Our guest on the sellerboard show was Emma Borochoff – head of marketing at 8fig, e-commerce financing company.

Contents:

- how 8Fig can help e-commerce sellers;

- why sellers need financing;

- how the financing works;

…and much more!

Watch the full interview by clicking this link.

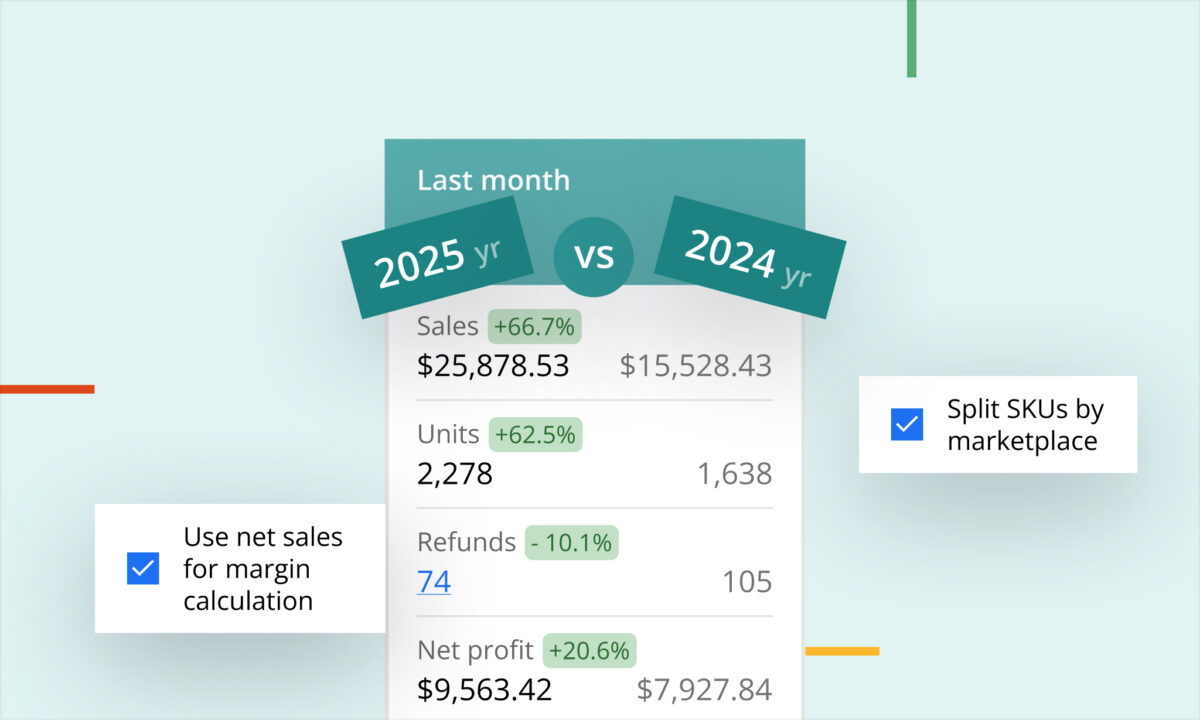

Speaker1: [00:00:07] Hello, everybody. This is Fernando, your host at The sellerboard Show. I have a very special guest for you. We have today is Emma from 8Fig. 8Fig is a financing company for sellers. And I think it’s inevitable when you have a scalable product, it’s inevitable that you’re going to need cash flow. So that’s why I wanted to bring Emma and hope you like this interview. But before we start, I want you to do something for me. I want you to go to sellerboard.com and click on the demo and test the software. It’s like it’s almost impossible to drive your Amazon store without a software like sellerboard, especially the way we set up everything for you. We can see your daily profits, you can have inventory, you have emails, you have all everything, like everything consolidated for you to manage your Amazon store properly. So before you watch this interview, go to sellerboard.com, click on demo, play with the software. I’m sure you’re going to like it. And without further ado, let’s go for our interview. Thank you so much. I’ll see you guys at the end.

Hello, everybody. Welcome. This is Fernando, your host from sellerboard. Thank you so much for being here. Have a very special guest today. I have Emma. Emma is the marketing. Are you. What’s your what’s your role at?

Speaker2: [00:01:31] Head of marketing US.

Speaker1: [00:01:33] He’s the head of markets for a week. So got eight feet for us here, guys. Thank you. I hope you like it. And I’m very excited. Thank you so much for being here, Emma.

Speaker2: [00:01:42] Thanks for having me.

Speaker1: [00:01:44] My pleasure. So I want to start with your story. Tell us your story.

