Our guest on the 25th of February, 2019, on the sellerboard show was Coran Woodmass, founder of thefbabroker.com

Coran is one of the largest brokers in the world, specialized on Amazon FBA businesses. We talked about selling an Amazon business, products and niches and how your portfolio should look like, in order to be sellable at a higher multiple.

Watch the full video here: https://www.youtube.com/watch?v=Kh4tHCEB9Os

[0:00:0-0:01:42]

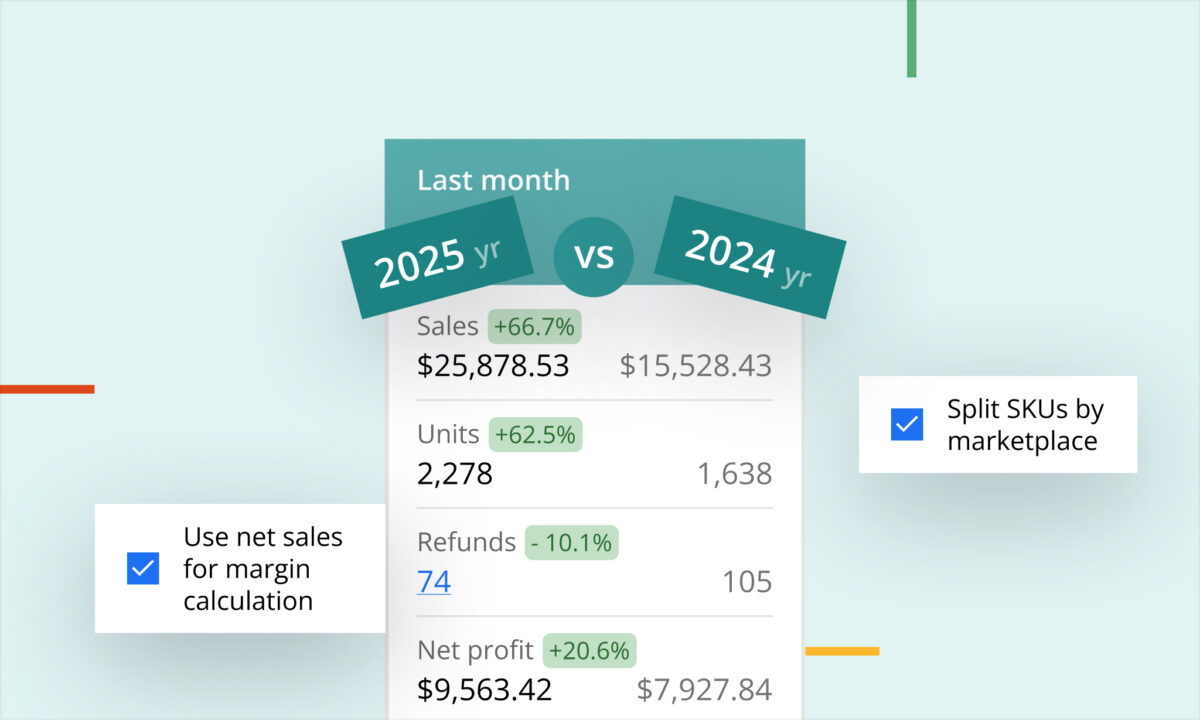

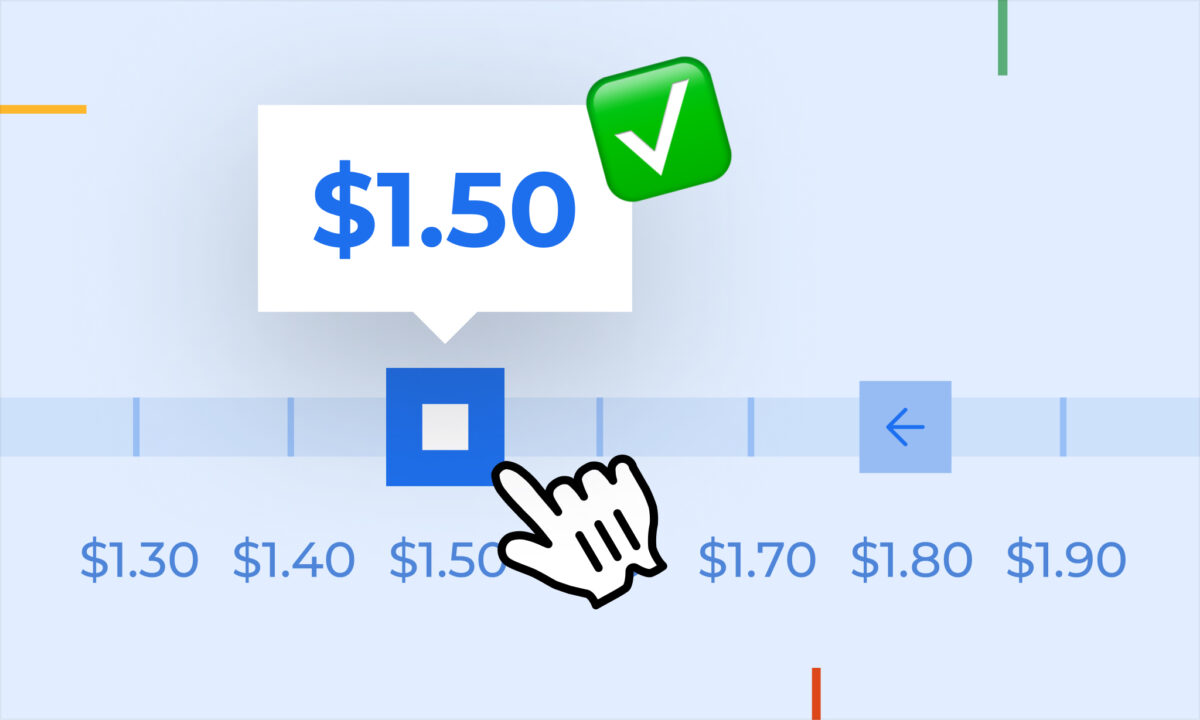

Hello everybody and welcome to the sellerboard show. My name is Vladi Gordon and my today’s guest is Coran Woodmass from thefbabroker.com One of the world’s largest Brokers specialized on Amazon FBA. So we’re going to talk about selling an Amazon business and Amazon brand, about the products and the niches and the waves your portfolio should look like in order to be sellable or in order to generate higher multiples. And I also bought the team is the multiples on the market at the moment in the process of selling a second. So if selling a business is an option for you then. Listen to this podcast or going to watch this video. I’d be very happy if you give us a like & subscribe to this Channel and before we started like to mention our sponsor sellerboard com sellerboard is the world’s most accurate profit analytics service for Amazon sellers. If you are an FBA seller, then probably you’ve had the problem that you don’t really know how much money you’re making from The Seller Central and this is why we build sellerboard. Basically, we’re showing you your profit and loss statement in real time in different forms, which helps you consume this information better and then make better decisions. What else have some additional tools like an inventory manager or email complaint rules for generating more feedback. Please click on the link in the description. There’s a free trial free one-month Miles Teller bored.com and let us know what you think.

[0:01:43-0:01:45]

And now let’s start the show.

[0:01:51-0:02:41]

Hello everybody and welcome to the starboard show. My name is Vladi and my today’s guest is the founder and the CEO of the FBA broker.com Coran Woodmass. How are you? Thanks for having me on thanks for coming Coran. Why don’t you tell our audience little bit about yourself just show up and like you said, my name is Coran Woodmass, the founder and managing partner at theFBA Broker. It was a fast business brokerage worldwide to focus exclusively on selling brands that have an Amazon sales channel. So we only work with physical product brands that have an Amazon sales Channelside we have similar to this business for every time before.

