK, when you signed the agreement, the money is transferred to an escrow company so that it will stay there and it’s secured. And you know that the server has paid and then you start transferring the assets to the buyer. So you transfer your account and you transfer your trademark and we transfer all the assets, your domain name, everything we need to transfer. Usually there is sometimes there’s a small period of like one week or two week for this. I want to see if everything is going well. And then at that period, you receive your money.

[00:14:33] So that would be, I guess, if you started the process of finding a buyer, it can be two weeks or a month. It depends on the business. And then there’s the legal part, which can be a month or including the due diligence to doing that part and then the migration and everything up to a month. So I guess three months is that is a good is a good time, but it’s normally like directly after the transaction.

[00:15:03] So it’s like you get your best period of one year or two years or.

[00:16:07] And so most of the deals we see lately have a cash component. For example, 80 percent would be cash and then some component that is not cash, for example. It would be a part that is paid over a year or paid in one year. Sometimes it’s it depends of the performance. So sometimes there is a stability payment. For example, some some buyers say we will pay you fifty percent of anything that’s above the profit that you had. So if I’m growing, you will get a percentage for that so that they call it stability payment to make sure that it’s not declining after you sell the business. So if you believe in your business, then usually you would be fine. The only problem is that you let the buyer driving your car. The buyer would have to manage discounts. You have to trust the buyer. So it really depends of the specific buyer and how experienced they are. But most of the deals we see for larger accounts have some kind of component that is not cash.

[00:17:28] Ok, very cool. So tell us, like, if somebody wants to sell, I assume they should contact you with the link of the description.

[00:17:38] What what kind of what part of the get for free from you. Right. So starting at a certain point they will have to pay money, but if they’re not even sure that the business is good or sellable, so so the consultation.

[00:18:53] So I mean, we work on the success based fee. So you pay when you get a transaction, actually when you get your money. So that’s on our part. But even before we start the process, usually there’s an initial discussion where we look at the numbers, we look at your business and we decide together if that’s the right or the right time to start or not. That part this is part of the process. And we are here for the long term. We sometimes we start there are funds that we started two years ago and we failed. It wasn’t the right time. And then a year later, they came back and we and we sold the business. So we’re trying to look at the larger picture.

[00:19:41] Ok, got it. Luke, thanks so much for this. This was also very interesting and congrats.

[00:20:49] I’m really your fan because you have two companies and they’re in different sectors and both seem to perform well. So thumbs up on that.

Thank you. Thanks so much.

So we’ll leave all the links in the description. And if you guys have any questions, feel free to comment and like this video and subscribe to this channel and check out Yael’s homepage and basically both homepages. Thanks so much.

Thanks very much. See you. Bye-bye. Good luck. Bye-bye. Bye.

Thanks for watching, guys, if you like this, don’t forget to press the like button and subscribe to our channel. We’re making those videos regularly and let us know what you think in the comments. Bye!