Speaker2: [00:01:49] Oh, my gosh. My story. Well, my personal story. So I’ve been with since June 2022. Um, and I’ve always been in, you know, tech, tech marketing. Um, so that’s something that, you know, I love just kind of, you know, building the narratives and stories and meeting customers. And I find marketing, like, very, very fun. Um, I think e-commerce in particular, like something I really like about, you know, being with, with eight figures, seeing how close we are to the customers. And, you know, even though we’re, we’re technically like business to business, you know, we’re working with. Sellers who are their own business. A lot of times just like one person. So I find that, you know, super rewarding and interesting is like, okay, these people, this is this store is their livelihood. And they’re, you know, they quit their full time jobs. They’ve quit kind of like that stability and they’re taking on this adventure. So I really, really love the industry. Um, probably like my most favorite industry I’ve been in so far. I’ve been in, like, market research. Guess I’m still technically in fintech, um, as well as like professional events. So, and currently am based in Austin. And I was living in New York City for 12 years.

Speaker1: [00:03:09] Where are you from?

Speaker2: [00:03:11] I’m from Maryland. Like DC area. Yeah. Nice. Yeah, love that area. It’s a good place. Yeah. Dc is nice. You know, it’s. It’s clean. It’s not as fun as New York, but it does have, you know, it does have its perks. I would say.

Speaker1: [00:03:29] So then you moved to New York and now you’re in Texas.

Speaker2: [00:03:33] And now I’m in Texas, the place I never thought I would be, especially after living in New York City for so long. But I’m in Austin, so people call it Texas, You know, Um, it’s a really, really cool city, especially like since I’ve been in tech for so long. It’s like Austin is such a, like booming tech, um, epicenter. So yeah, I mean, the tacos are incredible. Like Mexican food. You can’t beat it here. So we’re having a good time.

Speaker1: [00:04:02] Yeah, it’s a great city, uh, for the for the people that doesn’t know what eight figure is. Can you explain what eight figure is?

Speaker2: [00:04:11] Yeah. So eight Fig. We are a planning and funding platform, a growth engine, if you will. So basically the way we kind of differentiate ourselves from other funding partners is that we have a platform that allows our sellers to pretty much map out your supply chain. So you, you look at each batch of inventory that you need. What are the different costs associated with that? Like what are the deposits, what’s the freight, you know, when are all these things do? And then you kind of build that out over the course of 6 to 12 months. And then we take a look at that plan and we see all the areas that where you’re going to need cash flow the most, and then we fund you at those moments. So we’re funding you in a way that’s incrementally and based off of your plan so you get the funds that you need when you need them. And what’s also great is that you can actually change things as you go. Since the funds are incremental, you’re not getting it like boom, lump sum. Yeah, you’re not getting a lump sum, you’re getting it kind of like at those moments that you need to pay for all those different costs. So since you’re not taking it all upfront, you can kind of change things like, okay, maybe you’re selling a little more, you’re selling a little less, You can you can change your plan and then change kind of the amount that you’re taking as well. So it’s really, really focused on, Yeah, I like that sound, really focus on optimizing your cash flow and then kind of like giving you that flexibility that we know sellers need because, you know, you build a plan, but how often does it go according to the plan? So that’s kind of yeah, that’s kind of kind of what we focus on and why we’re different than other companies in the space.

Speaker1: [00:05:54] Let me ask you something else. Is it possible to scale an Amazon without funding?

Speaker2: [00:06:02] Um. I mean, it depends how much money you already have. I would say it’s like, you know, you you need to spend money to make money. Like, as, you know, you’re selling physical products. You need to pay for that inventory up front. And, you know, there’s the vicious Amazon cycle of going out of stock. So a lot of times, you know, you’re you’re paying a pretty penny to get that get everything in production well before you’re actually able to, you know, sell it and get that money. And so and even if you if.

Speaker1: [00:06:33] Yeah, go ahead. Even if you try to use your credit cards, they got like 55 days. That’s it.

Speaker2: [00:06:40] Sorry. Say that again.

Speaker1: [00:06:41] If even if you try to use your credit card as a funding, you got like 55 days and after that, start getting charges.

Speaker2: [00:06:48] Yeah. Yeah, exactly. So, um, we’ve, I mean, you usually do need to have funding from somewhere, like every everyone’s different. Like, there’s different solutions for different people. But in terms of like scaling, if you really want to scale, you know, some people are fine just having, you know, a little bit of side income and that’s great. But if you really, really want to scale, you know, and become like seven figures, eight figures, you do need to get that funding from somewhere. You do need to be buying that inventory up front.

Speaker1: [00:07:21] I think it’s inevitable, and that’s one of the main reasons that I wanted to bring you here on the show, because I think if you if you have a good product, if people naturally give you five stars, it’s going to scale and it’s you’re going to need some cash flow. You’re going to there is nobody that can keep up with with the demand, you know, especially for Christmas, you have to buy in September. But who’s going to pay for that?