[0:02:42-0:03:41]

Yeah, sure also price of this about five and a half years ago. I left Australia and I was working on corporate job. I was doing some online businesses on the side and Consulting and I started looking at ways to find out travel basically, so we didn’t have to go home and I stumbled into the buying building and selling online business. Well. I was actually started out looking at all offline businesses, brick-and-mortar businesses to buy and dumb and build up fire on my marketing and then sounds the online marketplaces that was installed businesses. So I started investing myself in online businesses. So I bought sold and businesses online website basically and I built a from scratch any Commerce business and sold that as well as some of the profits from the inside of an Amazon-based business and around the same time a few months of business. I’d met quite a few brokers doing then when I was investing myself, so I built relationships and started realizing that I wanted to do more of a the breaker inside as well. Because once you start doing deals you basically want to keep doing deals. So that’s how I got into the brokerage space and mid 2016 is when I launch that they broke up cuz I still will have some the buy-side I saw so much to mind from investors looking for physical product Brands and infantry based businesses. It’s easy to wrap your head around 8 a physical business than it is say an ad set size or that’s the way it’s vital something like that. So yeah, that does a lot of I noticed a lot of money on that side wanting they start their businesses and no one was focusing on this space. So that’s what we did a nice story to tell me a couple of questions. Actually. My first question would be where you know physically so look like I’m in a sauna but I’m actually in a recording booth and we work in Austin Texas so yeah I thought I gonna stay in Austin for a while or not. Not much longer and I will be leaving here within a week or so. Like I was just I’ve been here in the states for a couple of events and also seeing friends of the Christmas say yeah. I was just at the capitalism event with Rome and ran on a panel there which was kind of fun to travel a lot for meeting clients and also speaking in the lochside that sounds like an awesome lifestyle. I’m jealous when it can be good if you want to stay somewhere, it’s not so great. Okay. So tell me a little bit about your dropshipping business so it was off Amazon right yes yeah we actually drove back then.

