Understanding indirect expenses

Managing your financials accurately is crucial for sustaining profitability and growth in Amazon selling. While direct expenses like the cost of goods sold (COGS) and shipping are often the focus, indirect expenses play an equally crucial role in the overall financial health of your business. Additionally, Amazon fees such as referral fees, FBA fees, and storage fees are often well-accounted for, but it’s the indirect costs that can be easily overlooked. These costs, not directly tied to the production of goods, include software subscriptions, office rent, consultancy fees, and more.

Why indirect expenses matter

Indirect expenses can significantly impact your bottom line. Monthly software subscriptions for inventory management or advertising automation tools are essential for maintaining efficient operations but can accumulate into a substantial annual cost. Failing to account for these expenses can result in overestimating your profitability, leading to misguided business decisions. By meticulously tracking and including these expenses in your profit calculations, you gain a clearer picture of your financial standing, which helps in making informed decisions about pricing, budgeting, and strategic investments.

Case studies of indirect expenses

Software subscriptions

Tools for keyword research, inventory management, and advertising automation are significant costs that must be factored into profit calculations.

Accounting

Monthly fees for accounting services are essential for maintaining accurate financial records and should be included in the overall expense calculations.

Consultancy fees

Consultancy fees should be spread across the period they impact, ensuring accurate profit analysis.

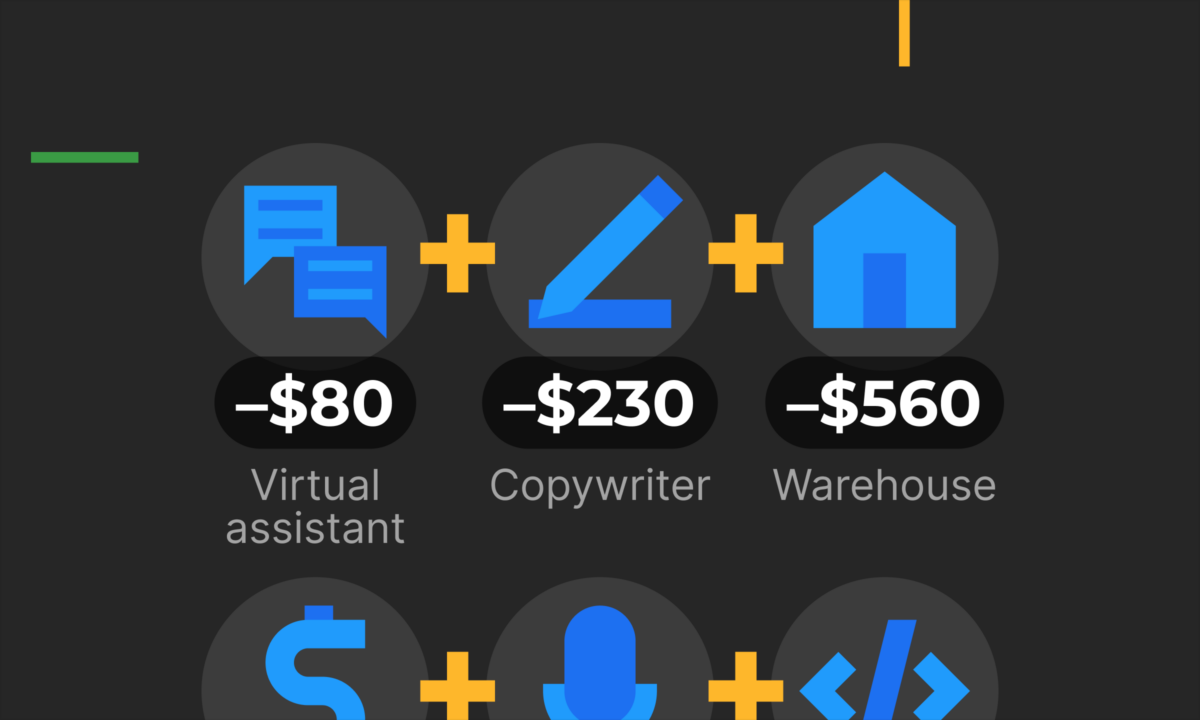

Virtual assistants

Salaries for virtual assistants or customer service representatives are ongoing indirect expenses that affect profit margins.

Photography

Professional product photography costs should be allocated to the specific products that have been photographed, reflecting their direct impact on those product listings.

Office rent

Office space rental costs need to be distributed accurately over the relevant time periods for precise expense tracking.

Packaging materials

Costs for packaging materials like boxes, tape, bubble wrap, polybags, labels, printers, and stickers are ongoing and necessary for product shipping and must be factored into profit calculations.

Online courses and training

Investing in online courses and training programs helps enhance skills and business strategies and should be considered part of professional development expenses.