Speaker2: [00:07:46] Yeah, yeah. 100%. Um, yeah. Q4 is usually the biggest season for all of our sellers, so meeting those funds like as early as possible and making sure that everything is, you know, the inventory is kind of positioned in the right places that they’re ready to go. Um, yeah, it’s massive. And if you don’t have that cash flow like and a lot of times like people don’t really necessarily realize that they aren’t going to have that cash flow until they’re living that and realizing, oh, that all their cash is tied up in different places. Um, you know, there’s just a can be a decently long timeline if you’re looking at kind of mapping out the whole kind of inventory flow from like production transportation holding warehouse to FBA to selling, you know, the point where you’re actually getting the money in your hand, It can be pretty long. So you do need to have, you know, multiple options.

Speaker1: [00:08:42] Got it. Do you require some sort of insurance from the sellers in terms like keeping the cargo, producing the cargo and auditing the cargo before he leaves? Because if the cargo bike if the if the seller buys a duds order like 5000 of a product that it’s not good, they’re going to have a hard time paying you back. So you have like the the you have this requirement to do like an audit assurance, things like this.

Speaker2: [00:09:09] Yeah. So we don’t currently have that. It’s something that we, you know, are we work with our. We have had sellers before who, you know, it was, I think it was a seller where they had like, um, like wreaths that you hang up on your door and, and yeah, it was kind of a bad batch that ended up getting crushed. And that’s something that we work with them through in terms of like, okay, building out a payment plan that works for them because like we understand that that happens. Um, we look more at things like sales history and some other variables. Like for instance, you have a very seasonal product, the rest will be a little higher, the cost might be a little higher for us to work with you. Um, but you know, it is still very much in the seller’s hands, but we are very, you know, in touch with our sellers. We want to make sure that like when things do happen that, you know, they can change things, that we’re there for them. Like we have it built into our system. We call them change requests because, you know things are going to change. So it’s literally part of our platform is like, okay, you are you are kind of mapping how things are going. And then we we are also another thing is that we are start working on as well as too.

Speaker2: [00:10:23] Um, so we plug into your store so we can kind of see how sales are going, so we can kind of see how your sales are going compared to or this is a feature we will have soon. Um, how your sales are going versus how what your plan is. So if you have like, okay, cool, we’re going to take out this much because we’re expecting to be here, but you’re here. That’s something that, you know, we’ll reach out to you and say like, okay, like maybe do you need this? Much like what? Like, let’s kind of take a look at your plan. So that’s something that we’re starting to build a lot more into. The system is like, okay, you built the plan, how is it going and how far off from the plan are you and what does that mean in terms of what you need? Um, and should we change that? You know, it’s still very much up to you. At the end of the day, you’re going to decide what you want to do, what’s best for your business. But we are starting to kind of build those, you know, little indicators and guidelines in terms of like where you should be so that you’re kind of in a position that is okay, don’t take more than you need.

Speaker1: [00:11:28] So you already answered my next question. My next question would be like, do you like help the seller to to schedule inventory? And yes, you do. So that’s nice. So you have you have a software, people connect with their seller store and you’re able to see your inventory and you’re able to predict how much they’re going to need. And do you require people to put like the time of production, time of transit so you know how long it’s going to take to do that.

Speaker2: [00:11:55] Yeah. So so we don’t actually so we are not a complete inventory management tool. Like we do have aspects like we kind of help them understand how much, you know, like we kind of help them understand like the amount that they’re getting and then how that aligns with kind of the funds that they’re asking for. Um, but sorry, what was the question again? I kind of forgot it.

Speaker1: [00:12:18] You’re not in inventory management. You’re just like. Thing if they’re ahead of the plan.

Speaker2: [00:12:23] We’re mapping. Yeah, we’re aligning. We’re kind of like having them sit down and map it. So we do have now your question, which is, okay, like we want to know when you’re going to have your stock. So kind of the information that we get from our sellers, we’re using that to help them build that plan. There will be more at a later date where we can be a bit more hands on, whether that’s like working with a partner, something that we build out ourselves in terms of understanding that inventory like we do have like inventory management, I will say is an area of expertise for us. Like we do have kind of a few rules of thumb which I can just go through right now. But in terms of for regular selling season, so not like a peak season, we usually recommend having about like 60 days worth of inventory, 45 to 60 days worth of inventory in your FBA. And then if you’re using a holding warehouse, which we’ve seen, you know, as long as you’re scaling, some people are, you know, not big enough where they might need that. But if you’re looking to scale, like having a holding like a three PL and then having an additional 60 days worth of inventory there that you can, you know, then it will take you, what, like 3 to 4 days to get from your three PL to the FBA so that if you’re going out of stock like you can slow down kind of your selling speed so that you can make sure that you have, you know, another like three days and you’ll have that stock on hand. So there’s things that like we recommend and we work with our sellers to kind of. Give them as many buffers as possible. Um, but yeah.

Speaker1: [00:13:54] You have a success case to share with us.