[0:05:30-0:06:24]

This would be a man. This was years and years ago to drive most of all traffic through Pinterest. Actually. I’m not on that business different model and ends as ever almost getting into Amazon, but as we built that up and sold it, I will looking at other businesses to buy and at the same time we saw this a lot about friends Amazon site that we decided to launch. We’re launching a supplement and brand and I was watching my son. I establish supplement company who made the game basically and we weren’t actually going to stop on Amazon that was going to be a channel but it ended up being a predominantly Amazon based business then right at the same time Amazon was really renting another the dominant player in the US at least. Okay, cool.

[0:06:26-0:07:25]

There you know the topic I’d like to pick your brain on them. Which is I think they’re interesting for our audience is you know how to sell a business on how to make my interviewing somebody this podcast isn’t released yet so long and yet or maybe I’ll just spilled the beans actually there’s a lot of money in in selling the business write so well in a couple of years ago, I’m everybody was starting with a purpose to build a Lifestyle brand which is still valid, I believe but he said in this was very new for me. Can you connect to make millions selling a business basically exiting it? So I guess I’d like to talk about how old is business should be in order to be available. And you know, what? What do our listeners yours have to pay attention to if they want to sell the business maybe starting from the product itself right back to the marketing.

[0:07:35-0:08:33]

There is a couple ways to view. This says they’re a pretty similar trajectory that I see clients take that that come to us and we do sofas millions of dollars a minimum lease prices in the US are we working exclusively seven nights ago. So basically what I normally see in the spices someone stops with products. I just figure out what products are selling and they find one that works or a couple of products that work and take off and then they doubled down on that space. So it’s really important in the beginning to figure out what works and then build your business around that Target Market. If you will say you don’t have to start with the tiger micro that you could have the most people at in the space that start with Amazon start looking at products that sell well and then

[0:08:33-0:09:06]

They build a brand out around that side of my cat so might be a specific type of sport or mothers or whatever. It is. Right. It doesn’t really matter what it is, but it’s not as if they buy more than one product, of course, so you want to so basically you’re saying like most of the successful business businesses that sell they started they’d rather started on Amazon, then it’s a brand off Amazon instead said true so

[0:09:07-0:10:05]

I found that we’ve seen and there is no right or wrong way to do it. This is just what I see the most. Okay, what would you say? I’m in there a couple of approaches to know some guy say, okay. I’m going to stay in the niche and try to maybe build some economies of scale with respect to the watering order in Effect 3. So she don’t like your supplier can produce multiple products in your head you at the supplier then you can order more maybe you’ll get a better price, right? So they have kind of an approach was just kind of more triggered to torts as a friend and I know some other guy switch you’re doing like more less Arbitrage, right? So I found a fidget spinner. Okay tells well with this fidget Spinners light-up fidget Spinners, probably a bad example because it’s so like a trendy right, but I don’t know if she could talk about that also a little bit like what you say

[0:10:06-0:11:04]

It should be like it when we start with it with the products like that shouldn’t be something which looks like a brand or are you also okay with you know, just beautifully fix products which are just analytically metalworking seconds. Our business is really hot to sell. Okay, what’ll talk about is if you are starting from today or your ear into it, I’ll explain your best chance of being able to sell in the future because it’s based on what investors are looking for an again. We circus only on the multimillion-dollar is if you want a multimillion-dollar exit with the highest chance of success is a start with a friend. So stop knowing the target market unique products just for them and expand out that’s less than 1 2 if you start with the Amazon route is figure out the first product that really takes off and build a brand around. Black Market.

[0:11:06-0:12:03]

Like you mentioned Supply Supply to come into it, but it’s really important that it’s around it selling to that same type of buckets. And if anything outside of Amazon to sell the rest of it to that talk about the Dust Bowl that’s really important when it comes to sell because the bulk of the investors in the space that wanting something that they can leverage so they’re not necessarily just looking for something that selling on Amazon a making money with a random approach of just a hundred different products. That’s not as exciting today. And for the most part you’ll see a much lower multiple for that type of business. We have one right now that’s in diligence with a random mix of products couple different brands, but they’re not really friends. Find at a very low multiple for the size of business. It is literally get One X multiple more if it was a brand focused around 1 target market

[0:12:05-0:13:04]

