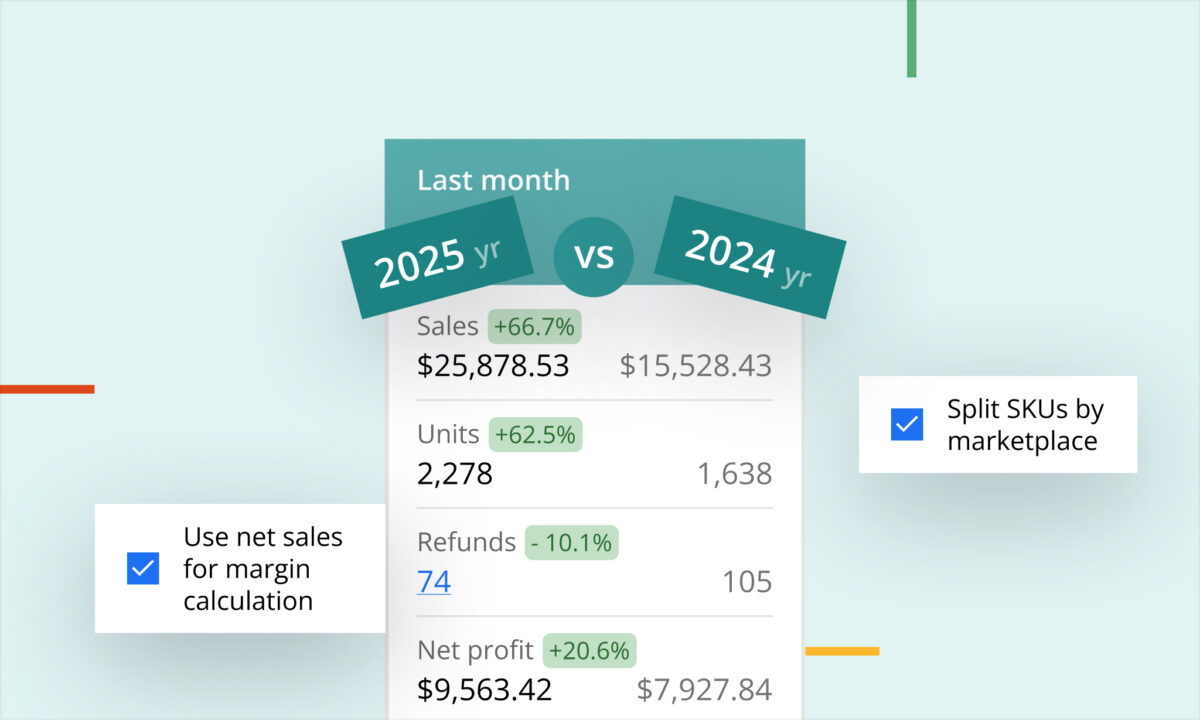

Return costs are often ignored by Amazon sellers. There are usually two reasons: sellers underestimate the return costs and it’s not clear how to account for returns correctly. The bad news is: returns cost you more than you think (and sellerboard will tell you exactly how much).

Return costs include not only processing costs and non-refundable costs but also adjustment of already booked profits. Let’s say you sold 1 unit in January and have already booked the profit from this sale in January. If the customer returns the product in February, you should now subtract the previously recorded profit from your February result.

How to calculate returns correctly? sellerboard shows all of the components of returns and refunds:

- Product (-1207.99): money refunded to customers for the purchases they returned

- Refund commission (-31.60): Amazon fee for returns handling

- Commission (+157.98): Amazon returned us the refer fee, that they withheld upon sale

- Shipping / Shipping chargeback: refund for the shipping to the customer and to shipping chargeback refund to the seller. The sum is approximately zero, so these positions don’t really matter.

- Cost of goods (+316.17): if the returned item is “sellable”, sellerboard will calculate the COGS with a plus sign (which “cancels out” the negative COGS applied when the product was sold). If the unit is returned damaged, it’s COGS become your loss.

In this list, there is no “FBA fee” that Amazon takes when the product was purchased. This fee is not refundable, that is you pay it when the unit is sold and it’s not reimbursed when it’s returned.

As you can see, refunds cost us 770 €, about a third of the profit this month.

sellerboard is an accurate profit analytics service with additional tools: follow-up mail campaigns, inventory management, reimbursements for lost & damaged stock and other FBA errors, PPC optimizer, listing change alerts.

Get 1 month of free access to sellerboard using this link: https://www.sellerboard.com/blog