Speaker2: [00:13:59] Yeah. So actually one of our. Well, they’re a duo team. Fantastic. They’re now they’re doing consulting I believe Divan strategy. So they, they actually got started during the pandemic. And so they it was something they just kind of dabbled in. It was one of them. And his wife just started to decided to do an Amazon store and actually originally their first product totally bombed because they they spent a lot of time like making sure it was like really nice product, high quality product seemed really cool. But, you know, they failed to do some of that like keyword research and some of those things. So it didn’t quite work out. But then when they kind of saw an opportunity with, you know, there weren’t a ton of sellers in the space for this product. And so they saw that there were a lot of peak seasons for them to kind of capitalize on. So that’s something that they, you know, brought in the other partner and really started to build out. And they and they were very successful. And so they needed that’s when they kind of hit the wall in terms of needing those funds. And they’re so they are they’re Canadian based in Germany selling in the US. And so they didn’t really have credit. And so you don’t need you don’t need credit to work with us.

Speaker2: [00:15:17] You don’t you know, we don’t look at anything related to the actual seller. It’s more about your sales history. So we saw that, you know, they were successful and they had potential to sell even more. So they came to us and then, you know, we were able to work with them to build a growth plan and then fund them. And they scaled, um, I should know the numbers off the top of my head, but I don’t remember. They, they went to at least it was at least a seven figures. Um, and they sold their, they sold their company so they did all of that in about, I believe it was like 2 to 3 years. Um, and so, and yeah, and so that’s something that like was really fantastic. And we have, you know sellers that a lot of them are, are similar. Like, you know, when you’re kind of reaching that point, you’re seeing that initial success and then you need the funds and you need them quickly. You might not have, you know, a ton of options, but you need something that can be flexible and work with you because you don’t, you know, not everything’s going to go as it, as it should. Um, but yeah, so. I’m proud of them. Got a little.

Speaker1: [00:16:27] Jealous. Very good. Very. Don’t we all get jealous when they’re company? Yeah. Let me ask you something else. How are you? Better than the competition.

Speaker2: [00:16:40] Yeah. So I would say that first off, I would like to caveat and say that there are quite a few funding options and some options are better for other people than others. And so I wouldn’t I wouldn’t say like, oh, we’re better for everyone than all the other options. I would say our our sweet spot is for people who are, you know, like smaller to medium businesses. You’ve seen that initial traction. So what we look for is you need to be selling for at least 12 months and then you have 100,000 in annual revenue over the last 12 months, at least as a minimum. So people who’ve, you know, seen that initial success and then are looking to scale rapidly. And so it doesn’t need to be I know like this this conversation is more like Amazon, but we also do work with sellers who are Amazon, Shopify, WooCommerce, Wix, quite a few of them. So if you’re also like multi-channel like, we can support that as well. But say like the biggest. Yeah, yeah. Multi-channel. Um, the biggest difference, the biggest differentiator for us is that we do have a platform that it is like pretty DIY in terms of like the way you can kind of change things as you go, like it’s built to be changed. So there’s that flexibility and the fact that we focus on cash flow.

Speaker2: [00:18:07] So that’s like incremental and based off of kind of what you need. So there is a lot of I don’t know if I’d call it science on the back end, but, you know, we’ve really like kind of looked at what you need and then formulated, you know, that’s kind of the how you’ll get paid out. Um, another thing while I’m just listing things is that because we do get a lot of sellers coming to us and saying like, okay, well, how much can I get? And that’s like, that’s not the approach we have. We want our sellers to come to us and say how much they need and then we can we look at that and then validate that. And whether we think that is something that is, you know, realistic or not. Um, so it’s really more about like what your potential is versus like, cool, how much money can I get? Because that’s just not taking more money than you need to. Just not. A healthy approach to it. It’s really just looking at what you can forecast and what you’ve what you’ve shown from your previous history. And that can give you kind of a better idea of of the amount you should be taking.

Speaker1: [00:19:15] Nice. Nice. I want to ask you the most important question of the interview.

Speaker3: [00:19:25] Apr.

Speaker4: [00:19:27] What’s say? Yes. Yes. So.