By the way, what are the multiples that you’re talking about? So what are they? Maybe you can give us a fork is weighing investable value business is the trailing-twelve-month cash flow is s e e which is solid discretionary earnings of the last 12 months. This is essentially an adjusted net profit. And that’s the Baseline Sault Ste. That’s a million dollars and that’s what the investment use as the face and then multiply multiple to figure out what they want to pay for the business Willowside put a multiple on that cash flow to come up with a list price right to the list price is different to a cell process that everyone’s going to be using a multiple of what that is the difference between multiples. If you wear a random mix of products mess as a brand it ranges and then if you have access to the customer it also

[0:13:05-0:14:01]

Will also increase the multiple a million in cash flow s d e n u have a random mix of products at my cell phone 2.3 2.5 X Tesla said about 2 and 1/2 million dollars if you had one brand specific brand and it was just selling on Amazon that could sell for to 3 and 1/2 times, so like I said, it’s almost have multiple more that would be three three and a half million. If you own the customer at about forty 50% of your business was coming in from your own website. So you control a customer that repeat touch to sync 3 a website yet sensitive Revenue if it was higher than 40 50% on your own it maybe four or five times. So it really the range is very vast land based on the type of business when you say it like 2 and 1/2 x cash flow. You mean two and a half times yearly.

[0:14:02-0:14:16]

Annual cash flow like what is a 30 months?

[0:14:17-0:14:23]

We don’t use monthly for investors in the specks in the seven Knight figurines that I use monthly.

[0:14:35-0:15:35]

Okay, I guess this means that somebody has a let’s say even though not optimal business to sell. It’s still kind of two and a half years of cash so you can kind of go for on vacation for two and a half years. Well, let’s see if it was to sell today and it’s friend is definitely not moving in that direction. So it’s it’s very hard to sell a business. That’s not a brand today. It’s only going to get hotter at predicting the next 6 to 12 months. It’ll be unavailable. Oh, okay. I was just too by the monitors moving because of so much lemon tree on the market and it right now with tracking 240 different listings worldwide with about seventy different broke his own marketplaces. I’ve been watching the whole market for almost three years. Now, how many deals are on the market about the trends are and that’s what the trend is saying that buys one Brands interesting. Alright? Okay, so we talked

[0:15:35-0:16:28]

All the multiples of what I thought brand sell better than the mix of products. Although of course, you’re like analytical and if you do your grandma’s on whole work. Well, then you can also sell a random mix of thought I said it might work but that would be more costly play. If you want the random mix products and dust mites on your analytical skills, then don’t sell it just keeps going to tell me like we’re talking about private label, right? What about online Arbitrage? Have you ever sold? That’s an interesting facts and also guys if you’re doing on an Arbitrage stand

[0:16:28-0:17:27]

I guess downtown. Hope to sell it at least business business and it’s not even really albatraoz. It’s more traditional retail hot style businesses where you have set Supply and you have you can reorder a hundred thousand of these products if you wanted and maybe had exclusive distribution that would be available. But if you need to go to fun Source new products all the time and you competing for the buy box unless you have a team and an infrastructure that can be sold with the business to make it a business is it’s it’s like buying a job so I know a lot of fun yours to do heaven and it kind of infrastructure maybe not a huge team, but also couple of clients back

[0:17:28-0:18:06]

I guess you can Outsource it to away, but I don’t have to do everything yourself. But yeah, I think I’m probably we should you should look at every single case but this still a good learning for for me at least that on my garbage right is not available. So she got him to make millions so than Brothers switch to the private label basketball. So are there any specific nichas that sell? I don’t sell let’s put it this way.

[0:18:07-0:19:07]

I’m not really I’m somebody who has moral issues with certain categories of products of the like the best of the my spot and I are gets it’s more about the the numbers than anything. So, is it a brand and they like this at 11 to get outside of Amazon? What’s the margin stick to with future competition and how unique of the products but I’m not really that the fact make something less more is it says repeat touch as possibilities of someone keeps buying the product over and over again. I’m unsubscribing save on a subscription through a website at the consumable and that can be interesting cuz that’s actually quite tough to get through Amazon a lot of those products that one off site as people if they find a niche they find a target market that is a one of them. Can they add in?

[0:19:07-0:20:07]

Something that is consumable or something else that I need to buy often and if you can have both so I can actually give you a little bump in value. Okay? Okay. So alright let’s let’s say we have a beautiful brand and Celexa together. Like what’s the next step? What what do I need to do to make this business telephone people. I usually figuring out what wax you to they usually figuring expanding as much as possible. So finding other products that work. Yes, sir Ian year for I really wish you would optimized for recital. So you either build it to a certain point and then optimize the sale, will you keep building until you decide to go sell at typically date growth phase and the selling phase.