Mentorship programs

Joining mentorship programs provides valuable insights and guidance and should be accounted for over the period of benefit.

Conferences and trade shows

Attending industry conferences and trade shows incurs travel, accommodation, and entry fees, which should be distributed over the relevant time periods.

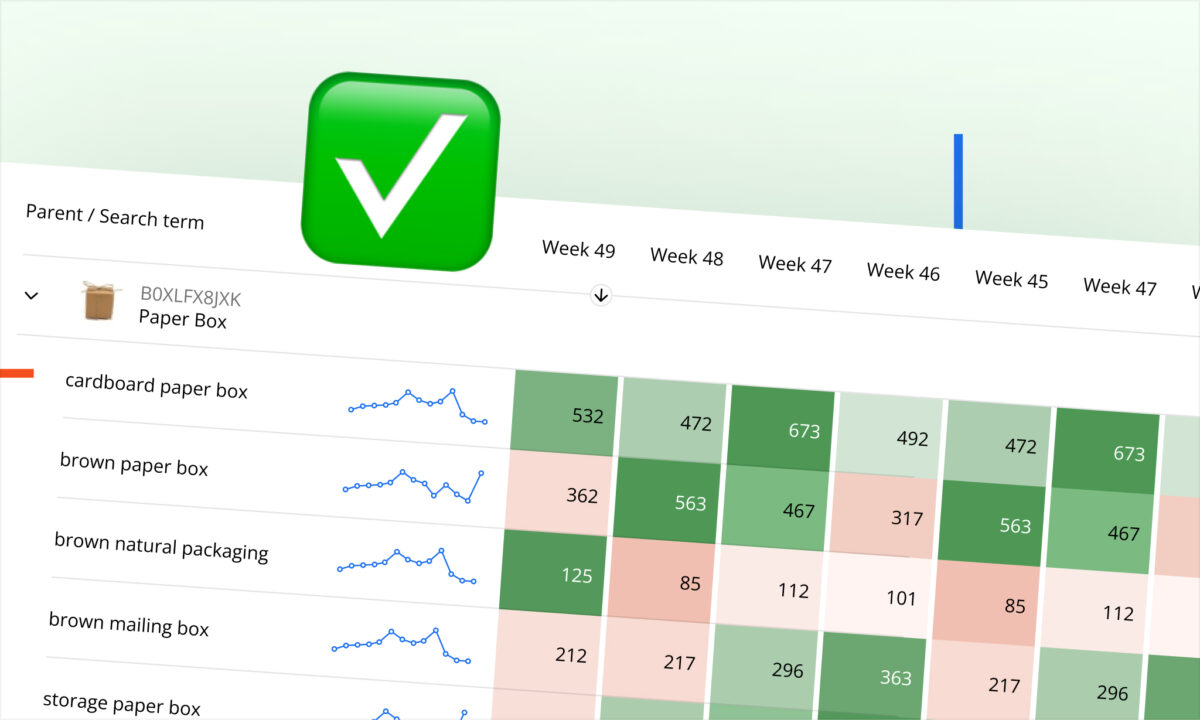

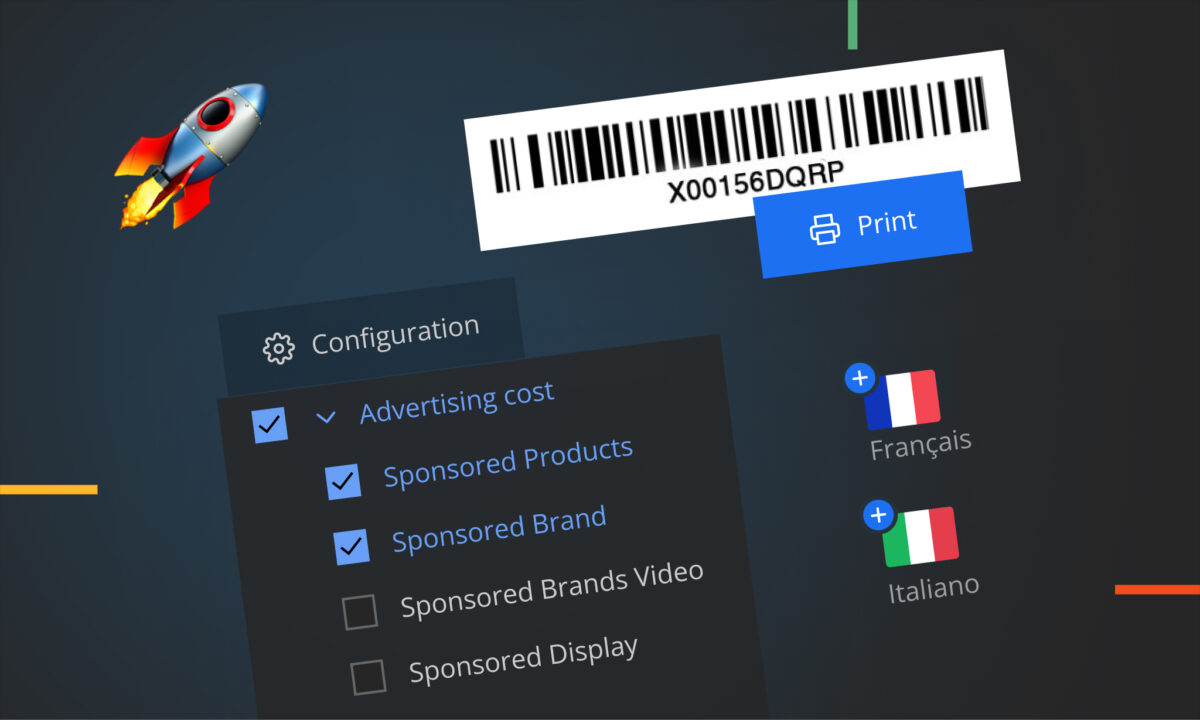

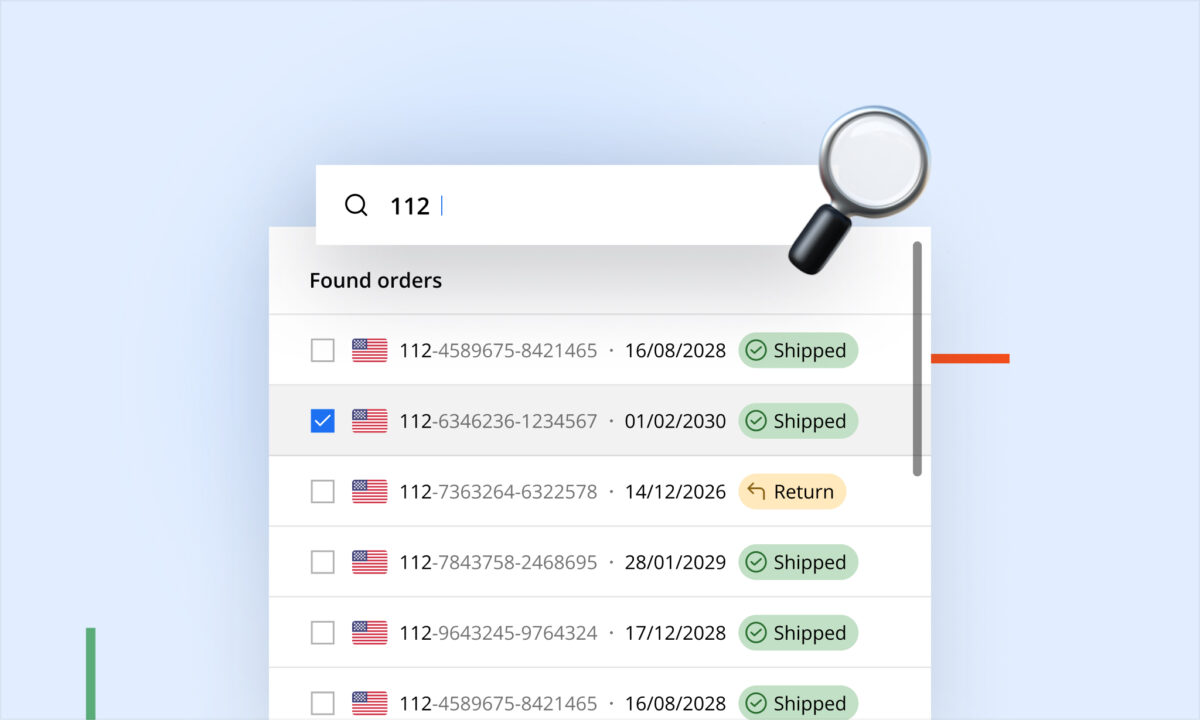

Managing indirect expenses with sellerboard

sellerboard’s expenses module offers Amazon sellers a comprehensive solution for managing indirect expenses. It allows you to set up regular expenses, amortize costs, assign expenses to multiple products, organize them into categories, and handle different currencies with automatic conversion. The ability to search, filter, and export expense reports makes tracking and managing these costs seamless and efficient.

Conclusion

Indirect expenses are a vital component of an Amazon seller’s financial strategy. Properly accounting for all costs ensures a realistic view of profitability, aiding in better decision-making and financial planning. By integrating indirect expenses into your profit calculations, you can ensure your Amazon business is not only sustainable but also poised for growth.

For more detailed insights and tools to manage your Amazon business finances, consider exploring sellerboard and its comprehensive suite of profit analytics features.