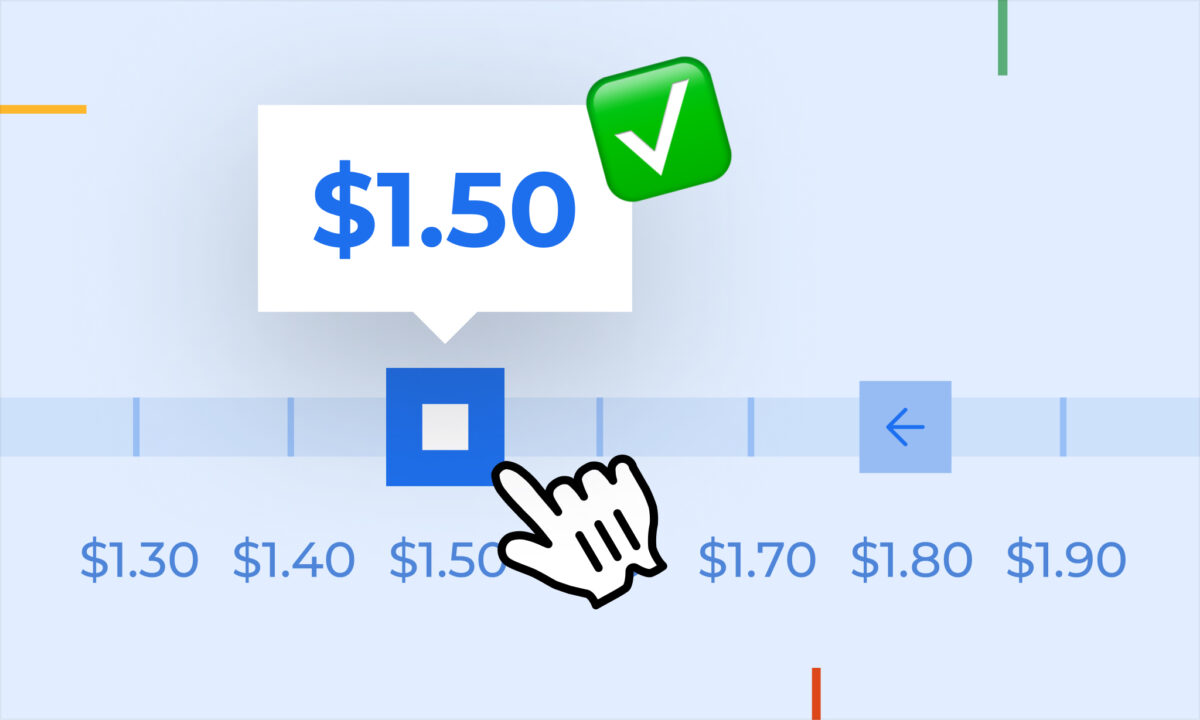

Speaker2: [00:19:31] So since we technically are a merchant cash advance, it is. So it’s a fixed cost instead of an interest rate because they are more short term. The time span is more short term. So it’s 6 to 10 K over every 100 K funded.

Speaker4: [00:19:53] So that’s like the usual range.

Speaker2: [00:19:55] So it’s kind of like the way we work is that you build, we call it a growth plan. So that’s kind of what I mentioned before when you have, you know, your, your supply chain mapped and you’re building out like, okay, this is how much I need for each inventory batch. So we kind of look at that whole thing and that’s usually between, I think it’s between 8 to 14 months. And then there’s that amount that you’re going to get from us, and then there’s our cost of capital. So it’s the fixed cost that you have to pay us back on top of that. And that is usually the 6 to 10 K for every 100 K.

Speaker1: [00:20:30] Links to 10-K for every 100 K is the 100 K the minimum.

Speaker2: [00:20:37] Oh, no. So we’ve had like a really wide range. Like I think the smallest I’ve seen us blend is like 20 K, like 20 K to a 19 million. So we have a wide range.

Speaker4: [00:20:53] Oh my God. So yeah, you don’t know that 100 K.

Speaker2: [00:20:56] Yeah, you can definitely take less. Um, for sure. It’s really just like that’s kind of the typical ratio. So if you’re going to be taking. Yeah. So if you’re going to be like 50 K, it would probably be what, between like three, three, two? Okay, maybe 3 to 5. But um, yeah, that’s kind of what.

Speaker4: [00:21:14] That’s a.

Speaker1: [00:21:14] Very good rate. So you’re getting 6% per, you’re getting 6% and you, you can pay between 8 to 14 months. So we’re going to average an year. So is it is it like a 6 or 10% rate? If we were to put that in an APR, would that be the equivalent of a 6% rate?

Speaker4: [00:21:38] Okay. So so think.

Speaker2: [00:21:39] If you actually were to break it down to APR, it’s usually a bit higher than that, but it’s more of just looking at the time frame itself that we are lending that out over and that costs related to it. So yeah, I wouldn’t it’s not just like 6 to 10. Yeah.

Speaker1: [00:21:57] And how, um. How do people pay? They have to pay, like a monthly installment plan, like something like this, or they pay everything at the end.

Speaker2: [00:22:06] So the first payment is 30 days after you receive the first funds. And then after that it’s typically like in two weeks installments after that. Yeah.

Speaker1: [00:22:18] Oh, gotcha. Very cool. Very cool. Very cool. Minimum 20 k to start working with you.

Speaker2: [00:22:26] So there is no minimum. Yeah. Like you could. In theory, you could ask for less. Yeah.

Speaker4: [00:22:33] Um, but it doesn’t.

Speaker1: [00:22:34] Make sense because the person makes $100,000 per year. He’s going to need at least 20 K to.

Speaker4: [00:22:40] Yeah.

Speaker2: [00:22:41] I feel like if you need less than 20 k, like there’s probably other ways you can source that. Um, yeah, you know, but yeah, technically we don’t, technically we don’t have a minimum. We don’t have a maximum. So, you know, do you have like, come on over and give us a chat? Yeah.