[0:20:07-0:21:01]

Kind of compete with each other because they have the maximum value at sale. You want the maximum profit over the trailing 12-months But It’s tricky because you also need your advice that stuff today so you can never really optimize 100% the absolute maximum and you need to move towards that exit. They need to balance growth and profitability the sometimes our clients will slow down that product release. So have a product roadmap. Maybe they have five ten products. I want to launch the launch the highest percentage chance products. First one product is best. With that so instead of releasing turn the release one, maybe one month’s one every two months and have that for a grade math to give to the Bible that works really well.

[0:21:02-0:21:54]

So the average of businesses sold that was seen as a trailing 12-months to about mid 2019 went up time without 2019 numbers yet. But the the trailing twelve to Mid 2018 was about 30% net margin way to work out. You’re not Majin. You need to work out your Ste and divided by revenue and that will give you your net margin and net profit way to sell a discretionary earnings. So it’s adjusted net profit. So you can add things back in like you own personal salary your company taxes anything that say the new owner won’t need to pay for we also use add back things like one of the expenses of 1 things that aren’t related to the business. So if you do I didn’t really need to do the trip, but your business paying for it you can have that back.

[0:21:59-0:22:24]

I can get it. I’ve done such trips are for sure. She’s okay. Alright, that’s interesting. So you guys can we calculate your net profit and seller board? And then I guess a cracked head back your trips and maybe bookkeeping and stuff like this, right? So I wish I was there to buy already faced for okay, I see don’t tell me I like

[0:22:25-0:23:02]

what else do we need like in terms of the team? For example, I want to see some sort of operational team come with a business often times sellers or a client’s when my looking at going to sell the business. They are the business will have been there last night at brother wax in the business and several months to leave once the bills done. So unless thereby that has the existing operations team that narrows they say give you some example we have

[0:23:03-0:24:03]

And we just picked over a billion dollars in registered capital on the by-side Now by has registered Buys have ever billion dollars to spend one at the top. And yeah. Yeah, that’s like on I-90. Oh my God. Say I deal with thousand dollar deals in this is what that buys looking for. The only buys we deal with a big money Buys. So this is what they are asking for. So what they’re looking for is an operational same at minimum to run the business after the sell you get extra credit extra points, if the team that runs the business can also keep scaling the business the right now with same also has where the client owner of the business is made an offer to stay with the business for a. Of time to continue with the grace and in some cases. Those buyers are looking to add on

[0:24:03-0:24:50]

Brands to that business to make it larger than 3 to 5 years. So it might actually make sense for you to stay on if you if that is part of your plan, right? Yeah, that’s that’s what we’re saying at this this answer the more operationally capable of businesses and his staff members can go out Soul Steam and go with the sale that would make your business more attractive than one that just has nothing if it’s just you and you want to leave that’s going to be not necessarily hot. It’s a cell it it’ll just limit that would be interested in understand and I would about like the location of the business basic around a lot of global sellers, right? Cuz it’s

[0:24:51-0:25:47]

No matter where your companies registered out of my spot that I said sales. I’m going to slight Edge if your company as US based and it’s been paying us taxes for a couple of years and about half of our clients are outside. The US most of the buyers are in the US but they have their own lines of credit will cash that they using to make the touch just the one thing that you will see more often if you’ll business isn’t in isn’t US base is some form of deal structure so that the deal ypu get 100% cash of clothes will be maybe some seller financing maybe a hold back. They’ll be a deal structure and make sure that they was to make it easier for the buyer to pay for the business traditional finance options available. Okay, and what about the brand like I don’t need to probably rent register the bronze light on Amazon.

[0:25:51-0:26:28]

Solar Products, if you can get patents to help out the night moves the multiple, it just gives mold to sensibility. So we’ve had a number of clients with patents and trademarks that old gets transferred across definitely brand registry oven brand registry. Now, you need a trademark as well. So that way going through a couple of trademarks at the moment that it takes months to get done. So I definitely want to get that sorted soon as the light up pens in some cases as well. If you go get your go apply for the trademark you may actually run into a problem and need to change the name that I’ve been to a couple of clients. Actually they went through the person they definitely want to do that first.

[0:26:29-0:27:29]

In N what does it mean for their product? Because I guess you can’t change the name the brand name arbitrarily on Amazon, right? You might lose your listings and everything you need to fix that and you don’t want to be doing that in a Cell process cuz I can tell you okay. Okay. Alright, so tell me about the procedure. So let’s you mean we brushed our business to assemble condition of this way and we have a buyer know how does this work like that? The transfer basic is it a transfer of the seller account or or Just in brand normally depends on the business everything available. So we could transfer the La Jolla count. So to do that you really want the products in the Brand on not account. Just being this one business and run into problems if you have multiple brains, and you really want to know one.