Speaker4: [00:23:00] Uh.

Speaker1: [00:23:01] Do you have a special deal for. For holidays? People that need to buy their cargo in September.

Speaker4: [00:23:09] Yeah. So we.

Speaker2: [00:23:10] We don’t have a special deal. You mean just like in terms of, like, additional.

Speaker4: [00:23:16] Some sort of. Yeah.

Speaker1: [00:23:17] Like additional payment plan for people that are buying for the holiday season?

Speaker4: [00:23:22] Yeah. Not, not.

Speaker2: [00:23:23] Anything specific, but that’s one of those things that we understand is super important. Um, so that’s something that like we can always work around and figure out something that works best for yeah, for our customers. So.

Speaker5: [00:23:40] Mhm.

Speaker1: [00:23:41] Okay. Have you ever had a problem that you, you, you loan the money to a seller and you start looking that he’s like, he’s doing something wrong? Maybe he’s spending too much on ads. Maybe the product is like a commodity. It’s not doing that well and you kind of feel like you need to talk to the seller. Have ever had that that occasion?

Speaker2: [00:24:04] Yeah, we’ve had instances where people maybe it was like their sales numbers weren’t as high as anticipated or something like the funds are being used in different areas that weren’t as aligned to the plan, in which case, you know, we’ll have just a conversation with the seller and let them know like, you know, based off of, you know, what we’ve been seeing, you know, do we need to it’s usually it’s still like at the end of the day it’s still up to the seller of like, do they want to change their plan? Like if things are just going differently than kind of what those expectations are. So that’s something like we like to be in contact with our sellers and just say like, this is what you know, this is kind of what your plan was and like this is how, you know, you might kind of get back to the plan or maybe we should just change the plan and align with kind of this new path you took. So that definitely does happen. And we understand that. You know, you build up, you build a plan and.

Speaker4: [00:25:04] You.

Speaker2: [00:25:05] Sometimes you don’t do it. Um, but yeah, and that’s kind of just why we, we like to be, you know, a partner for our sellers and kind of be there and know that they can reach out to us because.

Speaker4: [00:25:16] Change happens.

Speaker1: [00:25:21] What were your predictions for the market in 2023, 2023?

Speaker4: [00:25:29] Oh, my gosh.

Speaker2: [00:25:30] My predictions.

Speaker1: [00:25:31] So and so on and so forth. How I think that this market is going to grow a lot. That’s my question. Like, think the funding is going to grow a lot. And I really I was surprised to see that you guys are already connected with seller and you’re already helping them to know their cash flow needs. So that’s very cool. What do you expect that’s going to happen in the future?

Speaker2: [00:25:55] Yeah. So in terms of the future, I mean, there’s a few things that we are building, like we are looking to kind of build more of those guidelines for our sellers to help, like automate their experience in terms of like, oh, our things. Like if there’s any sort of red flags for them in terms of, you know, selling speed or inventory delays and things like that, like we want to be able to kind of be, you know, their dashboard for understanding like, okay, all the back office operations, like how are things going? How can you kind of improve, what should you be aware of? Like how can you just be alerted to anything that you know might be going wrong before it’s like too late? So those are areas that we want to focus on, especially with this like impending recession that feels like it’s a full recession. Everyone says it’s impending. It feels like it’s here. I guess technically it’s not yet, but that is, you know, I’ll be waiting for.

Speaker1: [00:26:49] The recession since 20 2020. I’m like, why is the recession? I’m just waiting, waiting, waiting. And the recession doesn’t come.

Speaker4: [00:26:57] I know, I know.

Speaker2: [00:26:58] But it’s like it seems like it.

Speaker4: [00:27:01] Will.

Speaker2: [00:27:02] Come. And if not, then it seems like, you know, things might get a little worse before they get better. But that’s like, I mean, we’ve still seen our sellers, a lot of our sellers, very successful. And it’s really, really just kind of like if we’re to give them one piece of advice, it’s just like double down on what’s working, you know? Obviously it’s great to always love that.

Speaker4: [00:27:22] Can you repeat.

Speaker1: [00:27:23] That?

Speaker4: [00:27:23] Really like that?

Speaker2: [00:27:24] Like maybe, maybe hold on the new stuff for now and just look.

Speaker4: [00:27:29] To see what’s working.

Speaker2: [00:27:31] Yeah, I’ve seen some really great, um, like threads on Twitter as well about just like things that you can like you should be auditing like all of your spend like especially for like your ads and just looking at like, okay are these converting? And I believe like seller board is helps with profitability. So I think that is also an area that sellers do struggle a lot with is like, okay, everyone talks about revenue, but I’m like, cool, but what about profit? And so make sure that those areas that like you actually are understanding if you’re profitable and focus on those areas and then scale down the things that are newer experimental that, you know might not be as profitable, profitable or as reliable. Um, because like, I think that’s just also like as a marketer, I think that’s like something that, that’s a mistake that Renoise makes is like, Oh cool, let’s have like a million channels, let’s do all of this. And then most of the time it’s like, okay, you can have experimental like period, but then there’s a point where you’re assessing it and seeing if it was working or not, and if it wasn’t, cut it. You know, this is not the market to kind of keep things running if if they’re not bringing in those results. So really just, yeah, double down on those things that are working. Figure out how you can scale that and then figure out kind of more of the experimental like new products. Um, you know, at a later date is kind of what we’re, we’re telling most of our sellers.

Speaker4: [00:28:59] I like.

Speaker1: [00:28:59] That. I really like that. That’s, I think that’s a very good tip. I mean, unless you’re like doing something that like just an upgrade of your products and you put it on the same list that already have the same reviews, you already have the same on some consumers there, that’s good. But if you’re launching new stuff, I mean, I remember when I used to launch new stuff before the pandemic, it was so easy to launch product and now it’s getting harder and harder.

Speaker2: [00:29:26] Yeah, because people aren’t. I mean, yeah, like inflation. People are not like interest rate. People just aren’t spending the way they were. Like, people are holding onto their money. Like money is literally more expensive now. So we’re not all buying, you know, whatever on Amazon, like cool bath bombs and things like, you know, or like maybe, maybe don’t buy that stuff that you just know will kind of end up in a pile in the corner. Not to say that that’s what all the sellers are selling, but I do think a lot of a lot of Amazon products do definitely get hit in terms of like what are those kind of necessary products and what are those ones that are more, you know, not not even like luxury, but more kind of what you see people buy when when they have an excess of money. So definitely trying to to to be very, very smart about, you know, what you’re putting out there.

Speaker6: [00:30:25] Nice.

Speaker1: [00:30:26] Very nice. And okay, I have a few questions. How do people get in touch with you? People that think that all the sellers, if you have a scalable product, think you’re going to need seller financing. So that’s why I want to bring you here, because it’s so important to have this. You know, what are you going to do? You’re going to finance with your credit card for the Christmas shopping. What happens when Chinese New Year and and Chinese stopped for a whole February or what are you going to get your cargo? So you need to buy your cargo ahead or to avoid February 2nd and you have high peak. So you see spring, we have lots of sales in spring and then have a drop in August. So you need cash anyway. You need cash. So how do people get in contact with you? How people start negotiating, how they get a credit line, how they do call a credit line like you do in the banks? Is that what you call.