[0:27:29-0:28:26]

Partially because of day am reporting side of dark line right now. We’re having to wait just so we can pull out all the advertising. A braid out the brand striped frustrating. But ideally you want to be able to have the brand on the seller account already to go and that maybe two friends but it’s all in this together as one business and if it’s transferring say u.s. Seller account to the buyer. It’s a very fast process and you don’t need to move anything. That’s once the deal is done. The money goes into escrow you transfer we do it in an hour on Summa scrape if the buyer needs to Text back for the Brand on wants to transfer to their account or your inside Germany sense why you cannot sue a seller account transfer we need to transfer the brand across to the revised accounts accounts. Are there an existing account?

[0:28:29-0:28:35]

I’m brand across some used inventory across a little bit longer could take anywhere from three to six weeks.

[0:28:44-0:28:52]

Okay, I didn’t know that it’s so easy in the US was basically one hour of work and that anybody can transfer the account to a new owner.

[0:28:54-0:28:59]Yep. Exactly. Nice. Okay, I can imagine it’s longer than that in Germany. Okay escrow. So how does this work? Basically the buyer pays the money to the escrow and Earnest account is transferred. Everything is transferred escrow place money today Cellar Trace said how it works to Escrow with a aloia. So one of the m&a attorneys on the deal will called the cops. Usually it’s the by actually at 7 to the greeman and place once every everything in the patches agreement as checked off. When I have the account. They have all the trademarks moved out of that. It has to be like what steps we need to take to be able to payments be released and then it will be released from escrow. So you’ll say that the money is in the account basically that buys paid and then once It over the checkpoints then you’ll pay that the schedule that’s light out in the purchase agreement would be what would you recommend with the sellers in terms of selling the business is so maybe no not telling you may be growing like what’s your take on the next to a couple of years with respect to selling a man went to sell? What is it a good time to sell now or other two to Build a Dino kale? Yeah. Sure. I say two things of going to that one is the market and more importantly I’d look at my own business. So if it was me, I’d say what what am I? What am I knees? What am I? Why am I doing this? Right? So in one respect it might be you wanted to quit your job in this is your full-time business. So if you sell the business you no longer have the cash play. So what are you going to Do with the cash even if you can get $1000000 us is your Target and you got a million dollars US what would you do with that to generate password in the bank depleting is not the same as cash coming in as cash place that you want to figure that out first. And then what else would you do? Like, would you stop another brand would you other ways that you could to keep yourself engaged? So I always kind of default to not selling and then build a case to so it’s typically if the devaluation of the business could be at a point where it is a hell. Yes number for a client. That’s what we want. We want to listing above a hell. Yes number of clients to give them as much room as possible about selling. Is there another straight line and it’s not the best option and every case and it doesn’t fix all your problems as well as a friend of mine interview in last week’s are out Now podcast that exists. He wrote a book called before the exit. So I definitely recommend people read that book because he and his business partner sold and I actually kind of regretted it hasta and they gave us an asset. That wasn’t as bad as they saw it. Like I saw it selling would be the ultimate goal and really it didn’t move the needle for the master to sell sake really think Siri thinks it’s cool to say to your friends that you sold but maybe that’s not actually what you need. So I don’t think there’s any urgency to sew a certain types of businesses that you know, how I’m going to be hotter to sell but I think that’s already the case. So it’s not like, you know, if I don’t change one thing we are seeing changes that listings under million dollars us as a list price of dropping so there’s so much competition.

Mama cat 30 the sale price is actually dropping. So those businesses of being West less and less that’s still selling but that been moving for less and the deal structures of mall by a favorable sells the buys Market below a million interesting.

Cool. Thank you. Look. I’d like to talk about it another topic on briefly a couple weeks ago. I saw your post on Facebook on the friends for for 2019 and now it’s an interesting topics to talk about maybe you can walk after these Trends and discuss them shortly.

Nail shop Ella. I’ll have to pull it back up cuz that was some that was funny. Yes. I right that. We put out a lot of stuff today. Let’s see. Where is it?