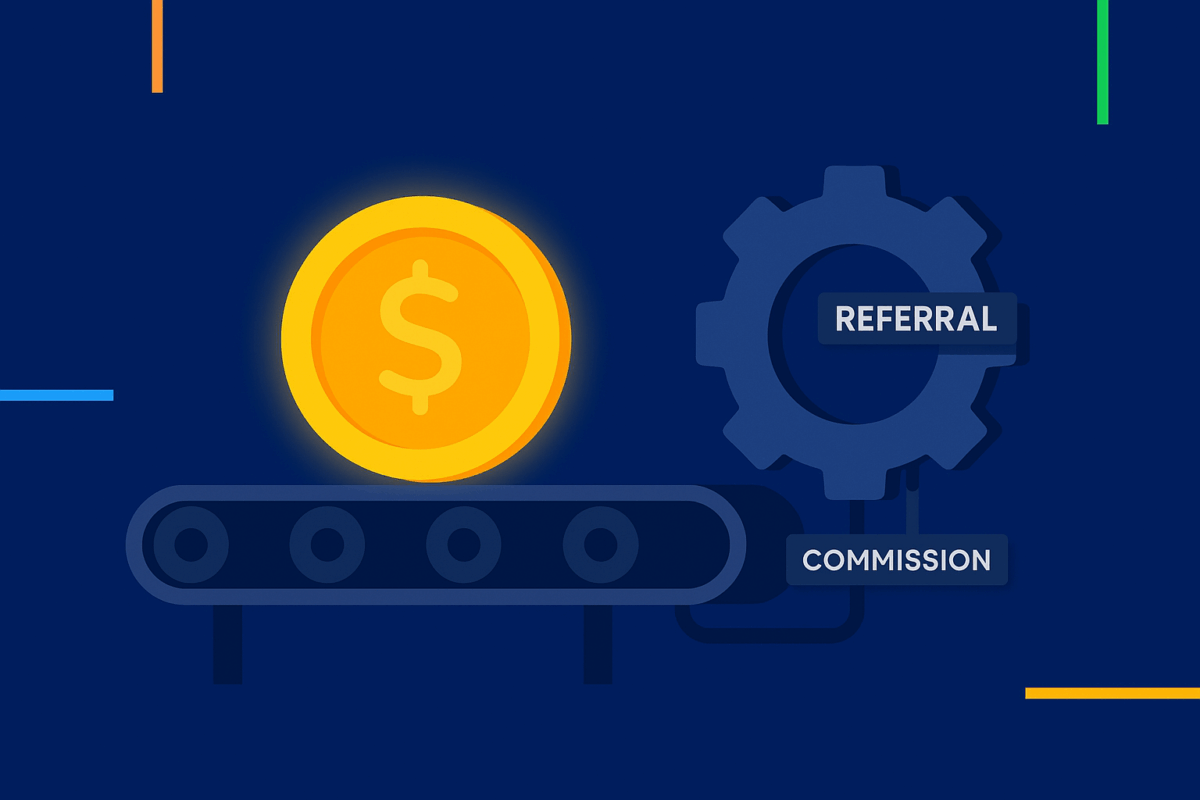

Speaker2: [00:31:18] No, I think it’s similar, but we don’t. Yeah, we don’t call it a credit line. Yeah, but so I recommend for people to go to eight fig.co. So that’s Yeah. The number eight fig.co that’s our website. You can actually get started there. There’s buttons you can say like get funded and then it’s a pretty like.

Speaker4: [00:31:42] Diy like.

Speaker2: [00:31:43] Onboarding process. If you want to reach out to someone directly, you can reach out to myself, Emma, Emma at Fig Echo or our general email, which is Howdy try to be cute because you know, we’re like based in Austin. H o. I hope you know how to spell howdy. I’m not going to spell it out. Fig Co as well. So multiple emails or just check out our website and you can get started there.

Speaker1: [00:32:13] What is the most common question that you get?

Speaker2: [00:32:17] The most common question.

Speaker4: [00:32:20] Um, probably.

Speaker2: [00:32:21] How did this work? Um, you know, and I think just because it’s like, okay, what is, what is this tool? I feel like, you know, people are like, okay, I get the money thing, you know, but like, what is like, what is this tool do? Um, so, so yeah, that’s probably just a general. Like, what is this? Yeah.

Speaker1: [00:32:45] Nice. Nice. Is, is the, is the company established in the United States or Israel?

Speaker2: [00:32:52] So we’re in both Austin and Tel Aviv. So, yeah, we’re in both places.

Speaker4: [00:32:59] Do you fly a lot to Tel Aviv coverage? What?

Speaker1: [00:33:03] Do you fly a lot to Tel Aviv?

Speaker4: [00:33:05] I haven’t gone yet.

Speaker2: [00:33:08] I’ve been like, it’s it’s one of those things where I’m going to I’m going to go. I’ve been before. Beautiful place. Have you been?

Speaker1: [00:33:15] No, never really want to go.

Speaker4: [00:33:17] It’s. Oh, my gosh. The food, the nightlife.

Speaker2: [00:33:21] It’s the beach. It’s got it all. It’s got it all. But haven’t I haven’t been for a fig yet, but I’m.

Speaker4: [00:33:27] I’m sure I will go soon. Um, and.

Speaker2: [00:33:30] And eat some really good, good food.

Speaker6: [00:33:34] Nice.

Speaker1: [00:33:36] All right. Emma, do you have any any last comments for us before we wrap up this interview?

Speaker2: [00:33:42] Um, no, I don’t think so. I’d say like, yeah, I’d recommend just going to aviaco or reaching out to, um, to myself if you have any questions.

Speaker4: [00:33:52] Um.

Speaker2: [00:33:53] But yeah, so we’re excited, I guess. Oh, maybe one, one other thing is that so I mentioned like we have the platform we are also going to be building out, um, we’re going to be making that much more robust. So there’ll be a lot of changes for us in terms of functionality in the future as well. And then also if you’re watching this and you’re a partner, please reach out to me. We have a partnership program. We love working with people and.

Speaker4: [00:34:18] Yeah, that’s about it.

Speaker6: [00:34:21] Nice.

Speaker1: [00:34:22] Thank you so much. Emma, thank you so much for your time. Appreciate it.

Speaker4: [00:34:26] Awesome.

Speaker2: [00:34:27] Thanks, Fernando. Fun being here.

Speaker1: [00:34:34] And that was our interview with Emma from 8Fig. I hope you guys liked the interview. Before we go, just make sure you go to sellerboard.com. Click on them. Play with the software. I’m telling you, it’s almost impossible to drive your store, your Amazon store without a tool like sellerboard. You got to keep an eye on your TACoS. You got to keep an eye on your daily profits. You got to keep an eye on your inventory. You have emails, you have so many functionalities there. It’s very cool. The software like it works amazing. Everything is like very smooth and clear and very, very good to understand. So don’t, don’t, don’t, don’t, don’t take this for granted. Go through sellerboard.com, click on demo, play with the software. I’m sure you’re going to fall in love with it and it’s going to be an indispensable tool for you to manage your Amazon store. I’ll see you guys in the next video. Thank you so much. Bye bye.