Accurate predictions for 2019. So yeah, it’s an idea of what I saw it was kind of changed and in 2019 and I are really spot and it’s December 31st of December of South Korea’s q17. First quarter of the year is when most of those businesses want to sell any part of that is because it was pretty big the most definitely saying not we’ve seen double-digit me listings every single week. So 10 to 14 you listings a week sometimes more coming out in the first few weeks of 2019 already and in Elmont to watch Monday emails yesterday Lewis plays on the bottom of the email. Holding me list things regardless of who has them. So that’s a good resource to a.m. To check out some of that definitely happened. And I’ve also got that number to point was self to write the multiples will continue to decline for the average FBI business. So we’re already seeing that Stadium the Seltzer rate globally last year was about 20% out of business is listed and you have a 22/7 l to write that means I like 2,100 businesses sold. Okay. I’m web tracking 240 businesses right now to sell so about 80% of those based on the current Trend will not sell. Why is that isn’t because of the seller’s or because of the buyers just head to the bar so I could subdue many sellers, right? Too many average businesses. So people that like you said that they don’t have an optimal business for sale something that has longevity that the brand does just a lot to choose from Harrison. You can see I’m not Majin comes into play at dual making an 8% return on your cash of the heater or studied this out of there. Of course, they going to show you. Okay. So let’s not like a probabilistic play like, you know, five businesses were listed only one guy’s guy gets to sell him the other four unlucky, but you can actually influence that right. So you’re any ship to me to build a nice business automate basically do all the stuff that we talked about. Okay to get a facial and number three is more investors will be looking to acquire Amazon based friends and the multiples as multiples full. So we are seeing a New investors I spent about 80% of my time talking to investors looking to buy Amazon bass Brands and Wes a more and more money coming to the market so one because the multiples or so but also because people like Amazon and I want a piece of Amazon in the US about 50% of the just on that 50% of the e-commerce is fly on his own say you’re a lot of investors are looking to get a foothold on Amazon number for f course Amazon will continue to change the rules and increase fees and I think that’s pretty obvious. They going to keep trying to make more money there in a in business make profit just like everyone else. So yeah, you just got to accept that it’s interesting though investors will see as we’re looking at the piano on if using cell aboard to see this to you see that the trend year of the year. Your Revenue can actually be going up, but you’re not profit.

[0:25:26-0:27:12]

Can be going down trending down because of Amazon face. You’ve got a shipping cost to file storage fees. At least not that he’s right. You really need to keep on top of that to understand how to take as much cash out of the business as possible and make yourself as profitable as possible before going to sell the right. Now a lot about clients in the US are actually using on Europe is well by using party warehouses because that run the numbers service is actually cheaper in some cases than Amazon. I guess you more flexibility to change this long-term storage fee billing rules in the US last year in August and they’re about to change them in in Europe is well, at least in Germany me it’s getting

[0:27:12-0:30:12]

Getting more expensive to make sure you don’t pay the long-term storage fees will be before it was like twice a year. Now. The bill every month is hotter 2 minutes. So say OK and the five. I was just in a bit shaky because I know a lot of people that are in cryptic Crypt I will stop calling themselves invested as the number one role of an investor is to not lose money and I just like to explain this cuz this might not be obvious. I love the warmth of the number one rule of investing is to not lose money. And the number to roll is the same number one. What are you actually talking about is on the line value, but that’s that’s what I was referencing there. I got some feedback on that set up set to

[0:30:12-0:31:55]

Number 6 Amazon sellers will realize they are investments that business and that peroxide. So as long as the highest return Investments, they will ever find and I have full control of their wits Ends by my Amazon business when we were still running up steps with another quick now so that the amount of cash invested in inventory service business returned back to me after the product was paid for the net return 35% cash on cash return in my pocket. So try and find an investment that will give you 35% cash on cash return.

[0:31:00-0:31:04]

That was on each order of inventory was 35%

[0:31:13-0:34:12]

That’s fantastic. If you go, I can’t listen Europe the you put your money on the bank virtual. You need to pay for pay the bank for for the money to keep it safe and sound alarm that I don’t know too many good ways to invest at the moment because the money sent you into the space and want to buy you a brand is dope a maybe they pay three times to let us study 3% return on investment just on the couch play and then they have the cash play sounds of the Infantry. So there is there is a legitimate reason people are buying these businesses and the Seltzer rate is affected because some of the businesses don’t have longevity. So the longer your business has been around the more muscle called you have in your nice though. If you had legs really been selling the six months and you expect someone to pay three years ahead. Just not going to do that, right?

[0:34:13-0:37:13]

You’ve been around for five years. You’ve got a track record. You’ve been growing year of the year. You have a real Brand on the something to build off at some point where you were happy to sell. It needs to be a win-win and the buy needs to see a better return. Right? So you are giving up the asset. So that’s why I’m talking about here is you need to understand that you actually have a great investment vehicle. And if you sold for $1000000 where can you go get 35% shrink a shirt or whatever it is. So I’m number seven. I put the world economies will continue to change and it’s not human nature that everything is going to change. There’s a lot of talk FBM in the US amendments site. A lot of people here talking about the economy going to change it. So it’s always going to change and we act emotionally and that drives markets.

[0:37:13-0:39:13]

That’s just something to tell them what to think like the brexit and and maybe they the current u.s. President with his tariffs on Chinese Imports, right? Do you see like some basically talk in the market about this? Is there more less walls, right? It’s it’s making the business more complicated. Maybe the margin lower in the end. I don’t know how I’ll sitting in Europe will work on Master brexit. Anybody knows of the day that it was no breaks its yet. We’re in January 2019 talk about and I’m not in the UK. So I’m very very much a Distance by the tariffs on the US side of Chinese tariffs our problem and they are affecting more milk out of

[0:39:13-0:40:13]

Investors are actually posing and asking is this a degree affected will it be affected in the future rent deal structures will reflect the risk lately. There is there is some risk if you are still selling in the US and your sourcing from China regardless of if you’re on the top hit list or not, and it makes sense to look for alternative supplies, maybe go to another country and got some samples schedule and see if you can work with someone else then maybe there’s other ways that potentially around it. So I talk to you your friends that I’m also selling got some ideas on how else to do it. I don’t have any proven ways to get around it, but you can talk to people that are actually doing doing that to say the number eight is a like you said I put this on Facebook. It was a joke about my wife and I so I like finding a home base.

[0:40:13-0:42:12]

We’ll get a lace and I’m almost three weeks later and for the past five and a half away six years. Now. We’ve been traveling every six months. We don’t stay in one place too long subs, and they said if that’s going to be true and it’s probably your audience is a small group of investors that has raised either raise money will have access to a lot of capital that will acquire most of the good deals this year. So that’s what I’m protecting us a group of neddies 325. I put one that’s for you that was about three to five different groups. Of looking to acquire most of the the good deals sake brands with good margin Goods contradictory and some of those have their own internal team some dumb that I believe so selling they’ll end up buying most of the good deals and Blue Barn they’ve got about three to four hundred.

[0:42:13-0:42:18]

US divers SM pretty powerful groups

[0:42:19-0:44:19]

Yeah, and the 10th point which also would be interesting to you to a group in your audience is that I believe is Malmo business ideas. Discovering the power been fussing networking and stops with 10 events. This has been the one thing for my business that really has been that the biggest boost to my businesses in Tustin events. And some of the most successful largest clients. We have doing your 20 million a year or more and revenue all sometimes they’ve got coaches that must my groups that go to events. They travel to go hang out with other watch that was sometimes you can see that as an expense to go pay for access to other cell has but honestly, like that’s that’s the thing to invest in the only thing the first thing outside of my business by investing is going to meet other people that have doing cool stuff and most

[0:44:19-0:46:19]

With some time to have them sell a business with us. That’s my focus. When I go in that would be the same as you’re selling on Amazon right has to figure out what other people are doing or let it go to events where people are selling outside of that’s really hard to do. But if you can as I mentioned before if you can move that Revenue needle outside of Amazon new business could be more valuable. So why not go to learn how to do that little copywriting lender direct response figure out how to sell your products yourself without relying on Amazon and I got something that would have a huge return it would also give you more Comfort because you less reliant on one channel Amazon employee eBay or Shopify for when you control control. Okay, if it’s Shopify how do you drive sales to Shopify? So it doesn’t just have a Shopify site. But how do you

[0:46:19-0:48:19]

Drive traffic in and predictably people pay more for so eBay is not going to move the needle on a multiple because you still got control the customer. That’s why it’s so important to understand and Tyga one audience one target market is when you really get to know that person know that she is nice things that motivate them to buy products and unsolvable products. But if you control at Channel and that buying direct from you as well as from Sam has on then you’ve got a real business analyst most valuable car and thanks so much. It was a ton of value and it was very motivating at least for me. So why don’t you tell us where we can find you set a website is the FBA broker.com. And yeah any questions just reach out to about team at sales at the FDA burka.

[0:48:19-0:51:05]

And some that’s that’s pretty much hit ask anything you want, I’ve already it’ll be a couple weeks and we’ll be talking to people from all sides of a transaction. So investors of people that have sold and what they’re doing now people that haven’t sold so I went to sell and then so people on all sides of the transactions is what waist discovered. I was the last full five years of doing deals is not deal nicer deals of the same. There’s always something different about a deal and it’s super interesting things to talk through all those different variations and why things happen I’m going to subscribe Link in the description as soon as it’s available.

[0:51:08-0:52:13]

Yep, definitely check out the accordance podcast and the FBA broker.com.

[0:52:14-0:53:35]

Thanks so much, and hope to see you again sometime. Maybe in a couple of months. I’ll be back in Europe for summer. I’m sure. Thank you. Bye. Bye.

[0:53:35-0:54:05]

The one thing guys think please let us know in the comments. I hope you like this video, sellerboard, don’t forget to press the like button and subscribe to our channel. That would be very motivating for us. And if you still don’t use sellerboard, then check it out. There’s a link in the description starboard, It’s the world’s most accurate profit analytics tool for Amazon sellers. We have a free trial free one month trial so take a look and let us know what you think.

[0:50:06-0:50:54]

Thanks so much. Have a great day. Bye bye.